Disclaimer

kairoscap is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Before starting the analysis, I would like to remind you that there are two videos available on my channel regarding the current situation of the oil market and the impact of the tin mining ban in Myanmar. Tomorrow, I will upload a new episode discussing the AMR results, so I appreciate it if you subscribe and share the channel.

Introduction and business model

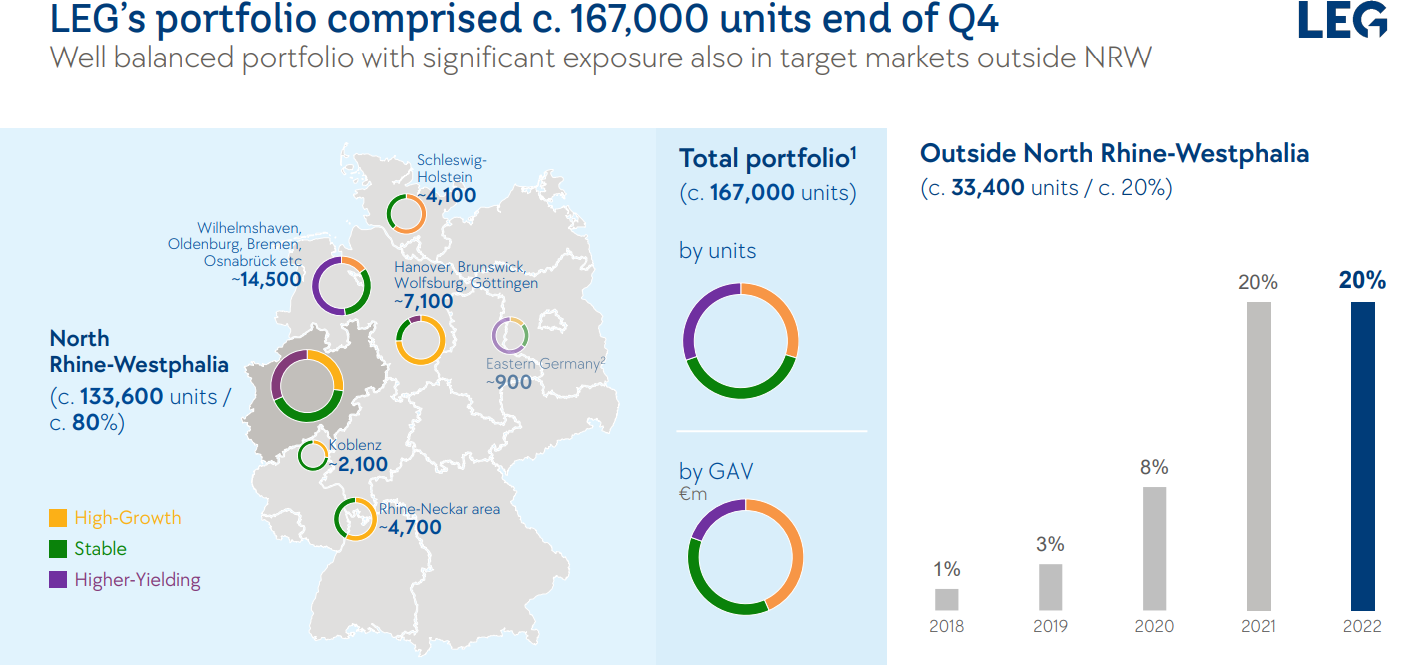

LEG Immobilien (LEG, hereinafter) is a property management company based in Dusseldorf, with operations mainly focused on the North Rhine-Westphalia region, the most populous region in Germany. Specifically, they have 167,000 rental properties that accommodate 500,000 tenants. Germany is one of the developed countries with the highest prevalence of rental housing, with over 50% of households using this form of housing. LEG is a pure-play rental property company in Germany and has no intention of expanding but aims to be cash flow neutral in its segment, with capex, Opex, financial expenses, and dividends covered by cash generation.

The region they operate in attracts the majority of the country's investment and has a GDP higher than that of many European countries! The homeownership rate is only 44%, making it an extremely attractive region for this business.

Their focus is on the affordable housing market, particularly in tier 2 cities, which is yielding excellent results in Germany. The demand for this type of property far exceeds the supply, leading to near-full occupancy rates and average yields above 4%. In addition to rental income, they offer a range of vertically integrated services such as internet, TV, small repairs, plumbing, electricians, etc. These services generated €50 million in FFO (Funds From Operations) in 2022, representing a growth of nearly 28%. They are now expanding into gardening and cleaning services. The tailwinds for the country's residential market are strong, with a sustained increase in population and a growing housing deficit. The high rate of skilled immigration and the arrival of refugees are intensifying the need for affordable housing while the number of new constructions is decreasing.

