Disclaimer

kairoscap is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction

Silver has been considered a precious element used to make jewelry, utensils, and religious objects for almost 5,000 years. The earliest known mines are located in Anatolia, Turkey, around 3000 BC, and the main extraction and processing centers were later moved to Greece and Spain, where it began to be used as currency. However, the true production boom for this metal came with the Spanish arrival in the New World, which, from 1500 to 1800, accounted for 85% of global silver production (Bolivia, Peru, Mexico). Currently, the majority of production is still concentrated in the same region (Mexico and Peru are the world's number 1 and 3 producers, with China as number 2).

Unlike gold, whose industrial use is very limited, silver, beyond its monetary/precious metal role, has broad industrial applications: over 50% of its consumption is allocated to functions other than wealth preservation and jewelry. Almost every computer, mobile phone, or household appliance contains silver because it is the perfect component for coating electrical contacts due to its high conductivity and resistance. Specifically, silver has uses in multiple and diverse fields:

Industrial applications

Photovoltaic cells

Photography

Medicine

Jewelry

Cutlery

Investment

Its unique properties make it very difficult to substitute (unless technological disruption finds more efficient elements in the future). In addition to its theoretical interest as a material, silver represents a very interesting investment idea due to the confluence of several factors at the same time, which create an ideal environment for this metal to shine. Several world-class investors, such as Eric Sprott and George Soros, have positions in silver, considering it as the commodity with the greatest potential.

Silver is the most undervalued asset in the world and has the potential to outperform gold significantly.

— Eric Sprott

Investment thesis

The investment idea in silver, which I see as one with great potential, is based on various factors that currently align:

Supply/demand balance

Gold-silver ratio

Macroeconomic uncertainty and inflation

Paper market

Let's explore each of them individually.

Supply-demand balance

Since we focus on silver not only as a monetary asset but also as an industrial asset, like any investment in commodities, it is very relevant to evaluate the supply and demand situation. The silver market is experiencing a significant deficit (~7% of the forecasted production at the beginning of the year, which has been even higher by the end of the year due to higher final demand of 1.21B/oz).

The supply has been stagnant for years (slight improvement in recycling, but not in primary production, and recycling is highly price-dependent, so without an increase in price, it is likely to remain stagnant). This is due to a lack of investment in new exploration and production, combined with the fact that primary silver exploration is rare, and it is usually exploited as a byproduct of gold, copper, and zinc exploration. In a deficit market, it is crucial to analyze the cost curve, and we can see that for the 10th percentile, the all-in sustaining cost (AISC) is above $35/oz, which sets the incentive price.

Regarding supply, if we focus on the main producers, we find several South American countries with recent government changes, such as Peru and Chile, and others in a complicated geopolitical situation, such as Russia. This political instability can affect production, further tightening the market (in 2022, both Peru and Chile have already experienced declines in their production).

On the demand side, some minor uses, such as photography, are disappearing (although they may eventually find a balance), while others have strong tailwinds for growth. Going into more detail, in various uses:

Photovoltaics: Solar energy is the main source of green energy in the world and the fastest-growing. Even with the setback of the pandemic in 2020, its adoption continues a clear upward trend. Silver is the most photosensitive element in the world, so it is used in silicon wafers of solar cells. When light hits these cells, electrons are released, and silver conducts electricity to batteries for subsequent use. In recent years, the demand for silver associated with solar energy has been growing at rates of 10-13% annually and already accounts for 12% of the total annual supply.

With the growth of solar energy, where it is expected to produce 8 times more energy by 2030 than it does now, the associated demand would consume 100% of the silver produced today, although there may be efficiency improvements. This year, China alone will add almost 100 GW of solar capacity, and it is expected to add between 85-100 GW per year in the coming years (to put it in context, the annual added capacity is greater than the total solar capacity of countries like Germany).

