Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction and business model

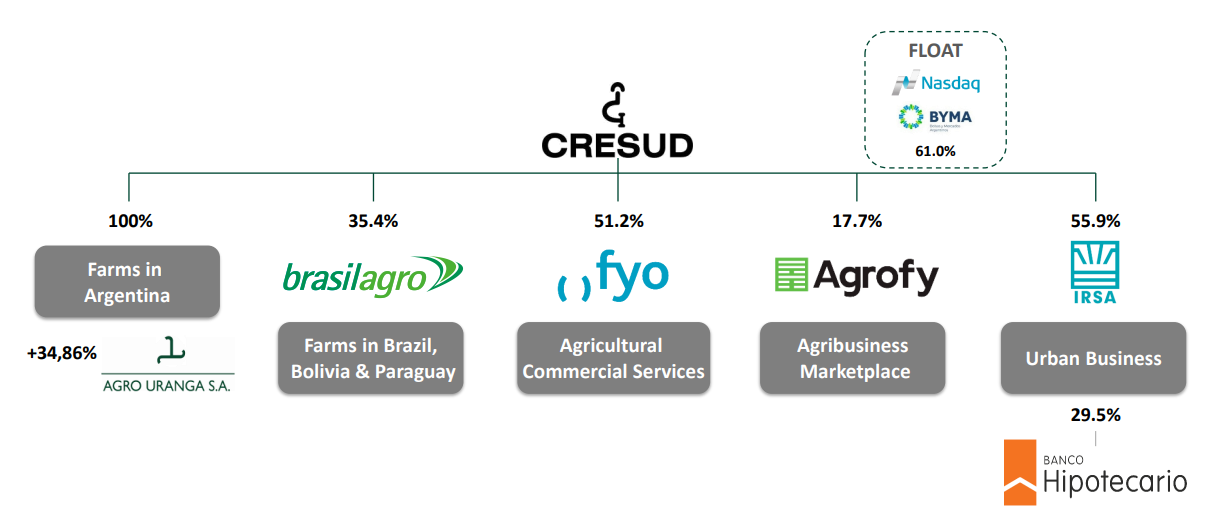

Cresud is an Argentine conglomerate focused on the agricultural sector. It operates a diversified business model that combines agricultural production with a strategic real estate approach. The company owns approximately 880,000 hectares, of which 106,000 are leased, used for cultivating soybeans, corn, sugarcane, and livestock farming. Additionally, it actively engages in land acquisition and development to later sell it at a higher price, following a rotational real estate model. As a conglomerate, Cresud also holds significant stakes in other publicly traded companies, such as BrasilAgro ($LND) and IRSA ($IRS).

For this analysis, we will focus on the core business—the agricultural segment—and only include the stakes in IRSA and BrasilAgro in the valuation section. However, it is worth understanding their activities and why they might be of interest (further discussed in the thesis section):

IRSA: Argentina's largest real estate group, with a substantial asset portfolio in the Buenos Aires area and near-monopoly control over shopping malls and other commercial real estate.

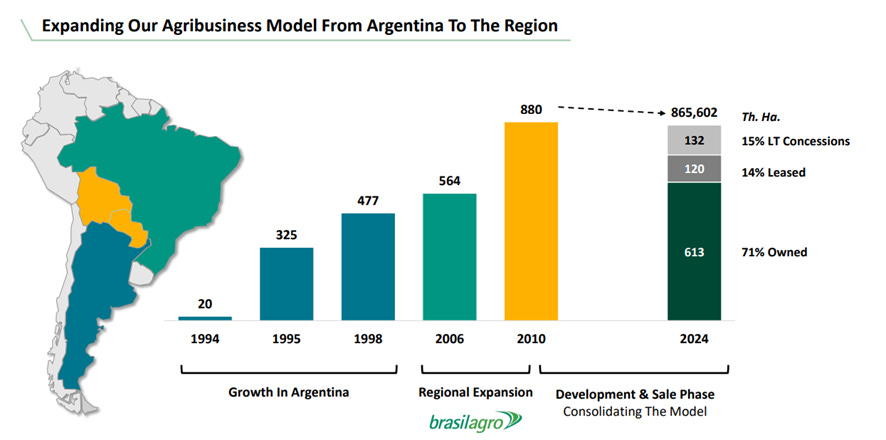

BrasilAgro: Follows the same business model as Cresud's Argentine operations: acquiring rural land with high cash flow potential, transforming and optimizing it (generating returns), and later selling it at a significantly higher value.

