Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Introduction

Ensco was incorporated in 1975 by a predecessor company called Blocker Energy Corporation, founded by John R. Blocker. Blocker had established a drilling company in South Texas in 1954, but was forced to dissolve it in 1958. He later worked at Dresser Industries as operations manager of the oilfield equipment division in Argentina and Venezuela.

When Blocker left Dresser in the mid-1970s, he purchased a small drilling company that eventually became the core of Blocker Energy Corporation. His goal was to leverage his South American experience to compete in international markets, aggressively relying on debt to expand the company’s fleet to 54 rigs in 8 countries by the early 1980s.

However, the collapse in commodity prices in 1985 left the company on the verge of bankruptcy, leading to its sale to BEC Ventures in 1986. This firm was led by Richard Rainwater, a financial advisor well known for his success with the Bass brothers’ fortune. In 1987, Blocker resigned as CEO and was replaced by Carl Thorne, a BEC Ventures partner and an experienced industry executive who had been president of Sedco.

BEC changed its name to Energy Service Company Inc., whose acronym became Ensco. In 1992, the company officially assumed the name Ensco International Incorporated.

Throughout its history, Ensco carried out two transformational acquisitions:

§In 1993, it acquired Penrod Holding Corporation from the Hunt family, adding 19 rigs to its fleet.

§In February 2011, it acquired rival Pride International for $7.3 billion, which allowed it to diversify its fleet into drillships and semisubmersibles in Brazil and West Africa.

In 2019, Valaris was created through the merger of Ensco and Rowan. Due to the depressed macroeconomic environment associated with the pandemic, Valaris filed for bankruptcy in August 2020. After emerging from bankruptcy proceedings in April 2021, the company eliminated $7.1 billion of debt and received a $520 million capital injection through the issuance of first lien notes.

Business Model

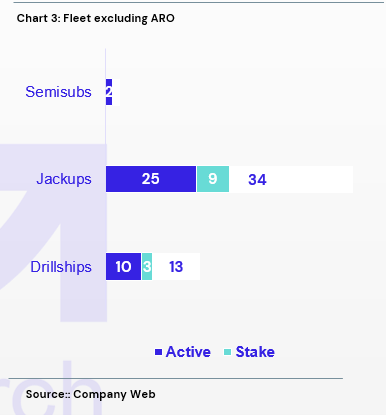

Valaris is the largest offshore contractor globally, with a fleet consisting of 49 assets: 10 state-of-the-art drillships (excluding 3 in cold stack), 2 semisubmersibles, and 34 jackups, in addition to a 50% stake in ARO, a joint venture with Saudi Aramco, which owns another 9 jackups (explained later).

The company operates under a business model based on providing offshore drilling services to international oil companies (IOCs) and national oil companies (NOCs). Revenues are generated through the signing of drilling rig lease contracts, the most common of which are:

1.Dayrate Contracts (the most common)

Structure: The client (IOC or NOC) pays Valaris a fixed daily rate (dayrate) for the use of the rig and associated services.

Payment components:

Operating dayrate: daily fee when the unit is operational and drilling.

Standby rate: reduced fee if the unit is not drilling but remains under the client’s control.

Mobilization/Demobilization fees: compensation for moving the unit at the beginning or end of the contract.

Duration: typically range from short-term (6–12 months) to multi-year (2–5 years). In periods of high demand, clients usually secure longer-term contracts to lock in capacity.

Idle time: when not under contract, assets are placed in stacking.

2.Bareboat Charters (e.g., with ARO Drilling)

Transfers the use of the rig in exchange for a fixed rental fee (bareboat rate), but without providing crew or daily operations.

This applies to some jackups Valaris leases to its joint venture ARO. In this case, Valaris receives a lower fee since it does not provide crew. However, it avoids operating costs and is therefore more protected on the downside of the cycle, even if it captures less upside when market dayrates increase.

Investment thesis

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.