Disclaimer

kairoscap NO ES un servicio de asesoria financiera, ni su autor está cualificado para ofrecer este tipo de servicios.

Todo el contenido de esta web y publicaciones, así como todas las comunicaciones por parte del autor, tienen un propósito formativo y de entretenimiento, y bajo ninguna circunstancia, expresa o implícita, deben ser consideradas asesoramiento financiero, legal, o de otro tipo. Cada individuo debe llevar a cabo su propio análisis y tomar sus propias decisiones de inversión.

Introduction and business model

Petroleo Brasileiro S.A. (Petrobras, hereafter) is the state-owned oil company of Brazil (with the government controlling 50.3% of voting power, as they hold common shares instead of preferred shares, although a smaller proportion of total shares). It is a vertically integrated full-cycle operator, meaning that in addition to upstream exploration and production, it also transports, refines, and sells hydrocarbons, thereby having the complete value chain process.

They have a very dominant presence in Brazil, being the largest producer (producing around 2.5% of global supply) and controlling most of the refining capacity: currently, they have 10 refineries (capacity of 1.9Mb/d), although they plan to reduce them to 5 by 2027, with a capacity of 1.2Mb/d (they have already divested from these non-strategic assets this year), and increase their gas processing and electricity generation capacity, although using plants with lower environmental impact. Almost all of Brazil's oil production is offshore (97%), and they have a production break-even of around $35/b, making the returns very attractive in almost any price environment (in fact, offshore Brazil is one of the areas with the highest exploration activity currently).

The Brazilian government has a majority shareholder position (50.26% of voting power), so as always when there is a controlling shareholder in a company, it is very important to understand their interests to confirm that they are aligned with ours. After the Lava Jato scandal, which uncovered a scheme in which Petrobras executives and politicians received commissions in exchange for granting contracts, and inflated CAPEX numbers (a bit like Gazprom), resulting in numerous arrests and the current President, Lula da Silva, in jail, legislative controls were established to limit the government's influence on the company's strategic decisions, as well as to increase its governance transparency. The total size of the theft is estimated at around $8 billion.

Lula was convicted by judge Sergio Moro, on charges of money laundering and corruption (this judge later became Minister of Justice in the Bolsonaro government), but was eventually released when the Brazilian Supreme Court concluded that Moro was biased. With Lula's recent re-election, in what will be his third term, fears have returned of greater intervention and exploitation of Brazil's crown jewel, spurred by some campaign statements:

I intend to change Petrobras' pricing policy... I'm thinking about implementing a policy based on national costs (rather than international parity).

Investment thesis

The initial investment thesis in Petrobras consisted of reducing debt to increase the weight of equity in EV, a high dividend return, and a potential rerating of the company. The first two objectives have already been achieved, although the third has not materialized, even with the price of oil accompanying it in the last two years. Now, the thesis has changed. The new key points are:

Political risk

Shareholder return

Oil cycle and multiple expansion

Let's take a look at them separately to understand if we are facing a great opportunity or a value trap.

Political risk

With the recent election of Lula as president of Brazil for the third time, all alarms have gone off in the market, as it is understood that his social policies will be subsidized through increased exploitation of Petrobras, imposing his environmental agenda and reducing remuneration to shareholders while increasing taxes. However, the past shows a different reality; in his previous tenure as president, the following advances were made:

Reduction of public debt, which went from >60% to 40% of GDP.

Halving of the inflation rate.

Helped +20M Brazilians escape poverty.

Lula has made it clear that he believes that dividends are too high compared to other peers worldwide and that not enough is being invested in CAPEX, which is partly true since PBR set the world record for dividend payout last year ($35B). In the other point of conflict, he wants more investment in energy transition and the creation of a parallel price market for Brazil. In this last point, however, Lula made his calculations with errors, considering that the State Law and the company's statutes could prevent his change in Petrobras' pricing policy. Additionally, he would have to guarantee competitiveness when diesel currently supplies around 30% of national demand.

To carry out this transition, Jean Paul Prates has been appointed by Lula, who has experience in the sector, unlike the outgoing CEO, and confirmed this roadmap, although he has already ruled out intervening in the domestic price market:

We have to think about the future and invest in the energy transition [...] This future-oriented approach was the main demand personally presented to me by President Lula.

After these intention-laden comments, during his first 5 months at the helm of the company, none of his measures suggest a change in business for Petrobras that would direct it towards renewable energies. In fact, some of his comments in the Q4 conference call and to the press suggest the opposite:

We will maintain our leadership position in oil and gas production while working to build a new future. This year we have achieved the highest level of reserve addition in our history, so we are very happy with the results achieved and focused, of course, on continuously reducing our carbon footprint. We reiterate our commitment to emissions reduction by 2025 and 2030, which we have been able to meet without any problems so far.