Medical: Silver has been used in the field of medicine for millennia, and its uses remain relevant today. It is a key reagent in some diagnostic processes, such as for tuberculosis, and is also used for wound and burn treatment. It is used as a purifier in water filters in hospitals, pools, spas, preventing the growth of bacteria and keeping the filters clean. Considering that 10% of the population does not have access to clean drinking water, its use is critical. In India, for example, a new silver-based technology has been developed to remove pesticides and arsenic from water, and millions of these units have been provided to poor communities.

Electric vehicles and electrification: Although more expensive, silver is a better conductor than copper and has significant applications in conductors and electronic components, which are common in electric and hybrid vehicles.

The trends of energy transition and electrification favor the demand, which is expected to triple in the automotive sector in the next 20 years.

Jewelry and silverware: Although more stable and without as many tailwinds, silver has been a desirable element for jewelry for centuries, and the global increase in living standards also creates a positive trend for this use. This year, India has increased its demand for silver in this category by 45%, and other countries such as Thailand, Italy, and the USA have also experienced significant increases. In terms of silverware, India has also been the main driver of change this year, and it is forecasted that its metal consumption will increase by 80% this year.

Investment: Given the macroeconomic and inflationary outlook, the demand for silver as a store of value is increasing significantly (+18% in 2022), and we will see later why this growth is likely to amplify.

As we can see, the majority of the demand includes sectors with strong tailwinds and growth trends, which will exert constant upward pressure on supply and prices.

Gold-silver ratio

The correlation between gold and silver, in almost any analyzed time horizon, is greater than 0.8, meaning that whatever the bullish case for gold is, it is the same for silver, but with more leverage. The conceptual similarities between both metals are clear (use as money and precious metal, jewelry, etc.), but their numerical relationship is less direct.

The abundance ratio of both metals on Earth is 7 to 1 in favor of silver, so one would expect the price ratio to move around that figure based solely on fundamentals. However, the reality is very different: the current price ratio stands at around 85-1, suggesting that silver is severely undervalued compared to gold. One of the most powerful forces in the markets is mean reversion, and historically this ratio has been around 40-1, which means that silver could double in price to return to average levels (or gold could fall by 50%, although I see this possibility as highly unlikely, as we will discuss in more detail in the following section).

In fact, the case of silver is particularly surprising, as it is the only metal that has not reached its historical highs reached in the 1970s (although it did so nominally in 2011, but not adjusted for inflation).

Macro uncertainty and inflation

As I have been saying for a while, I believe we are going to experience a period very similar to the 1970s in the markets, and the parallels between both periods are very clear, although the higher debt and weakness of the monetary system (in the 1970s they had just abandoned the gold standard) make the current moment more dangerous:

In the 1970s, silver rose by 3700%, from $1.3 to $50 in 1971, in 10 years, so it is clearly a favorable environment for this asset. In the last 25 years, all crises have been met with expansive monetary policies, which have provided extraordinary returns for risk assets and conditioned investors to believe that the Fed would support any valuation assigned by the markets. Faced with the uncontrolled increase in debt and central bank balance sheets, investors, increasingly concerned about the devaluation of fiat money, are once again showing interest in precious metals as a store of value.

Central banks, especially outside the Western sphere of influence, are expanding their gold reserves and even considering resurrecting old mechanisms of gold or commodity-backed money. As a result of the Russia-Ukraine war, we have seen several speeches in this regard:

They should pay in hard currency, and for us, that means gold, or in a currency that is convenient for us, which is the national currency. From states classified as non-friendly by Russia, we will only accept payments in rubles or gold in the future, and from allies, payments in freely negotiable currencies.

In the new multipolar economic order, we have already seen proposals from the BRICS+ bloc to create internal currencies, possibly linked to commodities or gold. With the use of fiat money as a weapon by the USA and the EU, as we have seen with the freezing of Russian reserves abroad, they have already sent a warning to other powers like China.

