Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q324 Earnings review, part II

This report is the third (and final) installment of the Q3 2024 earnings commentary for companies under our watchlist or model portfolio. These presentations are typically very positive events for our portfolio, as they showcase to the market the strong cash generation capacity of our holdings and are often accompanied by generous returns to shareholders. Specifically, in this publication, we’ll discuss the results of the following companies:

Dundee Precious Metals

Braskem

Petrobras

Warner Bros Discovery

Let’s get at it.

Dundee Precious Metals

DPM has seen its (strong) results overshadowed following the U.S. elections due to the strength of the dollar, which has put significant pressure on gold and mining stocks.

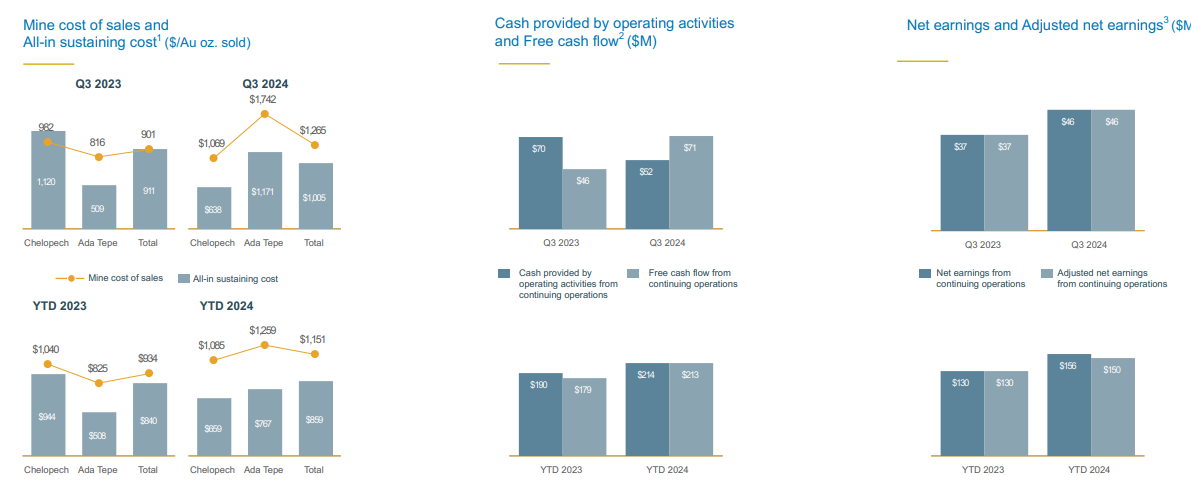

Financially, as expected with current gold prices, the results were outstanding. Operating cash flow was $52 million for the quarter, lower than the previous year due to the timing of two material shipments, partially offset by higher mineral prices. Free cash flow, which the company reports before changes in working capital, was $71 million, an increase of $25 million compared to 2023. Costs rose slightly to $1,005/oz (we'll delve into the operational issues at Ada Tepe later).