The other thing that is talked about a lot, and is not true, is that we are suddenly going to change our business. We are not going to do that. We need to be focused not only from an operational point of view, but also financially and in terms of investment in our exploration and production of hydrocarbons sector.

Regarding legal uncertainty and the possibility of nationalization, the current CEO of Petrobras commented on this after the elections, so I do not consider this risk:

We are not perceiving this insecurity. In the three weeks prior to the campaign, we had meetings with these investment banks, one by one, with more than 30 people, reaffirming the guarantees of legal security... Anyone who is speculating on this issue is doing so at their own risk. The market, at times, has elements that act in this way, trying to speculate with statements

It seems that the multiple intervention attempts by Bolsonaro, who tried to change Petrobras' pricing policy several times, especially in the last year, and fired 3 CEOs during his term, have already been forgotten. Each case must be evaluated individually, but after each political change, the market tends to overreact, offering large discounts that close as it is seen that, in general, everything continues with business as usual. As a final touch, it seems that Prates is aware of the burden that this perception of the company represents, and is fighting to change it:

Our biggest challenge is to use the government's participation in Petrobras to our advantage, not against us, that is, to assure our investors that being partners with the Brazilian government is not a disadvantage, but the opposite.

Return to shareholders

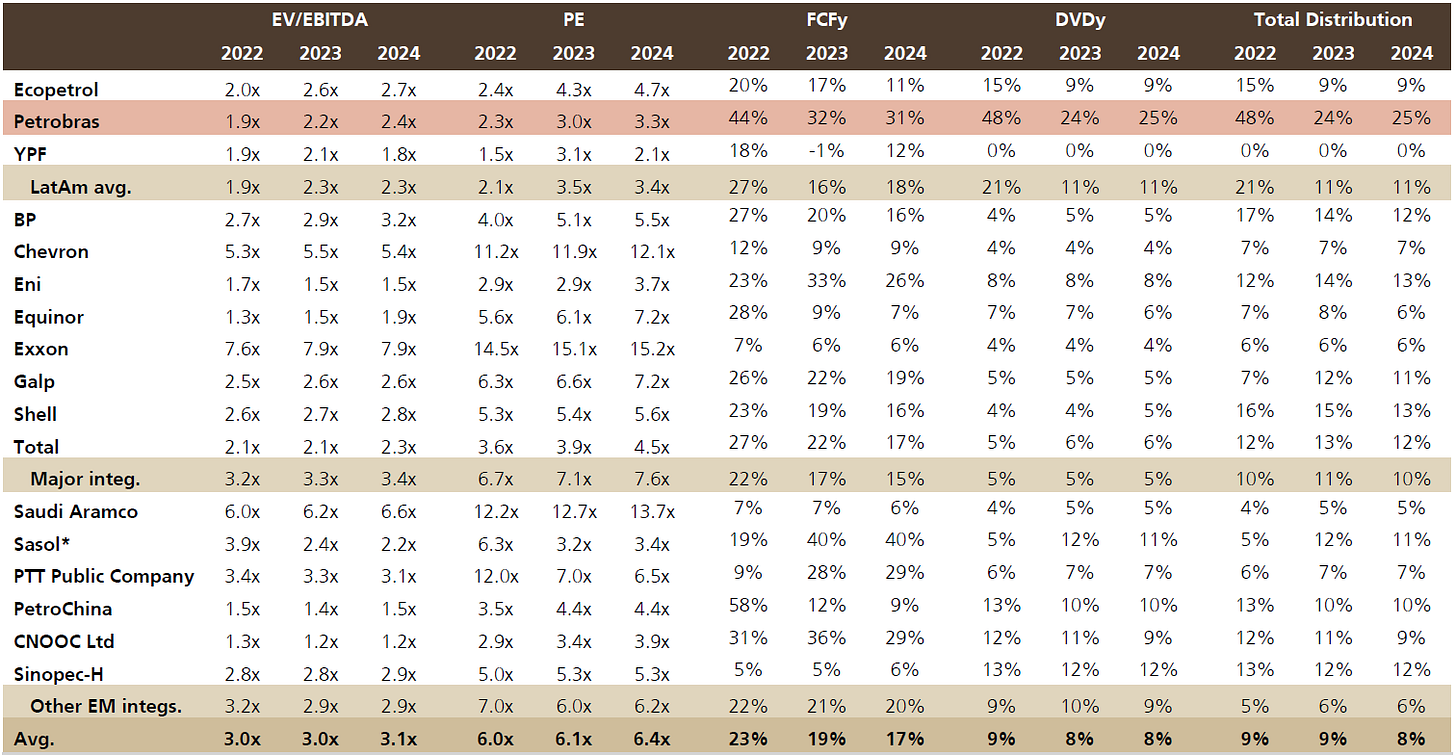

Among all the major international E&P companies, from a fundamental standpoint, Petrobras is the most attractive. Without knowing anything else, just looking at a financial comparison, its ratios are much higher than the rest (which includes samples from LatAm and China, jurisdictions with similar political risk, and from the USA and Europe which, in my opinion, have even greater risk).

