Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction and business model

HelloFresh is a food logistics company with a subscription-based business model. Specifically, the company has two main business segments (and some ventures that are still in their early stages but have great potential for the future):

Meal Kits: This is the company's original vertical, from which they have grown to become the clear market leader, using its cash flow to expand into other segments. They operate in 16 countries, and their business model is based on a subscription service where the customer selects the number of meals they want to receive each week (as well as the day and time of delivery) and receives as many boxes (like the ones in the picture) as they have chosen. Each of these units contains all the ingredients needed to prepare a dish, along with the recipe to follow. Although preparation takes time and effort (customers can also choose the level of dedication they want), it allows them to prepare elaborate and original dishes, avoiding the shopping and meal planning process, making it relatively convenient at a reasonable price. All their dishes are designed by chefs and nutritionists. Initially, they only operated under the HelloFresh brand, but they have expanded their catalog to include different price ranges and culinary options.

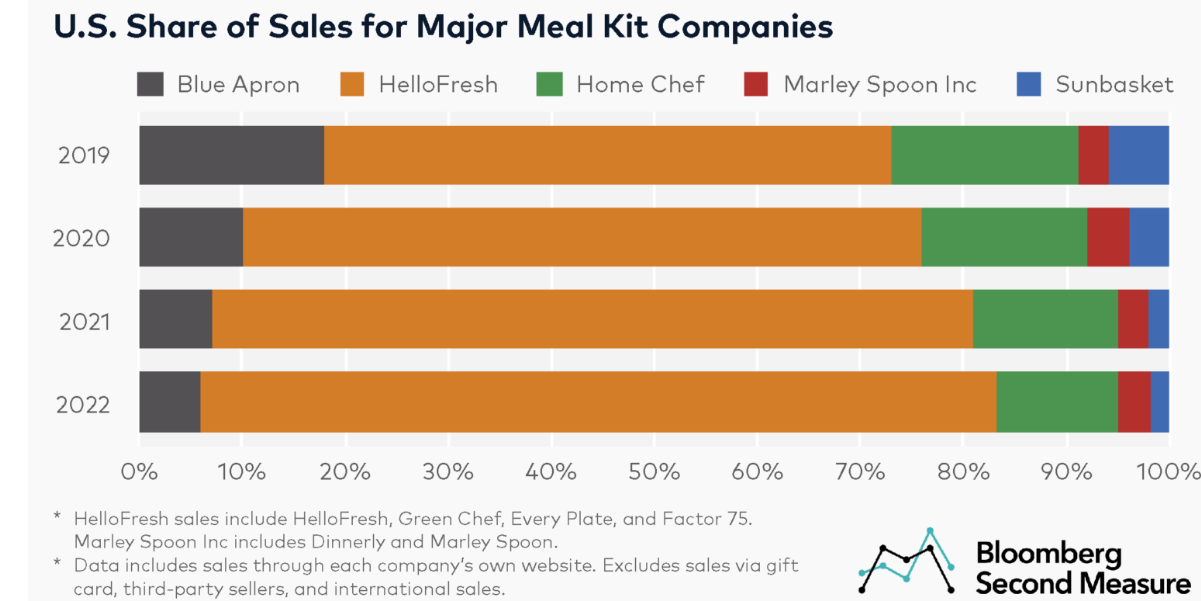

This chart is somewhat outdated, but it shows the company's market share in the United States, where it is the undisputed leader (the same situation exists in European markets, with the company itself estimating this dominance at 80%).

Ready to Eat (RTE): This is currently the most interesting vertical for the company. In this business area, the company offers ready-to-eat meals that require minimal preparation (often just heating) and offer a wide variety of convenient options. Given the evident change in lifestyle for much of the population, with much less available time and different preferences from cooking, it is a segment with a lot of growth and tailwinds.

In 2020, aiming to diversify its operations into a segment adjacent to its original one, they acquired the company Factor and have been scaling it up since then.

Recently, they have expanded into other verticals, such as pet food, which is a segment with huge projected growth, or vegan food.

HelloFresh was a big beneficiary of COVID, during which their products saw high natural demand and their marketing investment needs were significantly reduced, leading to a boom in profits and stock price, which led them to project exaggerated growth that they have not been able to achieve.

After the pandemic boom, when leisure and dining habits returned to normal, marketing expenses multiplied, margins shrank, and growth disappeared, leading to very negative sentiment around the stock, which has fallen 90% from its peak, recently hitting a low of €4.42 per share. The final blow came this year when the company (finally!) acknowledged that its guidance and projections for 2025 were unattainable and started a new strategic plan from scratch.

Is there hope for this company? Is the recent drop from its peak an opportunity or a value trap in a low-quality, clearly declining business? Let's take a look.

Investment idea

To understand this investment idea, we will analyze the following sections in detail before making a final valuation and conclusion:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.