Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

In this deep dive, we will analyze the Q1 2025 commentary from Goehring & Rozencwajg, an American investment firm specialized in commodities, known for its consistently insightful and contrarian views. In this case, they present an analysis of the current macroeconomic environment and how the PGM sector may be on the verge of entering a new bull market. This idea aligns perfectly with the perspective we shared in the Sylvania Platinum article, which combines a macro approach similar to G&R’s with a micro-level analysis of the company’s own evolution. The views expressed in this article, although written in the first person, reflect the research and opinion of G&R, not of LWS Financial Research.

The hidden revival of platinum and palladium

We believe the time has come to pay serious attention—and commit capital—to the platinum group metals (PGM) sector and to publicly traded companies involved in their extraction and processing. After sixteen years of a bear market in platinum and nearly four years of declines in palladium, investor sentiment is bleak. The consensus—almost dogmatic—holds that the rise of electric vehicles will render future demand for these metals irrelevant. However, current data points in the opposite direction.

Deficit conditions in both metals are not only real but likely to persist longer than the market anticipates. Demand has shown unexpected resilience, while supply—from both mining sources and recycling—continues to disappoint. Most notably, investment demand, historically the swing factor in the platinum market, is beginning to reemerge. Structural changes in demand are underway with significant implications. Approximately 65% of global production of platinum, palladium, and rhodium is used in automotive catalysts. Yet the market has adopted a unanimously bearish view on this key consumption source, with the dominant narrative asserting that PGMs will become obsolete as the vehicle fleet electrifies.

But that narrative is starting to crack. A slowdown in electric vehicle sales worldwide has called the most optimistic forecasts into question. A more nuanced scenario is emerging, where internal combustion engines (ICE) may continue to achieve sustained sales figures well into the 2030s. This would imply structural support for PGM demand for at least another decade. The numbers illustrate this clearly: global ICE vehicle sales peaked in the years before the pandemic at 95 million units, fell to 75 million during 2020–2021, and have now recovered to annualized rates near 90 million. Even under a conservative scenario—where EV sales grow from 14 million in 2023 to 40 million in 2030—ICE sales could remain stable around 90 million at least until 2033. And that would be the prudent scenario. If EV adoption continues to disappoint, the upside potential for PGM demand could be even greater.

There is a less-discussed trend, but with structural potential equal to or greater than that of pure electric vehicles: the rise of the hybrid vehicle. Although skepticism remains about the economics and real utility of EVs, increasing arguments support hybrids. The reason is simple: the total energy efficiency of a hybrid surpasses both 100% electric vehicles and traditional combustion engines.

This technical differential has direct implications for platinum group metal demand. Catalytic converters require high temperatures to function optimally. In a conventional ICE, the engine runs continuously, allowing the catalyst to reach and maintain those temperatures. In a hybrid, however, the engine cycles on and off constantly, causing the catalyst to operate at lower temperatures and less efficiently. To compensate, manufacturers increase the PGM load per vehicle, in some cases adding up to an additional gram.

The dominant narrative about the energy superiority of electric motors begins to crumble when analyzing the full energy cycle—from electricity generation to battery manufacturing. Starting from 100 kilowatt-hours of primary energy, a conventional ICE can travel 20% farther than an EV powered by a natural gas-fired grid. For reference, while an efficient ICE achieves about 37 miles per gallon, a hybrid reaches 58. Translated to energy consumption, the hybrid needs only 63 kWh per 100 miles versus 98 kWh for the combustion engine. This outcome favors the PGM thesis doubly: greater hybrid penetration implies higher metal load per unit, and simultaneously, the efficiency narrative supporting EVs loses strength. The market has not yet fully internalized these implications.

The PGM demand rebound driven by hybrids is only part of the new bull cycle. The second major driver consolidating is the progressive tightening of global emissions regulations. Today, 98% of new vehicles incorporate catalysts, with an estimated average PGM load of 5 grams per unit. But all signs indicate this number is about to rise. The physical rationale is straightforward: the higher the metal load in the catalyst, the better its performance. In Europe and Japan—where regulations are stricter—catalysts already include between 7 and 9 grams of PGMs. In the U.S., the average is close to 5 grams. China and many emerging countries still operate in the 3 to 4 gram range, but this is rapidly changing. Both Europe and China are preparing to implement new emissions standards before 2030. In Europe, the upcoming EU7 (for light vehicles) and EU VII (for heavy vehicles) standards will substantially increase metal loading. In China, the introduction of CN6 in 2021 raised the average load from 2.5 to nearly 4 grams; CN7 is expected to reach 5 grams per vehicle, converging with Western levels. India is also moving in this direction. Adding to this regulatory trend is a technical factor: the growth of turbocharged engines. Although they increase power and efficiency, they generate more particulates and require catalysts reinforced with approximately 2 additional grams of PGMs per unit. Currently, only 50% of new ICE vehicles worldwide are turbocharged, but that proportion is likely to rise alongside tightening regulations, pushing PGM demand upward.

Today, global demand for platinum, palladium, and rhodium stands around 18.7 million ounces, of which 65% goes to catalysts, 10% to jewelry and investment, 9% to chemical processes and refining, 8% to electronics and glass, and 3% to the medical sector. Considering these data, this figure could reach 23 million ounces by 2032—a 23% increase—even under optimistic assumptions about EV adoption. Both the platinum and palladium markets have already entered deficit. In 2023, the platinum shortage was 750,000 ounces; in 2024, 680,000 ounces. For 2025, the World Platinum Investment Council estimates another deficit close to 500,000 ounces—approximately 9% of total demand. Everything points to a structural trend, with supply shortfalls worsening over time.

