Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q125 Earnings review, part II

This delivery is the second installment of the first-quarter earnings commentary for 2025 for the companies under our watch or model portfolio. These presentations tend to be highly positive events for our portfolio, as they showcase to the market the strong cash-generating capacity of our holdings and are often accompanied by generous shareholder returns. Specifically, in this publication, we will discuss the results of the following companies::

International Petroleum

Amerigo Resources

Georgia Capital

Vermilion Energy

Let’s get at it.

International Petroleum

In the first quarter of 2025, IPCO managed to maintain its average net production at 44,400 boepd, despite the many planned maintenance activities, within the guidance range provided during the CMD. This figure consists of 52% heavy crude, 15% light and medium crude, and 33% natural gas. In terms of development, Phase 1 activities continued at the Blackrod asset, while at Onion Lake Thermal, all planned infill wells, including those for the last pair on Platform L, were successfully drilled.

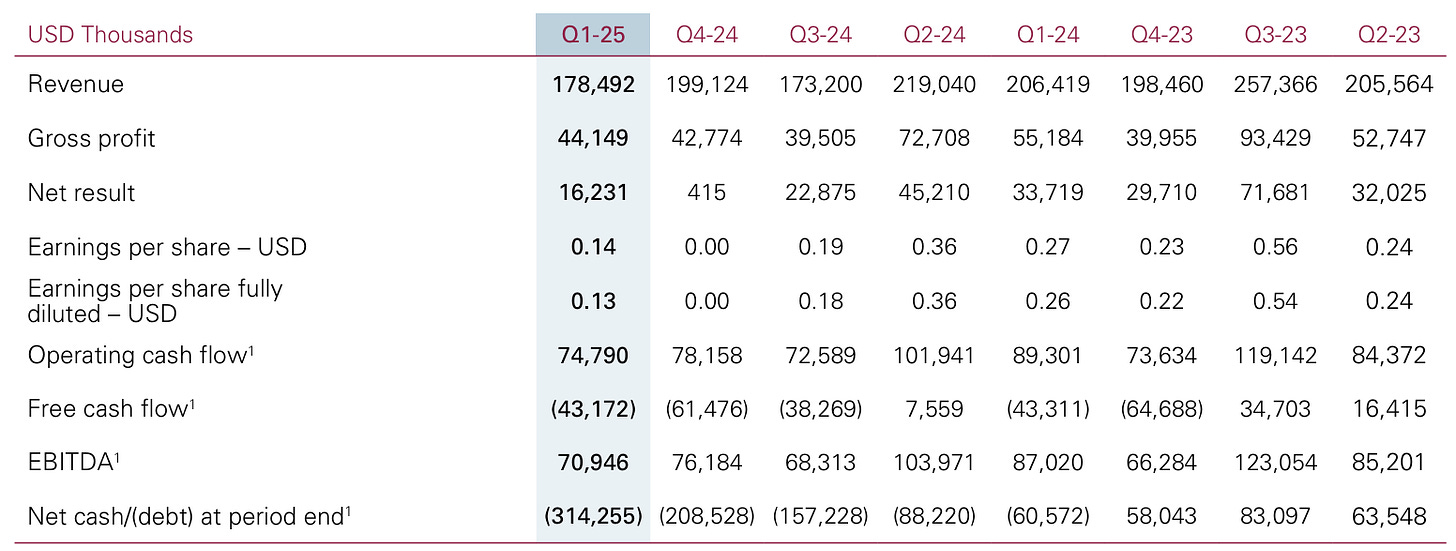

Regarding finances, operating costs per boe remained unchanged at $17.3, which helped offset, to some extent, the weakness in crude prices ($76/bbl in Q1, much higher than current levels). With these volumes and prices, operating cash flow (OCF) amounted to $75 million (also in line with guidance), CAPEX was $99 million, and therefore, free cash flow (FCF) was -$43 million.

At the end of Q1, they had gross cash of $140 million and net debt of $314 million. For the full year of 2025, the company has maintained its forecast for average production between 43,000 and 45,000 boepd. It is also expected that operating cash flow (OCF) for the year will range between $240 million and $270 million, considering a Brent price between $60 and $75 per barrel. On the other hand, free cash flow (FCF) is expected to range between -$135 million and -$110 million, after accounting for $230 million in capital expenditures related to the Blackrod project.

The following table is very useful for showing the operational leverage at higher oil prices and the increase in debt clearly, as they have disbursed the Blackrod investment.

During the first quarter of 2025, the physical oil market remained in deficit (as shown by inventories, despite what the EIA reports), which led OPEC+ to increase supply beyond expectations. IPCO, prudently, entered hedging contracts for nearly 40% of its projected 2025 oil production. These agreements have been set at prices around $76 per barrel for Brent and $71 for WTI for the remainder of 2025.

The first oil from Phase 1 of the Blackrod development is expected by the end of 2026, with net production anticipated to reach 30,000 boepd by 2028. In 2025, capital expenditures for the Blackrod asset are expected to be $230 million, of which $77 million has already been disbursed in the first quarter. Since the organic growth project was approved in early 2023, approximately $669 million has been incurred, representing about 80% of the total multi-year project capital budget.

Regarding the share repurchase program under the 2024/2025 NCIB, IPC has repurchased and canceled approximately 0.8 million shares in December 2024, 3.7 million more during the first quarter of 2025, and 0.2 million additional shares under other exemptions in Canada. The average purchase price of common shares in the first quarter of 2025 was 146 SEK / 20 CAD per share. It is likely that we will see the arrival of Blackrod at the best possible time: with a significantly reduced number of shares, a much higher oil price, and a much less negative sentiment.

Amerigo Resources

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.