Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q324 Earnings review, part II

This report is the second installment of the Q3 2024 earnings commentary for companies under our watchlist or model portfolio. These presentations are typically very positive events for our portfolio, as they showcase to the market the strong cash generation capacity of our holdings and are often accompanied by generous returns to shareholders. Specifically, in this publication, we’ll discuss the results of the following companies:

Amerigo Resources

Warrior Met Coal

Valaris

Coinbase

Let’s get at it.

Amerigo Resources

Amerigo Resources reported a significant year-over-year operational and financial improvement, although 2023 was notably impacted by an operational halt due to heavy rains. With an average price of $4.22/lb in the quarter, $ARG.TO achieved revenues of $45.4M, resulting in a net profit of $2.8M, although FCFe (Free Cash Flow to Equity, or the cash flow available for distribution to shareholders) was much higher at $5.9M.

Production costs, consistent with the previous quarter, remained below $2/lb ($1.93/lb), leaving a substantial margin at these prices and providing considerable optionality if, as in Q1 and Q2, prices approach $5/lb, when they even paid an extraordinary dividend of C$0.04/share.

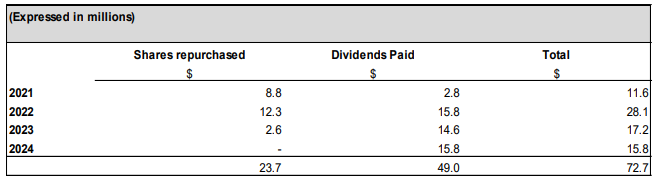

They’ve consistently stated that their cash threshold, from which they will distribute all generated FCF, is $25M, a level they reached in Q3; in addition to last quarter's extraordinary dividend of C$0.04/share, they have reactivated their share buyback program. While they don’t plan to be highly active with buybacks (due to its cyclicality — more likely to activate during high copper prices, which is when the stock is most expensive), they aim to ensure that shares outstanding decrease each year.

The board has declared its thirteenth quarterly dividend of C$0.03/share, bringing total annual shareholder returns to $15.8M, already close to 2023’s total with one quarter remaining. Ideally, the company should continue repurchasing shares, as they announced they started doing in October, complementing the dividend with a strategy that has a greater impact on the stock price.

Warrior Met Coal

In the third quarter of 2024, Warrior generated a net profit of $42 million ($0.8/share), compared to $85 million ($1.64/share) in the same quarter of 2023. This decline was primarily due to a 17.5% decrease in sales volume and a 7% lower average selling price, meaning that the comparison shows worse results in both volumes and prices (the volume part, as we will see later, is partly intentional). Combined with an increase in production costs, the margin per ton dropped from $70/st to $48/st year-over-year.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.