Three main factors converge in this scenario. The first is the contraction in South African mining production (the world’s main producing country), which has declined by around 400,000 ounces. The cause is clear: persistently weak prices have forced producers to reduce extraction in deep, costly shafts—operations long near the edge of economic viability. The second factor is pressure on recycled supply, which has fallen nearly 300,000 ounces over the past year. This reduction is concentrated in recycled automotive catalysts, for both economic and behavioral reasons. Used car prices have soared in recent years, raising the average vehicle age. In the U.S., drivers simply keep their cars longer: in 2024, the average age hit a record 12.6 years, six months higher than in 2020.

Although consensus expects scrap supply to recover in 2025 and 2026 as older vehicles exit the fleet, we remain skeptical. New car prices remain high, and the recent reintroduction of tariffs under the Trump administration’s economic policy adds upward pressure that could further delay fleet renewal. Finally, positives in industrial demand are offset by a collapse in investment appetite, especially for platinum. The culprits are well known: rising real interest rates and falling spot prices, a combination that has drained Western investors’ enthusiasm. Since 2020, physical platinum investment has dropped 75%, largely driven by redemptions in physical platinum ETFs—a trend also observed in other precious metals.

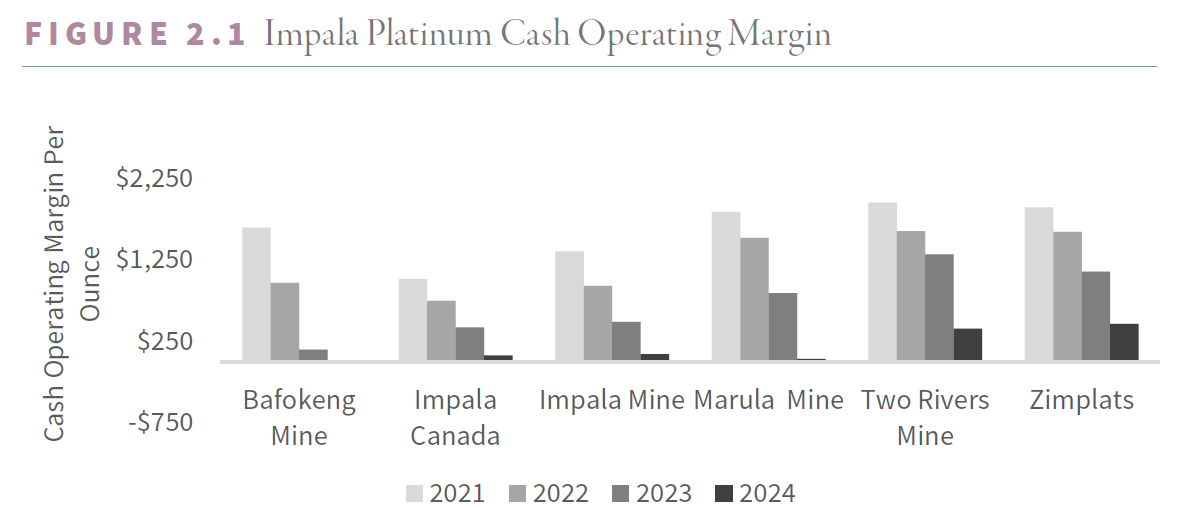

Large accumulated deficits over the past two years have significantly eroded inventory stocks. After peaking near 5 million ounces in 2022, visible platinum reserves have dropped approximately 1.5 million ounces. If our 2025 projections hold, inventories could fall to around 3 million ounces—a nearly 40% decline in just two years. Meanwhile, the average price received by platinum group metal producers has declined almost 50% in the last three years. While the price basket neared $3,000 per ounce in mid-2021, today it has retreated to around $1,200. At these prices, nearly 40% of global mining production operates at or below variable cost thresholds, implying an environment of virtually no profitability for a significant part of the industry.

Individual mine data confirm what aggregated figures suggest: profitability has evaporated and supply impact is tangible. Since the start of the decade, platinum production in South Africa has fallen from 4.5 million to 4 million ounces—a half-million-ounce decline. Palladium production has also reduced, from 2.7 million to 2.3 million ounces. Reflecting this situation, Impala Platinum recently announced it is considering closing its Lac des Iles mine in Canada, which produces around 280,000 ounces of PGMs annually, 90% of which is palladium. The operation is currently running deep losses. Regarding future supply, news is scarce. Only one significant mine—Platreef, located on the eastern limb of South Africa’s Bushveld Complex—is scheduled to start production shortly, offering no immediate market relief.

The South African mining complex, traditionally the backbone of global platinum group metal production, faces increasing structural constraints. Decades of underinvestment, along with geological depletion, mean even significant price increases will hardly translate into new production volumes. In this context, materially expanding supply appears tight, costly, and slow. The combination is clear: strong demand, contracting supply, persistent deficits, and investor consensus grounded in a narrative that, in our view, will not withstand the test of time. This, in our opinion, is the classic setup that precedes the start of a bull market.

As we noted at the start of this analysis, the moment to invest in platinum group metals and producing companies is now.

Peak shale amid maximum pessimism

The end of unstoppable shale growth likely represents the most profound shift in the global oil market in decades. The U.S. shale revolution—once the engine that transformed modern oil supply—was never going to last forever. It was only a matter of time before it peaked and began its decline. According to our models, that turning point has already arrived: 2024 appears to be the year shale reached its peak, and now it will either stabilize or start to decline.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.