Since Bolsonaro came to power in 2019, PBR has paid $8.19 per share in dividends, while its preferred shares are trading today at $10.55 per share (yield of 27% per annum, including 2020), and during Lula's presidency, totaling eight years, the total payments were $6.67 per share, so it seems reasonable to expect slightly less distribution in the coming years. During this same period, the company went from $4 per share to $70 per share, with 30% fewer shares in circulation, which would result in an adjusted price of $49 per share now (5x the current valuation). In recent years, after the balance sheet was cleaned up following the Lava Jato scandal, dividends have supported the valuation, and now we need to analyze what to expect in the future.

In order to be able to evaluate future returns, it is very relevant to consider the company's new strategic plan, presented after the elections and ratified by the new board and government. They plan to continue transitioning towards lower emissions energy (this mandate is prior), and intend to invest 6% of CAPEX over the next 5 years, which seems very reasonable, considering that many of these projects are also profitable.

The balance sheet is very healthy: they have reached their target of <60B$ in gross debt, with a figure of 54B$ (0.8x EBITDA22), which is at the lower end of their leverage target; of the bank debt (31B$), 50% matures after 2027, and has an associated interest rate of 6.4%, so it is not particularly burdensome (for an O&G company). Their target cash level is 8B$ (in the latest report, they had 7B$), so they would meet all their financial strength targets, and the current dividend policy includes a payout of 60% of OCF, with a minimum of 4B$/year if Brent is above 40$/b (4B$/year would equate, at current prices, to a 6% yield).

For their strategic plan, they assume an average barrel price of $85/b in 2023, with a linear decrease to $65/b in 2027, in line with futures (in my opinion, it's conservative and will surprise on the upside). With this price level, they plan to distribute 100% of the market cap in dividends (20% average annual yield), with potential for extraordinary dividends. It is important to remember that the government is walking a fine line, as they are the main beneficiary of this return policy, and if Lula wants to carry out a social agenda and cover the budget deficit, this is one of their main sources of income: 40% of the dividends.

The planned CAPEX for the next 5 years amounts to 78B$, a 15% increase compared to 2022, of which only 4B$ would be allocated to low-emission initiatives, 83% to E&P, and an additional 10% to refining. Of these figures, for the period 2023-2027, 95%, 90%, 80%, 56%, and 40% respectively are already committed, making it very difficult to affect the short-term. The total figure, 15% higher than the previous strategic plan, is very much in line with pre-Covid figures, where they were even higher.

Almost all of its growth is focused on the offshore segment, in its pre-salt fields (offshore deposits trapped between two layers of salt, which act as a seal). The economics are very good, with a medium breakeven of 35$/b. Over these 5 years, they plan to increase production from the current 2.6Mb/d to 3.1Mb/d, being one of the few regions that still offer this type of potential.

I expect a significant reduction in dividends in the coming quarters (~30%), following the modification of the distribution policy, which, although it is bad in the short-term, yields remain the most attractive in the industry (I expect an annual 12%-15% yield), and it will strengthen the company's balance sheet and operations and lead to an appreciation of the share price. If we add the positive contribution of the oil cycle, even with a reduced payout, we could maintain dividend yield figures with a significant revaluation.

As a reference, Banco do Brasil, already under Lula's government and with a similar controlling interest, has confirmed a 30% payout this year, which equates to a ~14% yield, which could serve as a reference for PBR.

Oil cycle and multiple expansion

I have a very positive outlook on the oil market in the coming years, with the belief that a paradigm shift has occurred that the market still doesn't value correctly, due to the lack of investment in recent years and the difficulties in carrying it out.

After a 2022 marked by the releases of oil from the American SPR and, above all, the low activity in China due to health lockdowns, which are now coming to an end, in a restrictive monetary policy environment, oil prices have held up very well, with a floor around $75/b (Brent). For 2023, all projections point to a recovery in demand and an insufficient response from supply, which, despite the high price environment, has had a very timid reaction. In this sense, it would not be surprising to see prices in the range of $90-$100/b, very similar to those seen in 2022.

If this bullish cycle occurs, Petrobras would be valued at <2x earnings, with a healthy balance sheet and top-notch operations, so I expect two multiple expansions:

Valuation in line with its peers, once it becomes clear that, beyond the dividend cut, state intervention will be very limited.