Although historically gold has been a great protection against inflation (more precisely against negative real rates), it has not been the case in recent years. The main reasons are:

Opportunity cost due to the high appreciation of stock markets.

Emergence of cryptocurrencies as an alternative.

Market acceptance of a narrative of transient inflation.

In recent months, however, we are seeing increased appetite for this asset, and it is behaving as one would expect.

Taking inflation into account, by 2030, the price of gold could reach $10,000 per ounce, and as we mentioned, the relationship between gold and silver is very strong, so at a ratio of 40-1, we could see silver at $250 per ounce.

Paper markets

For years, precious metals investors have argued that there is significant manipulation of futures prices that does not reflect the underlying physical reality.

Last year, with depressed futures prices, the premium on silver coins (the physical premium) increased significantly due to an increase in demand for physical silver, showing the disconnection between the two markets. Since then, and with the recent price increase and the influx of capital into ETFs, which has replaced part of the physical demand, the premium has also been reduced.

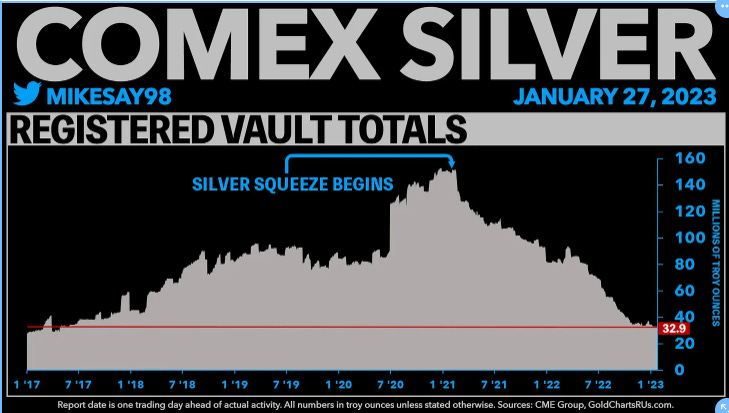

COMEX, the American futures market, is the reference for futures prices, and it holds the physical silver traded in futures. This stored silver is divided into two categories:

Eligible - Silver held for its owner at COMEX but not available for sale.

Registered - Custodied silver that is available for sale.

When the price rises, there is a transfer between registered and eligible, and more silver becomes available for sale. The current open contracts represent 245% of the total stored silver and 2.379% of registered silver. This means that there are many more contracts (24x) than silver available for sale or even stored. If contract holders decided to request physical delivery, it would be impossible, causing an immediate revaluation and the collapse of the paper market. The fact that there is so little silver available for sale indicates that owners consider the price to be too low.

If the demand trend continues to increase and COMEX reserves continue to be depleted, we could see a silver squeeze, as it is important to remember that commodity markets, especially those that are not in equilibrium, move based on the marginal, which would skyrocket in this case.

Investment vehicle

There are many ways to invest in silver, and the chosen vehicle depends on the purpose of the investment (related to the factors of the thesis):

Physical Silver - Coins or bars. In addition to the appreciation of the metal's price, this is the ideal vehicle if our investment rationale is as a hedge or insulation against the weakening of the monetary system.

Silver ETFs - They offer exposure to the price of silver without the risks and inconveniences of storing physical silver, although in an extreme case, the ETFs may not be able to provide physical silver for redemption.

Silver mining companies - This is the riskiest bet but offers greater leverage to the price of silver since operational leverage comes into play, magnifying returns (in both directions).

Conclusion

Silver offers one of the greatest commodity investment opportunities currently, with several significant tailwinds in terms of demand, landing in a deficit market, and adding to a macroeconomic and geopolitical environment favorable to precious metals.

Movements in the silver market tend to be very violent and fast, making it suitable only for volatility enthusiasts, but it presents a lot of asymmetry, and in my opinion, the cost curve provides significant downside protection.

If you like the content, you can follow me on Twitter, where I post daily information and recommend the newsletter.

Albert Millan