Disclaimer

LWS Financial Reserach is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Q424 Earnings review, part III

This delivery is the third and final installment of the fourth-quarter earnings commentary for 2024 for the companies under our watch or model portfolio. These presentations tend to be highly positive events for our portfolio, as they showcase to the market the strong cash-generating capacity of our holdings and are often accompanied by generous shareholder returns. Specifically, in this publication, we will discuss the results of the following companies::

ICL Group

Braskem

Golar LNG

Vermilion Energy

Let’s get at it.

ICL Group

The market is not fully recognizing the value (despite the 40% rally from the lows) of the company and its transformation process. In 2024, the company delivered financial results comparable to 2023 while gaining market share in its specialty-focused business. Annual revenues reached $6.841 billion, with adjusted EBITDA of $1.469 billion and a 21% margin (vs. 23% in 2023). So far, nothing particularly exciting...

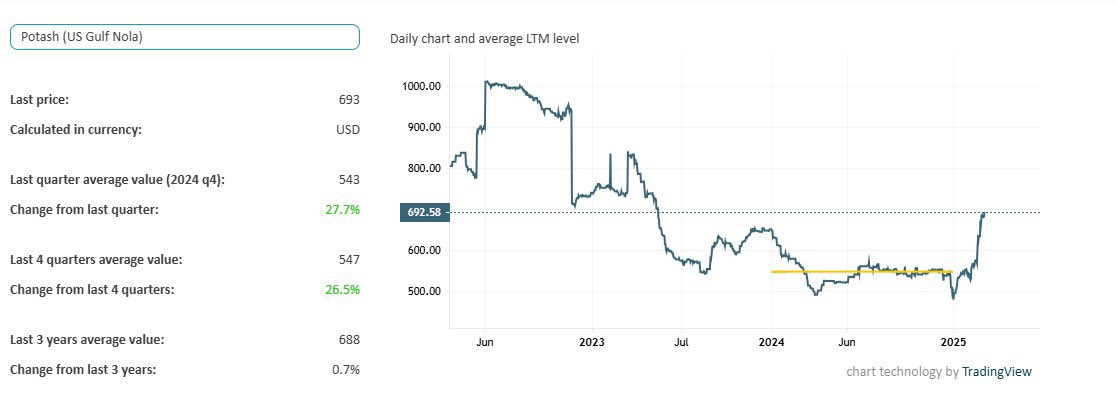

What stands out is that they achieved these results despite ongoing pressure from the falling price of potash, their main product—which dropped 24% compared to the previous year. The strategy of focusing on specialty lines helped cushion this impact. Thanks to this approach, annual EBITDA grew by 8%, driven by the Industrial Products, Phosphate Solutions, and Growing Solutions segments. Together, these specialty divisions contributed 70% of the total EBITDA for the year and 73% of the fourth-quarter EBITDA, confirming the success of the strategic shift toward higher value-added businesses with less dependence on the most volatile raw materials.

In this regard, we’ve seen them enter markets such as semi-solid-state batteries during the year, while continuing to grow in phosphates, where they are also the global leader (by volume, quality, and cost).

They closed 2024 near the upper end of their revised guidance and, on the strategic side, strengthened key partnerships across their three main divisions (Industrial Products, Phosphate Solutions, and Growing Solutions). Looking at the markets, potash and phosphates are on diverging paths: potash prices remained under pressure in the fourth quarter (though they stabilized in January and have recovered since), while phosphate prices rebounded, rising 4% since the end of the year. The sector outlook for 2025 looks favorable, with an improving trend in potash and sustained strength in phosphates. Financially, leverage remained under control with a net debt/EBITDA ratio of 1.2x. Additionally, the shareholder remuneration policy was reaffirmed, with 50% of adjusted net income allocated to dividends, amounting to $52 million for the quarter and a 3.8% annual yield.

Looking ahead to 2025, the expectation is to continue capitalizing on the momentum of the specialties, with an expected EBITDA range between $950 million and $1.150 billion (for these segments) and total potash sales of between 4.5 and 4.7 million tonnes, while anticipating an effective tax rate of 30%, adjusted for a potential further improvement in potash prices. For context, ICL is trading at a $7.6B market cap (<5x EBITDA).

Beyond the guidance, this year could mark a very positive turning point. ICL faces a favorable environment after years of pressure from unfair competition from China. Thanks to anti-dumping measures already in place in Europe and progressing in the U.S., their product has gained ground by gradually replacing Chinese imports, not only due to regulations but also because of rising sustainability requirements that will sideline many competitors in the coming years. Furthermore, the company has a new product line that meets the highest environmental standards, strengthening its competitive position in both markets.

On another note, farmer sentiment improved significantly in the fourth quarter (+50% versus the third quarter) and continued rising in January, driven by the post-election climate in the U.S. Demand remains strong, but the commercial strategy has become more selective: despite having the capacity to lock in long-term orders, they prefer to pace sales to optimize prices. Although they haven't sold out production through May yet, it's not due to a lack of customers but rather a focus on prioritizing margins. With the worst of the cycle behind them, the company is returning to normal activity levels, but now within a much more favorable commercial environment thanks to tariff protections and its commitment to sustainable products. Potash prices are already up +28% YTD.

Braskem

The company's financial results are not particularly exciting, but the recovery of the petrochemical cycle and the competitive position of the Brazilian giant in the sector certainly are. The decline in international spreads during Q4 2024, especially in polyethylene (PE) and basic chemicals, negatively impacted the company’s results, closing the period with recurring consolidated EBITDA of $102 million. For the full year, recurring EBITDA reached $1.1 billion, a 46% increase over 2023, supported by volume recovery and some operational normalization. Nevertheless, the company posted a net cash consumption of $91 million for the year, reflecting the ongoing challenges of a squeezed margin environment despite improved activity, as well as the lingering Alagoas event, which has yet to be fully resolved.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.