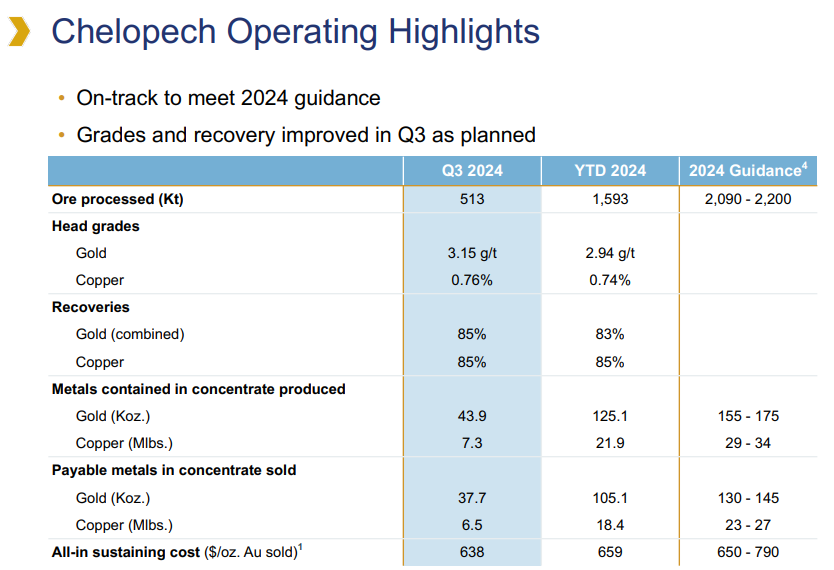

Starting with the positives, operations at Chelopech were very strong in Q3, meeting volume guidance with costs slightly below expectations. The grade of processed ore (and recovery) improved compared to the previous quarter, positioning the operation well to meet 2024 targets.

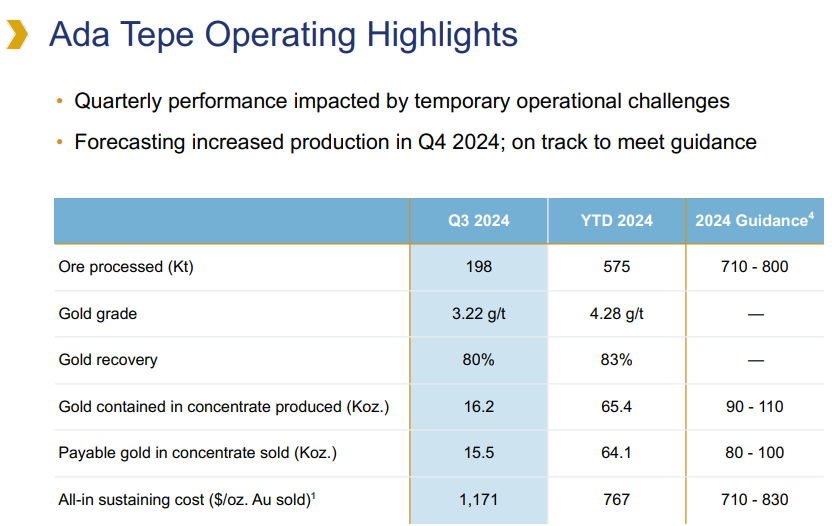

At Ada Tepe, temporary operational challenges impacted performance during the quarter, including lower-than-expected ore grades and recoveries, as well as fleet availability issues. This resulted in production of approximately 16,000 ounces of gold and an all-in sustaining cost (AISC) of $1,171/oz (significantly higher than $767/oz in the previous quarter, weighed down by lower volumes). These issues have since been resolved, and higher production is anticipated in Q4, enabling Ada Tepe to meet its annual guidance.

The pre-feasibility study (PFS) for the Coka Rakita project is progressing, with completion expected in Q1 2025. Once published and updated to reflect current price sensitivities, it should yield an NPV significantly higher than the company’s current EV, with the potential to create substantial value. My view is that, beyond the organic development of this asset, we could also see M&A activity. The company has also identified significant exploration potential across its four licenses, as evidenced by recent drilling results. In September, two new discoveries were announced at the Dimitri Proto and Frasen prospects, located just one kilometer north of Coka Rakita. While still at an early stage, the expansion potential for this asset is highly significant.