They divide their assets based on profitability and price into three geographical zones:

High Growth - Cities with high and growing housing demand. Properties tend to be more expensive, with lower yields (3.4%), higher rents (€7.23/m2), and lower vacancy rates (1.7%). This is where they are acquiring the most apartments.

Stable Markets - Cities with stable demographic and demand pressures, offering attractive yields (4.5%) and low vacancy rates (2.3%). This segment comprises the majority of their portfolio.

High Yield - Marginal cities with less attractive demographic profiles but more attractive valuations. They have the highest yields (5.6%), higher vacancy rates (4.2%), and attractive valuations.

Specifically, focusing on cities, the distribution is as follows: high growth (Aachen, Dusseldorf, Hanover, Mannheim, and Münster), stable (Bremen, Flensburg, Kaiserlautern, and Solingen), and high-yield (Duisburg, Hamm, and Remscheid). The overall high vacancy rate is due to the inclusion of newly constructed housing and acquisitions.

Part of their portfolio is subsidized (20%), meaning that the government funded part of the housing construction in exchange for a rental period at reduced prices for tenants. Therefore, this significant portion of the portfolio has rental growth potential as these subsidies expire. Contrary to what may seem, this is not a cyclical business, and the targeted segment is very resilient to crises, as demonstrated by the sustained increase in rents throughout the Global Financial Crisis (GFC) and the pandemic, regardless of the overall economic downturn during these periods.

For the expansion of their portfolio, they previously had a housing construction component, which they have decided to eliminate. They do not plan on initiating new real estate developments once the ongoing projects are completed. This construction aspect was a very small part of the business, and its impact should not be noticeable. In fact, they currently have 5,000 apartments for sale, which they will materialize when the real estate market stabilizes and becomes beneficial for shareholders. They only consider selling assets above their book value.

In the services segment, Renowate stands out, which is a joint venture established to carry out renovations. It has been well-received and also reduces future operating costs by improving the efficiency of facilities and buildings, most of which are old. The median size of the apartments is 60-70m2, and the majority of them were built between 1950 and 1969 (54%).

This joint venture offers a complete range of renovation services (one-stop shop) for both the company's properties and external clients. They have planned renovations for over 200 units for this year.

Investment thesis

Despite the apparent stability and tailwinds for the business, the stock price has fallen by 50% in the past year. It is crucial to understand the reasons behind this decline and assess the foreseeable future of the company to determine whether it represents a great opportunity or a value trap. Specifically, we will analyze the following points:

Balance sheet management.

Regression to the mean in NAV valuation.

Operational and business improvement.

Balance sheet management

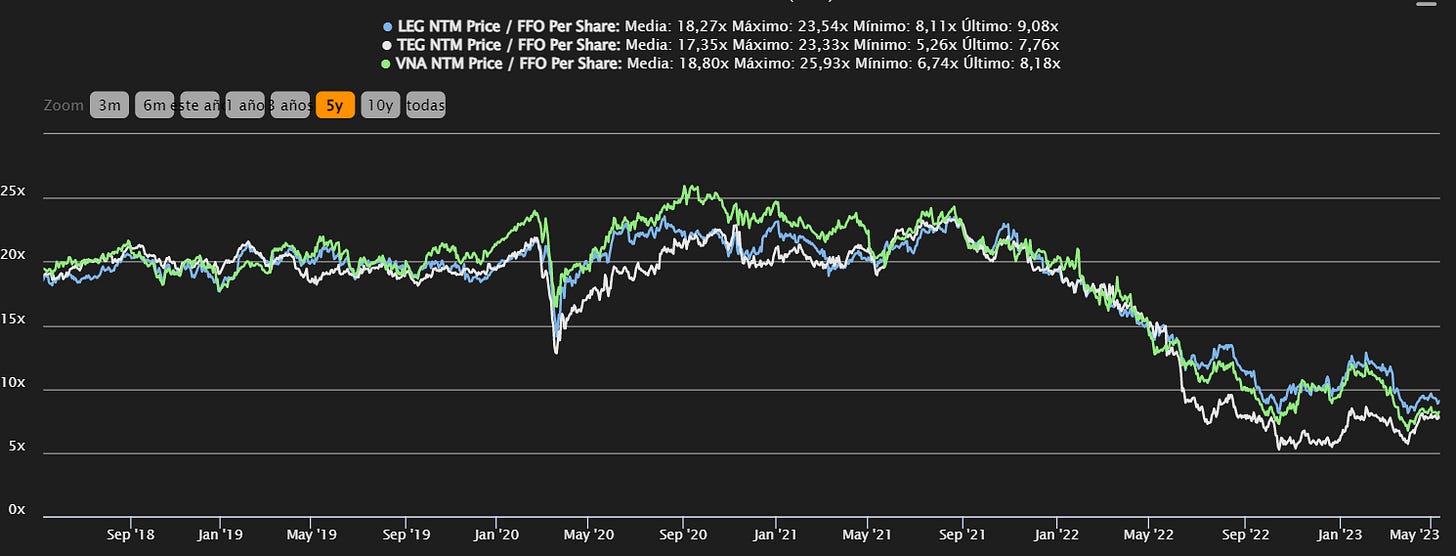

The main reason explaining the decline in companies in the sector (other competitors such as TAG Immobilien or Vonovia have experienced similar trends) is, obviously, the rise in interest rates we have witnessed in the past year. The most direct effect of these increases is higher debt costs (which tend to be significant in these companies) and a higher discount rate applied to asset valuations, which negatively impact leverage ratios (LTV).