In the agricultural business, which spans Argentina, Bolivia, Paraguay, and Brazil, Cresud has seen exponential historical growth, combining organic development (through its own operations or leasing/rental agreements) with territorial expansion—first to Brazil and then to Bolivia and Paraguay. Since 2010, the company has focused on consolidating its assets and gradually divesting some already optimized properties.

This segment also includes services offered by Agrofy and FyO—an agribusiness e-commerce platform and a supplier of agricultural inputs and machinery, respectively.

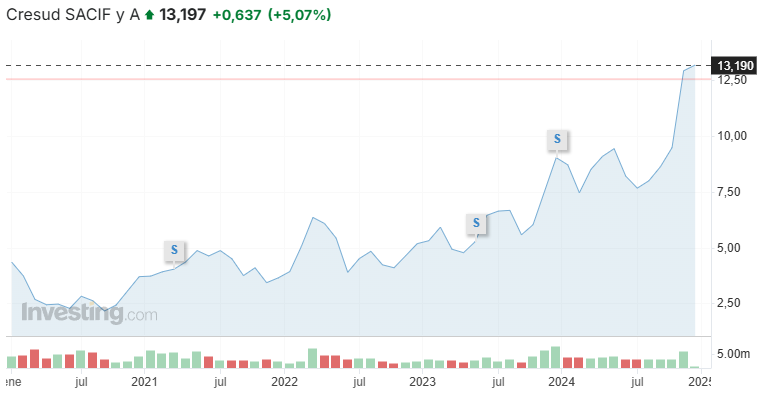

The company's performance over the past five years has been outstanding, with particular dynamism following Javier Milei’s electoral victory. As all subscribers know, this is a theme we have been tracking—thanks to one of our team members, Mr. Timbits—from the beginning, yielding spectacular results. (Premium subscribers have access to an introductory video on this theme.) On our subscription Discord channel, many companies have been shared in a synthetic ETF format, each with a specific catalyst calendar. Is it too late for this opportunity, or is there still room for growth? What is the size and what are the drivers of the value to be unlocked?

We will complement this investment analysis with a geopolitical overview of the country's political outlook and Milei’s chances of securing a second term and expanding his power base. This would accelerate the implementation of key measures essential to this investment thesis.

Investment idea

To answer the question of whether Cresud can be a good investment opportunity or a value trap, we will analyze the following sections:

Business Segments

Operations and Finances

Balance Sheet

Capital Structure

Shareholder Returns

Roadmap

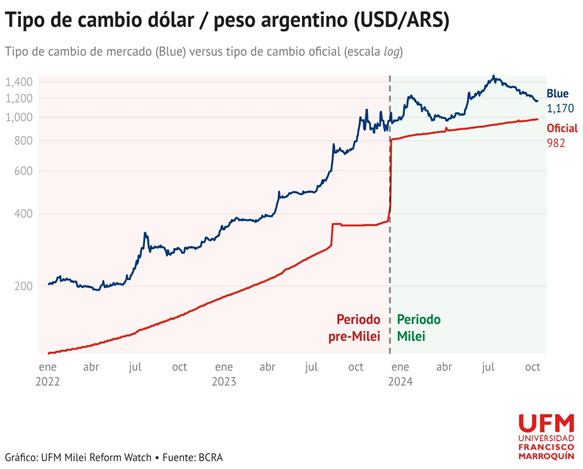

Throughout the article, we will convert ARS to USD using the market exchange rate. In the past, this posed a challenge, as the official (reported) exchange rate and the market rate showed significant discrepancies. However, since Milei's arrival, these values have almost converged, and we are very close to the lifting of currency controls.

Let's get started.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.