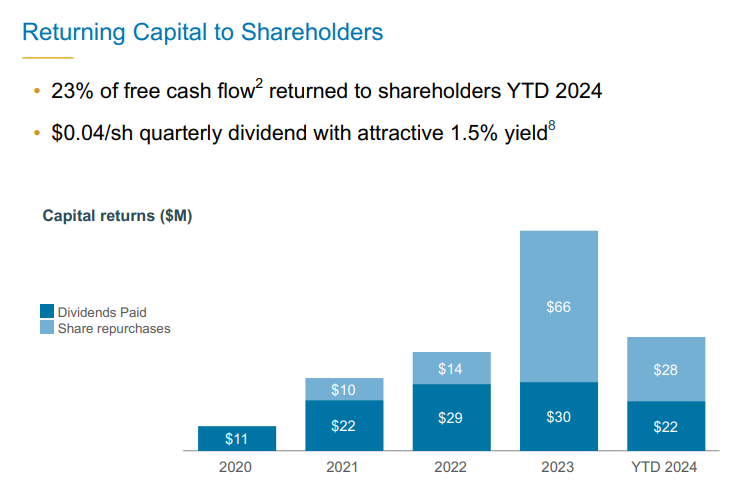

Regarding capital investments, maintenance CapEx was $11 million for the quarter, comparable to 2023. Investment in Loma Larga has been virtually discontinued, as the development of the asset now seems remote and unlikely. During the first nine months of 2024, the company repurchased 3.4 million shares for a total of $28.3 million as part of its share buyback program and distributed $21.7 million in dividends, representing a combined return of 23% of its free cash flow to shareholders. Once the final investment decision on Coka Rakita is made, we are likely to see a significant increase in this distribution.

Braskem

Braskem is perhaps the thesis that is most testing our patience as a community, as the price continues to fall without finding any support. My view is clear and backed by the data and signals provided by the sector’s capital cycle, but it is natural to have doubts during the trough of that cycle.

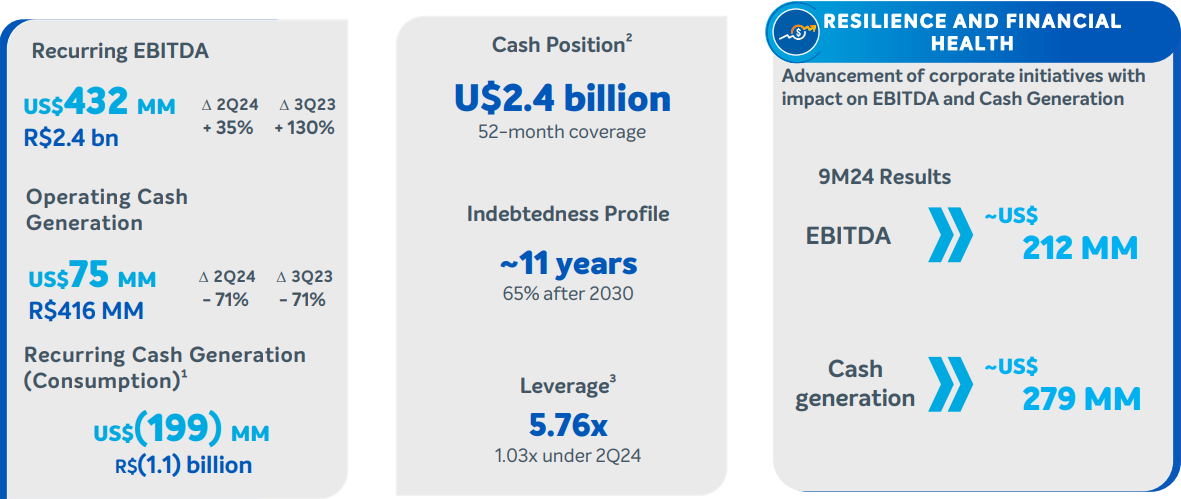

In the third quarter of 2024, the petrochemical landscape maintained a trend of increasing spreads in the international market. This trend is mainly due to a better balance between global supply and demand, along with the effects of the conflict in the Red Sea, which continue to impact global logistics, increasing maritime freight rates and, consequently, international prices. In this context, and thanks to the company’s ongoing implementation of financial preservation initiatives, recurring EBITDA reached $432 million, 35% higher than the second quarter and 130% above the same quarter of the previous year. Cash generation (OCF) was $75 million for the period, while the net cash outflow reflected a consumption of $199 million, mainly due to a higher concentration of interest payments on debt securities issued in the international market.

They are not yet at a cash breakeven point, but this moment is approaching quickly.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.