When it becomes clear that much of the cyclicality of the oil industry has been eliminated, all companies in the sector should receive a rerating, taking them from ~4x FCF to ~6-7x FCF, with a premium for majors like PBR.

If we are going to need significant amounts of oil for years to come, in assets with such abundant reserves and attractive economics, valuations that assume a negative terminal value three years from now don't make sense.

Valuation

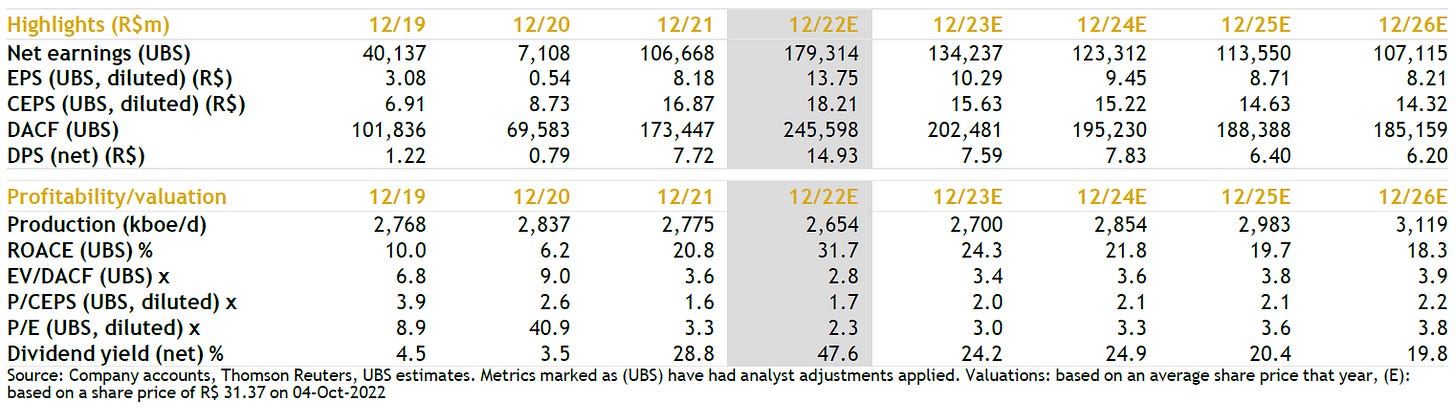

To carry out the valuation, we are going to rely on your strategic plan, whose assumptions seem very reasonable to me. Based on these assumptions, UBS publishes the following projection table:

At Thursday's close, the company is trading at 26.7R$, so we would be talking about a multiple of 3x earnings or 2x CFO (CEPS, in the table) for 2023, with oil at $85/bbl. As we have seen in the Investment Thesis section, even its South American competitors trade at FCF yields of ~20%, with political risks at least as similar, and without such a clear and generous dividend policy, which would imply, in the case of PBR, a 12-month valuation of 78R$/s, or 2.7x its current price. In the company's estimates, they assume an average price of $75/bbl, and if this figure turns out to be higher, as I expect, the margin of safety would increase significantly.

This comparison is made against companies of similar size and comparable characteristics. Considering that Petrobras has one of the best deposits for exploration and development, which offers growth potential (they plan to increase production by 20% in 5 years) and a very healthy balance sheet, it is expected that this giant discount would be greatly reduced, leaving a residual gap by jurisdiction, but leaving the multiples around ~6x.

In a valuation scenario at 6x FCF, which seems reasonable to me, the price we obtain is 34.3$/s, which would represent a 200% appreciation from yesterday's close. At this level, even a 30% reduction in dividend compared to 2022 would imply a dividend yield of 11%.

Conclusion

In conclusion, Petrobras represents, in my opinion, one of the most interesting investment ideas in the oil & gas landscape:

Prime assets with expansion capacity.

More attractive valuation compared to its peers.

Best-in-class shareholder remuneration policy.

Of the main political threats, I expect a more or less significant reduction in the dividend (~30%), which, on the other hand, will help improve the company's operations, and most of the return will come from the appreciation of the stock, somewhat in line with Lula's previous stage, especially as the oil cycle materializes. Petrobras' main risks coincide with those of any oil and gas E&P, but political risk must be added:

Fluctuation risk in oil prices.

Execution risk.

CAPEX discipline and investment in new projects.

Political and state intervention risk.

With all of this, I expect catalysts in the short term for the stock price, as soon as it becomes evident that government intervention will be much less than feared, which should lead to an immediate revaluation.

Ordem e progresso.

In addition to this analysis of one of the companies in the model portfolio, you will receive the weekly macroeconomic summary on Saturday.

If you like the content, you can follow me on Twitter, where I post information daily and recommend the newsletter.

Albert Millan