Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q224 Earnings review, part III

With this dispatch, we continue with the commentary on the second quarter results for the year 2024 of the companies under our monitoring or model portfolio. These presentations are usually very positive events for our portfolio, as they demonstrate to the market the great cash generation capacity of our holdings and are often accompanied by generous shareholder returns. Specifically, in this publication, we will discuss the results of the following companies:

Dundee Precious Metals

InMode

Warner Bros Discovery

Braskem

Let’s get at it.

Dundee Precious Metals

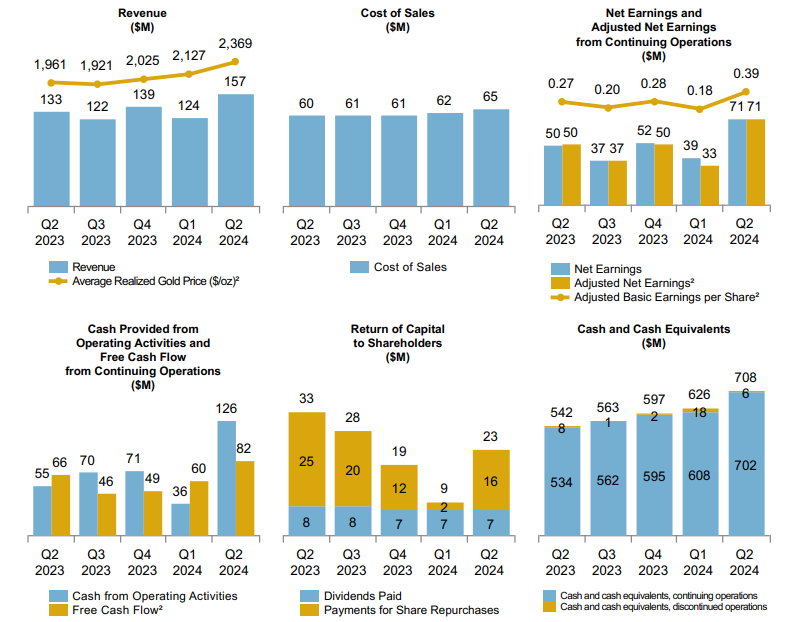

Dundee Precious Metals is making the most of the bullish market and positive environment for gold, reporting a record-breaking quarter. Production at its two assets (Ada Tepe and Chelopech) was in line with expectations, and thanks to by-product production, the cost per ounce has decreased by 3% YoY, down to $710/oz. The following chart shows record revenues, profits, FCF, and cash on the balance sheet, with improvements in all metrics.

The net reduction of shares during the quarter was 2.3M, representing 1.3% of total capital, complementing the quarterly dividend they distribute. They have renewed the NCIB, which allows them to repurchase 9.8% of the float over the next 12 months, creating significant shareholder value without compromising their ambitious organic development goals with Coka Rakita. Regarding this project, they published the PEA in May, which offers very interesting economic prospects, and as a result, they initiated the preparation of a formal PFS, which should be completed in Q1 2025. It's worth noting that this project, which at current prices has an NPV greater than its EV, comprises only one of the four licenses they hold in the area, and it's not even fully explored yet, so the potential is still enormous.

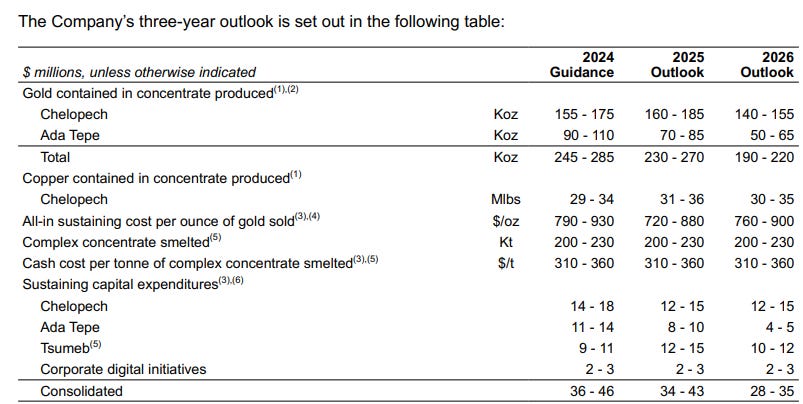

In the following table, they share their outlook for the next three years, highlighting the decline in volumes at their two production assets, although I believe they can reverse the trend at Ada Tepe and significantly extend its mine life with a brownfield exploration program that they are already starting to develop.

At these gold price levels, the company generates an enormous amount of cash, and they have very clear capital allocation priorities to generate shareholder value, even if the price doesn't fully reflect the progress they are making. With a balance sheet that is a fortress and such low production costs, the downside seems quite protected, and the upside and bullish case remain intact if gold maintains (or, as I believe, increases) these price levels.

InMode

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.