LEG has a relatively balanced debt profile and no debt maturities in 2023. The next significant milestone comes in 2024 when 10% of the total debt matures. 89% of their financing is fixed-rate, and the overall average interest rate is 1.36% (up from 1.13% last year).

So far, they have never had any problems refinancing their debt, but the new macroeconomic environment complicates the process. They comfortably comply with the bank covenants of their debt, although there is concern that a decline in asset valuations could increase the LTV ratio of the portfolio to levels close to 50%, far from their long-term target of 43%.

The immediate focus, once the 2023 debt is paid off, is on the 2024 maturities, particularly the €500 million unsecured portion (for the mortgage portion, the rollover is straightforward and already confirmed). Out of the remaining €500 million, they will make partial repayments (accelerated by asset sales) and have already negotiated the refinancing of €150 million, leaving approximately €300 million to address, which they expect to have ready in the coming months. They have €365 million in cash and €1.2 billion in credit lines and commercial paper, which also provides some guarantees.

They confirm that they will pursue a very similar strategy in 2025.

They have decided to discontinue the new construction line of business, which already had minimal weight in the business, and only complete ongoing projects. In fact, they have become a net seller and currently have 5,000 properties on offer, mostly consisting of non-premium assets and the lower range of their portfolio. Although divestments are a key factor in their deleveraging and refinancing strategy, they do not feel pressured to carry them out and are being very selective in terms of price (selling at or near book value, as shown by the 400 transactions this quarter, which creates significant value given the disparity between the stock price and NAV). They believe that the strength of the rental market supports their strategy, which they are executing slowly due to the low investor appetite in the real estate market.

One of the key levers to increase balance sheet flexibility has been a 40% reduction in CAPEX investment, with a strong focus on the new construction segment, while increasing maintenance investment to ensure asset quality.

On the other hand, in 2022, the decision was made to suspend the dividend (saving €330 million for the year) as a precautionary measure, which has been of great help in being selective with asset sales and flexible in balance sheet management.

This is the most delicate part of the thesis, as mishandling the debt could result in dilution, asset sales that destroy value, and a disappearance of cash flow due to a significant increase in financial costs. The impression I have, from listening to the conference call and studying the debt profile, is that this is not going to be a problem, especially considering that I expect a decrease in interest rates in Europe by 2024.

Regression to the mean in NAV valuation

Since mid-last year, when the cycle of interest rate hikes began, the stock price has fallen more than 50% (in line with the rest of the sector), and there has been a significant disconnect between the share price and the NAV. The market, due to higher interest rates (resulting in a higher discount rate and an inverse relationship with property valuations) as well as the economic slowdown we are seeing in Europe, is discounting a steep decline in asset valuations.

The transaction market in Germany, especially outside Frankfurt, Munich, and Berlin, is dry, showing the lowest figures in the past 10 years, with buyers waiting to see how monetary policy develops and if they can achieve better prices. As a result, there are not as many comparable transactions to assess portfolio valuations, although they expect to adjust valuations downward by 6%-7% in the first half of the year. For now, the few sales that have been made have been at prices close to book value, demonstrating some resilience in the market, especially in the areas where LEG operates.

If the economic slowdown in Europe becomes (more) evident and central banks adjust their policies accordingly, we should expect a moderation of interest rates in the second half of the year or in 2024, which would help asset valuation and reduce the substantial discount to NAV.

Operational and business improvement

Despite the decline in the stock price, the company's operating results have remained very positive throughout 2022 and in the first quarter of this year. Rents have increased by 4.5%, while the vacancy rate has decreased by 0.2%, once again demonstrating the strength of the residential market.

The decline in margin and operating cash flow is mainly due to the impact of rising energy costs in the auxiliary services offered by LEG, as well as a higher provision for defaults (although they have not observed them so far) due to increased utility costs for customers, which may be reversible in the future.

They confirmed the annual guidance they provided in December, with an AFFO (Adjusted Funds From Operations) of €125M-€140M (most of which has been generated in Q1 due to unevenly distributed CAPEX investment throughout the year) and the reinstatement of the dividend, using the total amount of these adjusted operating cash flows. The key, both for the pace of deleveraging and the magnitude of the dividend itself, will be the number of property sales they can carry out.

