Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction and business model

International Petroleum Corp. (IPCO) is an oil and gas E&P (exploration and production) company based in Canada, with assets in various geographies (Canada, France, and Malaysia). IPCO's story is inseparably linked to the Lundin family—the founders—who continue to lead the company and remain its main shareholders.

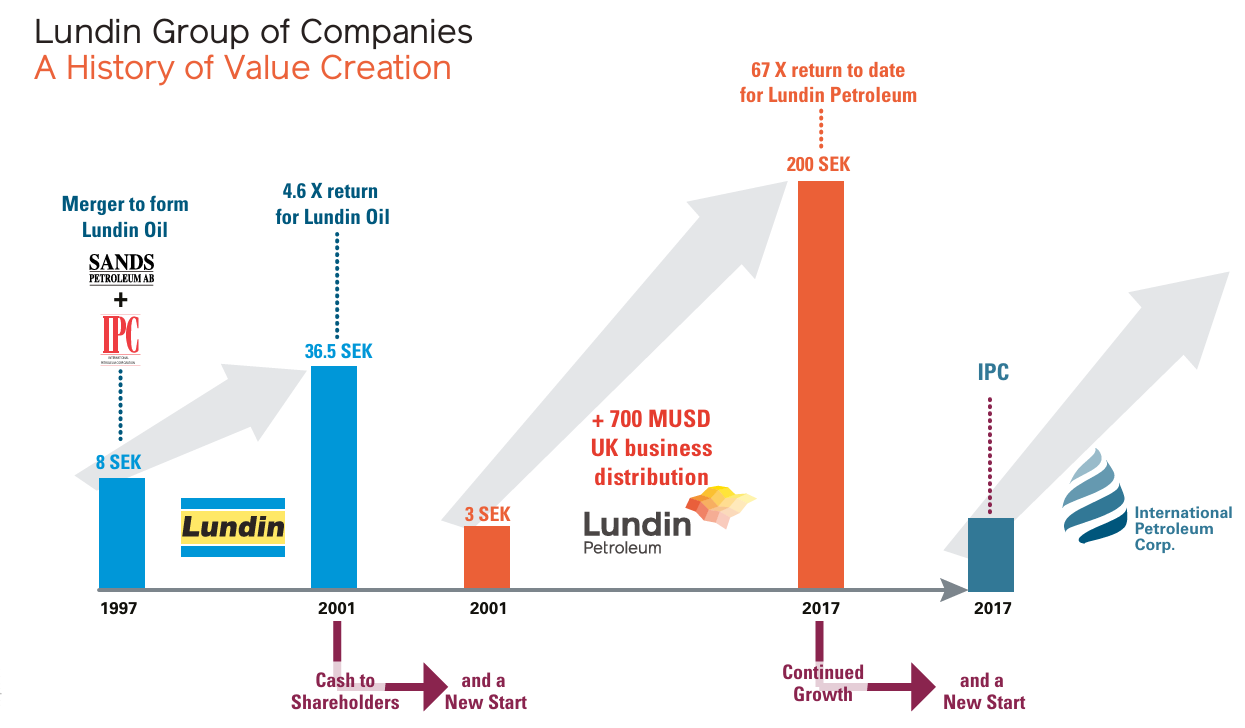

While each company should be judged on its own merits, it's undeniable that management, along with its vision and execution, are key components in investment ideas. In IPCO’s case, the Lundin family founded Lundin Oil in 1997 through the merger of two other companies and liquidated it in just four years with a 4.6x return (46% CAGR), returning the cash to shareholders and founding Lundin Petroleum in 2001. That company was also liquidated 16 years later, with a 67x return (32% CAGR), and from it, IPCO was spun off in 2017 (currently delivering a 4x return).

With Lundin Petroleum, they became the largest independent E&P by size, producing ~85k boe/d and developing one of the largest oil fields in European history—Johan Sverdrup. It wasn’t their only success, and companies from the Lundin group are typically synonymous with quality and strong execution; in fact, in our model portfolio, we’ve also benefited from Filo Mining.

Focusing now on this article, IPCO holds assets in Canada, Malaysia, and France, and produces both liquids (66%) and Canadian gas (34%), which means it has a significant exposure to the North American market. The main price benchmarks for its products are Brent (Malaysia and France), WCS (Canadian crude), and AECO gas.

Most of IPCO’s producing assets have a low decline rate, which allows for stable production with reasonable capital investment. Given the quality of its assets, IPCO is also a cheap stock based on the estimated value of the company’s reserves. Currently, the stock trades at a 45% discount to NAV ($3.1B), which represents the company’s after-tax NPV-10 of 2P reserves as of December 2024 (although this NPV was calculated using Brent assumptions of $75/bbl in 2025 and $80/bbl for the following years—above current prices). IPCO is a company with a similar profile to HCC in coal: a high-quality business engaged in a growth and development project that will transform it as soon as next year—with the difference that, in this case, it’s also returning value to shareholders in the present.

Investment idea

To answer the question of whether International Petroleum could be a good investment opportunity, we will analyze the following sections:

Business Segments

Operations and Finances

Balance Sheet

Capital Structure

Shareholder Returns

Let's get started.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.