Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Note: This article has been updated as of 02/21/2025. The original release was on 05/28/2024, when the stock was trading at C$ 11.56/share.

Introduction and business model

Dundee Precious Metals Inc. is a gold mining company with interests in Bulgaria, Namibia, Ecuador, and Serbia, headquartered in Canada. Specifically, they have the following assets:

Chelopech, a gold, copper, and silver mine located near Sofia, Bulgaria, which is Dundee's main project. They hold 100% ownership.

Ada Tepe, a gold mine in Bulgaria with a short remaining lifespan. They hold 100% ownership.

100% interest in the Čoka Rakita mine in Serbia, which is in the feasibility study phase—this is the stage immediately preceding the final development decision.

100% interest in the Loma Larga and Tierras Coloradas assets in Ecuador, which have faced some regulatory challenges in developing the deposits. However, there have recently been some positive

Until last year, they also had a smelter in Namibia, Tsumeb, which they sold in March 2024 for $49M, considering it no longer a strategic asset and having other alternatives for processing their product.

It is clear that we are in a bull market for gold, with the main question being which phase we are currently in. In my opinion, we are in a mid-phase, driven by strong buying pressure from central banks, which are reinforcing their reserves with hard money to counter the militarization of the dollar (i.e., the use of the Western financial system and reserves denominated in its currencies as a weapon against opposing political blocs) and the collapse of the fiat system due to a debt spiral. The following chart shows how, since 2022—when Europe and the U.S. decided to militarize the financial system—gold purchases by central banks, led by China, have accelerated significantly.

Historically, gold has traded with a strong (inverse) correlation to real interest rates, and that still seems to be the prevailing mantra in the West, where investors have been selling gold through ETFs—the most common exposure vehicle. This makes the recent bullish surge in the metal's price even more significant.

However, this dynamic has shifted in the last two quarters of 2024, with ETFs becoming net buyers. Given the recent changes in inflation expectations and the interest rate trajectory for the Fed and other major central banks, this trend could also reverse. If that happens, we may see the historical relationship between real rates and gold prices adding even more upward pressure on the metal.

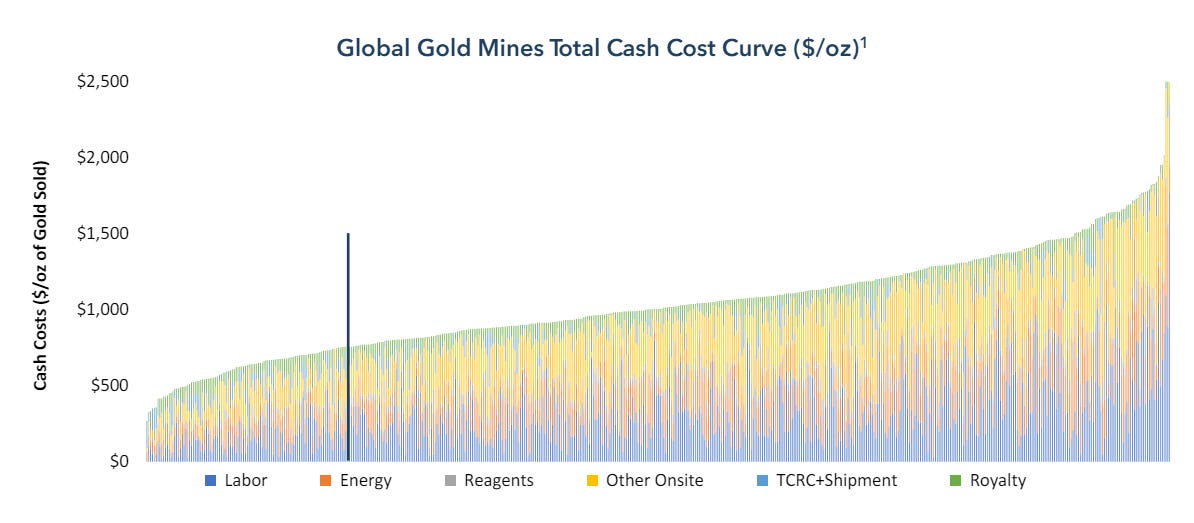

The case of precious metals, and especially gold, is paradigmatic in terms of commodities, as analyses cannot (and should not) focus on the cost curve of supply since they trade with a monetary premium. However, this is another aspect to consider when choosing which companies (or vehicle, if we want to do it through second derivatives or ETFs) to invest in. In this sense, the most relevant metric to observe is the All-In Sustaining Cost (AISC), which represents the production cost (cash cost) minus depreciation and amortization and with transportation, maintenance CAPEX, and G&A added, and is the benchmark for the true cost of production. In the following chart, we can see the industry's cost curve (cash cost) and where Dundee Precious Metals stands on it.

Once we understand the macro context in which we want to bet, it is time to analyze why Dundee Precious Metals seems to me a very interesting option to express this conviction.

Investment thesis

Once the underlying thesis for gold investment is understood, which we have been leveraging over the past year with Dynacor Group, let's look at the specific points that make Dundee Precious Metals interesting:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.