Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction and business model

Metals X ($MLX.AX) is a tin producer and explorer with operations in Tasmania, Australia, and one of only two publicly traded tin producers in operation, alongside Alphamin. The company owns 50% of Bluestone Mines Tasmania, a joint venture with Yunnan Tin—one of the largest tin producers and refiners in the world—and Greentech, which in turn controls the Renison mine (MLX’s main producing asset) and the Mount Bischoff project, which has been on care and maintenance since 2010.

In addition to its mining operation, Metals X acts as an investment vehicle, acquiring stakes in other projects (both tin and other metals) in Australia. Compared to Alphamin—which we've traded several times since the launch of this publication and exited due to increased geopolitical risk—the deposit it operates is of lower quality, but the jurisdiction is far superior, making the risk/reward profile much more attractive. Furthermore, with Denham’s recent sale of its stake in $AFM, the company is, in my view, no longer a retail-friendly investment vehicle. $MLX is the only viable option for investing in a tin producer.

But… what is tin used for?

Considered—rightly so—one of the metals with the strongest tailwinds for the coming decade, tin is involved in all major current megatrends: mobility, renewable energy, semiconductors, and AI. Specifically, its main industrial applications are:

Electronic soldering: Accounts for 47–48% of global consumption. Approximately 50–70% of all tin produced is used in the electronics and electrical industry, including mobile phones, tablets, computers, and other devices.

Chemicals: Make up 18% of the global market, used in the production of PVC, fungicides, dyes, and food colorings.

Tinplate: Represents 13–14% of demand, mainly in food and beverage packaging.

Other uses: Include lead-acid batteries (8%), copper alloys (5%), and other applications such as protective coatings and float glass.

As with uranium and PGMs (you may start to see a pattern in the ideas we present), tin’s cost relative to the total product (due to the small amount used in each soldering) is negligible, which makes demand relatively inelastic. In the following chart, we can see the substantial demand growth in recent years and the equally positive projections, particularly due to demand from EVs and, even more so, semiconductors. In fact, beyond the established uses already mentioned, some emerging trends are equally promising:

Electric Vehicles: EV batteries could account for as much as 60,000 tonnes annually by 2050. Tin shows potential as a high-capacity material for both anodes and cathodes in lithium-ion batteries.

Renewable Energy: Tin is used in photovoltaic cells in solar panels, where it can improve efficiency by up to 17% when replacing copper. Green technologies are driving increased tin consumption.

Global tin production remains highly geographically concentrated: China leads (24.63% of global output), followed by Indonesia (21.11%) and Myanmar (14.81%). Further down the list are Peru (10.32%), Bolivia (6.44%), and the Democratic Republic of Congo (5.47%). Global production has remained relatively flat at around 300,000 tonnes per year for nearly two decades, and its future is uncertain due to both geopolitical (cyclical) and geological (structural) challenges.

Historically, artisanal mining has played a key role in Indonesia and Myanmar. In Indonesia especially, there have been major issues due to uncontrolled exploitation (which depleted onshore deposits, requiring now more complex and costly offshore mining) and fraud. In an effort to regain control, exports were restricted in 2024 and have yet to fully recover. However, Indonesia shows signs of recovery in 2025: exports through April 2025 were 130.8% higher than in 2024, indicating a gradual normalization of supply.

Looking at the cost curve—and factoring in all CAPEX—it’s hard to imagine a breakeven price below $40,000/t by 2030. In fact, the most reasonable expectation is for figures even higher, around $50,000/t.

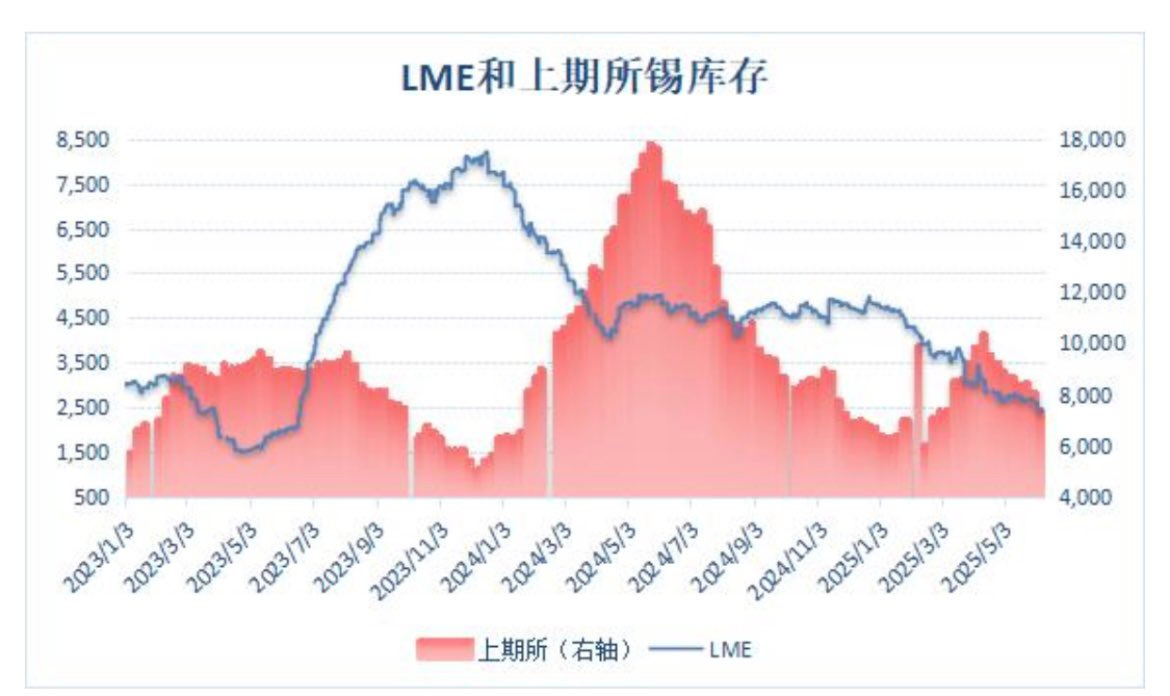

In this context, global tin inventories remain critically low. LME inventories are at a two-year low and Shanghai at a three-month low, with both combined holding just 10 days’ worth of global demand.

The global tin market is facing a structural deficit, which has worsened in 2025 due to multiple factors, with a projected shortfall of 28,200 metric tonnes for the year. Demand for tin will continue to grow, driven mainly by emerging sectors, and major analysts forecast prices above $35,000/t as early as 2026.

Investment idea

To answer the question of whether Metals X could be a good investment opportunity, we will analyze the following sections:

Assets

Operations and financials

Balance sheet

Shareholder return

Valuation

Let’s get started.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.