Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q124 Earnings review, part II

After the first delivery, we continue with the second round of company result presentations from the tracked or model portfolio. These presentations typically serve as very positive events for our portfolio, as they showcase to the market the great cash generation capacity of our holdings, and moreover, they usually come with generous returns to the shareholders. Specifically, in this publication, we will discuss the results of the following companies:

International Petroleum

Coinbase

Peabody Energy

Valaris

Let’s get at it.

International Petroleum Corp

International Petroleum continues to sail through its transformative process at full speed. Production (48,800 boe/d) exceeded the upper end of the guidance they provided at the end of last year, although, out of conservatism, they have decided to maintain the annual range of 46k boe/d - 48k boe/d unchanged. 2024 is a peak investment year for IPCO, with BlackRod as the main cash sink ($362M). In Q1, they had revenues of $200M and OCF of $89M, improving upon the figures from 2023. The heavy investment spending and an adverse movement in working capital (which will normalize in the coming quarters) have led them from a net cash position (+$67M in Q123) to a net debt position (-$60.5M), although nothing worrisome, considering the context and that they have $500M in cash on their balance sheet.

The following chart is particularly illustrative of the company's cash generation capacity, yielding 12%-15% (ex-BlackRod) for a price range of $70/b-$90/b, which will be much higher when the additional barrels from this asset are added. The strength of the balance sheet allows them to assume this period of cash burn in a solvent manner and without significant risks.

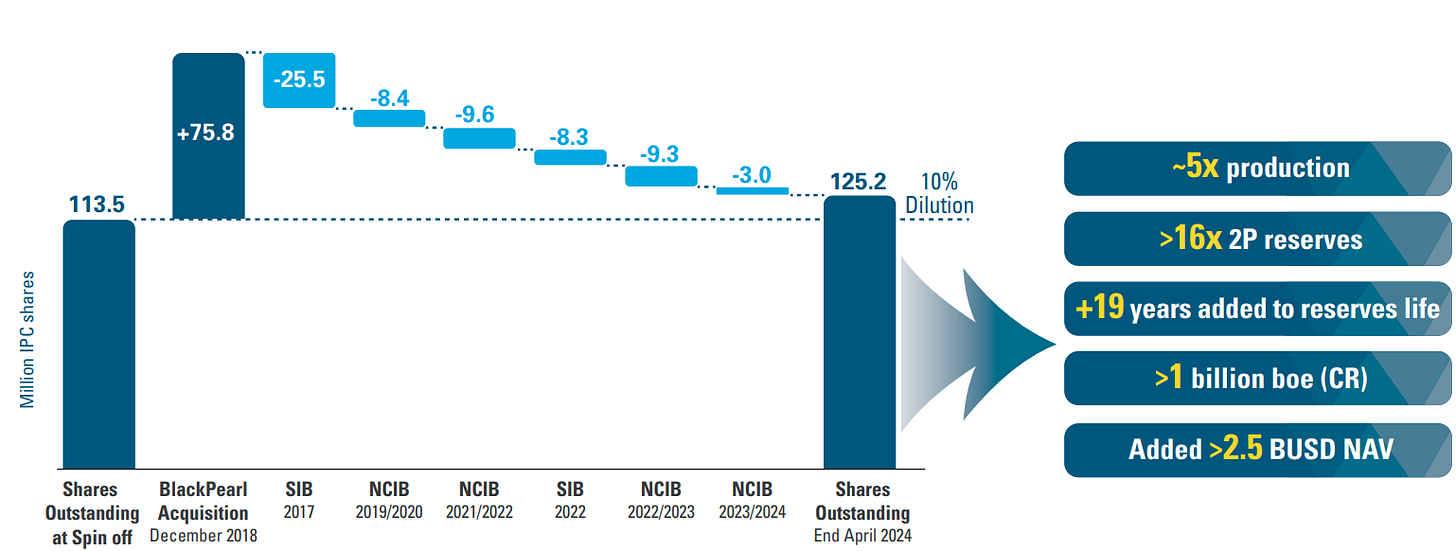

In fact, they have renewed their share buyback program, for 10% of the float, combining the best of both worlds: growth and shareholder return. It's impressive to see what a good management team can achieve, with the following chart being a clear example: since inception, the total dilution of the business has been only 10%, and it has been accompanied by a 5x increase in production, a 16x increase in reserves, and value creation of $2.5B. Lundin FTW.

Oil prices have remained high in this first quarter (average of ~$83/b Brent), and IPCO has once again demonstrated its great strategic vision and financial prudence by establishing hedges for 50% of its volumes at $80.3/b WTI and $85.5/b for the rest of 2024.

IPCO is an exercise in patience, if we are bullish and constructive about the oil market, which should generate a great IRR in the next two years if they execute as well as they have done so far.

Coinbase

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.