In the year-over-year evolution of AFFO, significant positive contributions come from the substantial reduction in CAPEX and the increase in rental income. On the negative side, operational costs have risen (including higher provision for collections, although defaults currently remain near 0%), as well as increased costs in ancillary services due to high energy prices.

As mentioned in the introduction, 20% of the portfolio is under subsidized regulation, with rents well below market prices. Over the next 5 years, a significant portion of this subsidized stock will transition out of the special protection regime, leading to a 45% average rent increase to align with market prices. This would unlock €6.2 million per year (an additional 5% of AFFO) until 2028, and €42.1 million per year thereafter (an extra 32% of AFFO annually).

As we can see, there is a clear disconnect between market expectations regarding asset valuation in the coming years and the reality and resilience of the underlying rental market that justifies such valuations. Does it make sense for housing prices to plummet by over 50% when rents continue to rise and vacancy rates are virtually non-existent? The risks to the thesis lie in liquidity management and the ability to refinance existing debt. However, we are already seeing that Europe cannot operate (competitively) in a high interest rate environment due to the low competitiveness of its economy. Therefore, a normalization of interest rates should provide support to the most delicate aspect of the balance sheet.

Valuation

To value the company, I have used three different methods: Net Asset Value (NAV) valuation, FFO multiple, and dividend yield, which are common and standard in the sector. Of course, the first two methods are more relevant than the third one, but it is important to explore all options.

NAV Valuation

The net value of assets, for such a stable and high-quality business, is the purest form of valuation, and in fact, these companies tend to trade at a premium to NAV. In this case, considering the rise in interest rates and the economic cooling, and taking into account that a revaluation of their portfolio has not yet been performed this year, it is prudent to apply a discount to the net asset value per share calculated by independent experts.

For LEG, the net asset value per share as of 31/03 was €153.5, but they expect valuations to decrease by 6%-7% in the first half of this year, and with the inflation outlook in Europe, it would not be unreasonable to see a similar movement in the second half of 2023. Thus, applying a discount value of 25% (to add a margin of safety) to the net asset value per share, we obtain a figure of €115.1, to which we would assign a multiple of 1 (without a premium).

FFO Multiple

A very common way to value REITs, and one that makes sense considering the underlying business (property rental), is through FFO multiples. Intuitively, since rental property yields range from 4% to 5%, it seems reasonable to assign multiples of 20x-25x, which correspond to the historical valuation of these businesses.

Taking the reference given for this year, €5.9 per share, with a multiple of 20x applied to this figure, we would obtain an associated price of €118 per share.

Dividend yield

The company decided to suspend dividends last year to preserve liquidity and have more flexibility in managing its balance sheet. However, for this year, they have decided to reinstate it at 100% of the generated AFFO, which would be €130 million at the midpoint of the annual guidance. The company has a market capitalization of €3,990 million, so the dividend yield would be 3.25%, in line with the company's historical average (3.83%) and its competitors (Vonovia 3.89% and TAG 4.79%). Reverting to its historical average would result in a price of €64.44 per share.

If we assume that the market normalizes and no additional balance sheet containment measures are required, they could resume the previous dividend path prior to 2022, focused on FFO instead of AFFO, which was €4.07 per share. In this case, the historical price relative to this payment would be €103 per share. For this method, we will take the average between both values, which is €83.72 per share.

Combining the three prices, we obtain a final weighted figure of €105 per share, which compares to today's closing price of €65.16 per share, offering a potential upside of 70%.

Conclusion

LEG Immobilien has a very stable and resilient business, with many demographic tailwinds in the areas where it operates, but it is affected by an adverse economic environment that puts pressure on its balance sheet and operations due to the rise in interest rates in Europe.

The strengths of the thesis are:

Highly attractive valuation relative to the value of its assets.

Quality management.

Operating in an ideal market for this type of business, as Germany has one of the highest rental rates in Europe and positive demographic pressures.

Sound balance sheet and attractive debt terms.

Stable and highly predictable business.

And the main risks are:

Inability to refinance debt on favorable terms.

Need for dilution to meet debt payments.

Customer defaults amid economic slowdown.

Overall, it appears to be an opportunity with an interesting risk/potential profile, supported by a business of the highest quality and predictability, but with some short-term obstacles in terms of refinancing to overcome. If the interest rate environment improves, as I expect due to a strong self-inflicted economic slowdown in Europe, the prospects for the company will become much clearer, and we should see a closing of the valuation gap with NAV as rapid as last year's decline.

In addition to this analysis of one of the companies in the model portfolio, you will receive the weekly macroeconomic summary on Saturday.

If you like the content, you can follow me on Twitter, where I post information daily and recommend the newsletter.

Albert Millan