Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q424 Earnings review, part I

This delivery is the first installment of the fourth-quarter earnings commentary for 2024 for the companies under our watch or model portfolio. These presentations tend to be highly positive events for our portfolio, as they showcase to the market the strong cash-generating capacity of our holdings and are often accompanied by generous shareholder returns. Specifically, in this publication, we will discuss the results of the following companies::

Cresud S.A

Dundee Precious Metals

British American Tobacco

Coinbase

Let’s get at it.

Cresud S.A

Cresud's results, as we previously discussed in the investment idea article, are not easy to interpret since purely financial data does not tell the whole story. Let’s start with the operational side.

Planted area has increased by 9% compared to last year, reaching a historic record when combining owned and leased land across the four countries where the company operates. In the last quarter, agricultural commodity prices have shown a slight recovery, while costs have decreased, particularly in Brazil, due to the depreciation of the real.

The temporary adjustment in export taxes announced by the Argentine government to support the sector amid drought conditions has led to an approximate 5% increase in prices received by farmers, although part of this margin is absorbed by exporters. Milei has reiterated his intention to reduce or eliminate these taxes, but always under the premise of maintaining a fiscal surplus. For now, the announced reductions will remain in effect until June 30, creating market uncertainty as expectations fluctuate between their extension or a potential reversion to the previous 33% level starting July 1. Meanwhile, other products such as rice, cotton, and various dairy goods have seen their export taxes permanently reduced to zero, a move welcomed by the sector. The industry perceives a clear intention from the administration to continue easing the tax burden, particularly export taxes, which have historically been the main obstacle to producer profitability.

IRSA, Cresud’s largest holding, reported a loss of ARS 40.9 billion in the quarter, primarily attributed to a non-cash accounting adjustment related to the valuation of its investment properties. Despite this, activity in shopping malls showed a recovery, with rental sales increasing by 21.4% compared to the previous quarter. However, when compared to the same period last year, there is still an 8.5% decline, although positive year-over-year figures are expected in the coming quarters. In the office segment, occupancy reached 100%, representing a key stability factor for the company.

In the hotel sector, results were weaker, with declining revenues and occupancy rates due to Argentina’s new macroeconomic environment and currency devaluation, which has reduced the flow of tourists compared to the previous year (Aleix already mentioned this in our Discord).

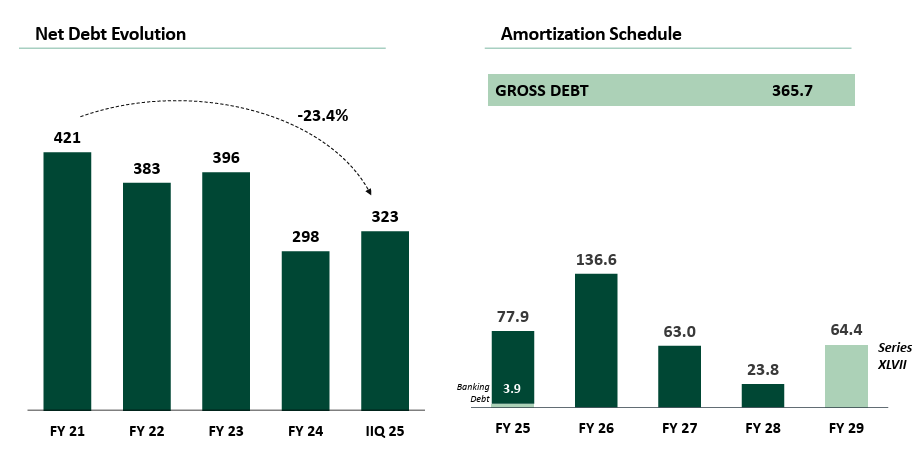

Debt remained relatively stable, and the amortization schedule is entirely manageable for the company, which is balancing deleveraging with a strong shareholder return policy: a 7% dividend (yield) paid in November and a 0.75% share buyback that same month.

At a consolidated level, both IRSA and Cresud’s losses are directly related to the devaluation of investment properties. Last year, the sharp depreciation of the peso led to an accounting revaluation in pesos, generating positive figures. This year, with asset prices stable in dollar terms, a reduction in the blue-chip swap rate, and the appreciation of the peso, accounting losses have been recorded. In dollar terms, valuations for office properties and land banks—key long-term value drivers—have remained stable, while shopping malls reflect an improvement of approximately $120 million. If agricultural tax cuts are maintained or extended in July, we should see an immediate rerating.

Dundee Precious Metals

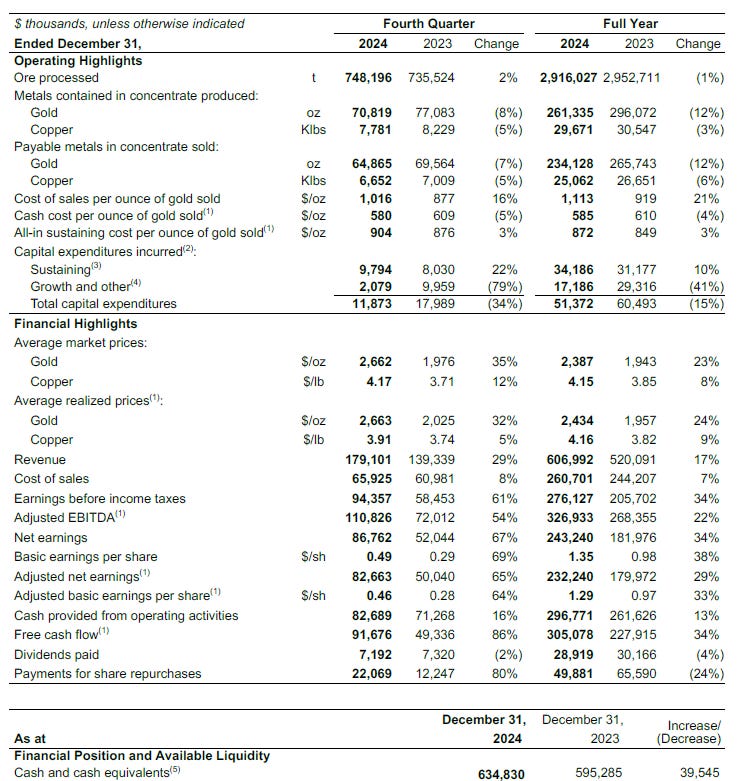

We are in a gold bull market, and Dundee Precious Metals is taking all the right steps to capitalize on it. The financial results are very strong, reflecting solid operational performance, with revenues of $607 million, net profit of $232 million ($1.29 per share), operating cash flow of $297 million, and free cash flow of $305 million.

The favorable metal price environment and a low-cost structure, which limits operating leverage, provide significant safety margins to sustain this trend. In fact, the all-in sustaining cost (AISC) stood at $872 per ounce of gold, a 3% YoY increase due to lower gold sales volumes, higher labor costs, and maintenance expenses, partially offset by lower treatment costs at Chelopech and higher by-product credits thanks to copper appreciation.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.