Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

After weeks of threats and feints of a trade war, the United States and the European Union have reached a bare-bones agreement that allows both sides to save face (especially the US, since Europe doesn’t exactly come out looking great…) — at least for now. The deal, announced with all the theatrical flair imaginable at Trump’s golf course in Scotland, sets a 15% tariff on most European goods, down from the initially planned 30%. A grand celebration… for avoiding a disaster of their own making.

Trump has touted it as the greatest trade victory ever achieved, with promises of $600 billion in European investment and massive EU purchases of American energy and weapons. Ursula von der Leyen, publicly forced to swallow the bitter pill, described it as “the best deal possible.” Translation: it’s this or the tariff abyss.

The agreement bears an unsettling resemblance to the one signed last week with Japan: vague, incomplete, and riddled with asterisks. It doesn’t resolve the issue of tariffs on alcohol or semiconductors, nor does it lift the 50% duties on steel and aluminium. These remain in place, though accompanied by hollow promises to keep talking. Economically, the deal benefits major European industrial champions such as Airbus, Mercedes-Benz, and Novo Nordisk… assuming it’s actually honoured. In exchange, Europe pledges massive investments in the US and greater openness in its automotive and agricultural markets — though the details remain murky. It all sounds impressive until one remembers that Trump reserves the right to raise tariffs if Europe doesn’t comply. And we all know what that means.

In the short term, the agreement avoids a commercial explosion with the EU, which would have hit Germany and its automotive industry particularly hard. But the risk hasn’t gone away. All it takes is for Trump to wake up on the wrong side of the bed for a new round of tariffs to be triggered. And this time, the documents are already drafted.

On the global front — focusing on markets beyond China — developments have been less encouraging. Without major headlines but with some constructive signals, the United States and China have agreed to explore an extension of their current 90-day “tariff truce”, set to expire on 12 August. The meetings in Stockholm, though yielding no formal breakthroughs, helped to temporarily ease tensions in a trade war that, if reignited, could see tariffs skyrocket into triple-digit territory and trigger a fresh wave of global disruption.

For the rest of the world, the outcome has been far bleaker — with the exception of South Korea, which secured a deal similar to those agreed with Europe and Japan. On the eve of the new tariff measures (marking the end of the moratorium), Trump announced the following rates:

Canada: Increase from 25% to 35%

Switzerland: 39%

South Africa: 30%

Taiwan: 20%

Vietnam: 20%

Cambodia: 19%

Thailand: 19%

Malaysia: 19%

Indonesia: 19%

Turkey: 15%

Venezuela: 15%

These are extremely high figures, adding further volatility and uncertainty to what has been dubbed Reliberation Day — something that was widely anticipated and for which we had already positioned ourselves in the model portfolio. Trump has once again wielded tariffs as a political weapon — and this time on a grander scale. Only those who have signed deals are spared — and not all of them. The rest will pay the price. Mexico has been granted an extension, contingent on compliance with the USMCA. The others — including Taiwan (20%) — face rates that defy all prior trade logic. And if you’re not on the list, you’re looking at a 10% tariff, for now.

The administration justifies the move on grounds of national security and trade imbalances. But in reality, the criteria seem more like a patchwork of geopolitics, ideology and retribution. If you offered terms deemed insufficient — by Trump — or never got the chance to negotiate, it doesn’t matter: tariff.

Meanwhile, Trump has promised more deals are on the way, though the tone couldn’t be more one-sided. The phrase that sums it up: this is the deal — take it or leave it. Pure America First 2.0,more ambitious, less nuanced.

The much-anticipated rate cut — the one Powell had been heavily pressured to deliver — did not materialise. And more importantly: there are no clear signs that it’s just around the corner. The Federal Reserve held interest rates steady at 4.25–4.50% for the fifth consecutive meeting, and Powell’s message was clear: this is not the time to ease. Despite visible and mounting pressure from the White House, the Fed Chair reiterated that the priority remains to contain inflation — not to make Treasury financing easier or to bring down mortgage costs. The Fed Chair stood his ground.

With the September meeting as the next key date, Powell made it clear they need more data, more clarity… and more time. Markets, which had been pricing in a 70% chance of a cut in September, slashed those odds to below 50% after the press conference. The market response followed the textbook: bond yields rose, equities dropped, and the famous “wait and see” returned. That said, the vote was not unanimous. Two governors — both, interestingly, appointed by Trump — broke ranks and called for a rate cut. The first dissent in over 30 years. The split within the FOMC reflects what has become increasingly evident: monetary policy is now caught between the inflation-control narrative and the fiscal-electoral urgency of the administration. Trump wasted no time and lashed out again:

Powell is too late, too angry, too stupid and too political

— Donald TrumpMeanwhile, unemployment remains at historically low levels (4.1%), but the economy is showing signs of cooling. Second-quarter growth surprised to the upside, but only due to a drop in imports — hardly a reason to celebrate. Domestic consumption, at a two-and-a-half-year low, reveals that the internal engine is starting to lose steam.

Trump has spent weeks lambasting Powell for not cutting rates “immediately and aggressively,” and the fact that part of his own economic team (Bowman and Waller) is now voting against the official line will only add fuel to the fire. Unless macroeconomic data deteriorates sharply in the next eight weeks, the Fed is likely to stick to the current script. “Modestly restrictive,” as Powell described it, appears to be the new neutral.

This week’s IMF update confirmed that, despite all the headlines, the global economy will (as always) continue to progress. The institution revised its growth forecasts upwards for 2025 (+0.2 pp to 3.0%) and 2026 (+0.1 pp to 3.1%), partly due to front-loaded corporate demand ahead of the August 1 tariff hike in the US. In other words, the world is growing… out of fear.

But makeup has its limits. Although the figures have improved since April, they remain below the 3.3% projected in January and far from the pre-pandemic average of 3.7%. Global inflation, meanwhile, continues its downward path — 4.2% for 2025 and 3.6% for 2026 — but in the US it will remain above target due to the same tariffs being passed on to consumers.

In fact, the effective tariff rate in the US has dropped since April (from 24.4% to 17.3%)… but it is still seven times higher than the January level. And caution is warranted: new tariffs on metals, pharmaceuticals and semiconductors are not yet reflected in the Fund’s projections. In fact, if all announced tariffs were implemented, global growth in 2025 would be 0.2 pp lower. All this takes place in a context where the economy is already showing more trade distortions than signs of structural health. Companies are front-loading purchases to avoid paying more in a few months. But the effect is temporary. What adds to growth today will subtract tomorrow. This forward consumption will weigh on activity in the second half of 2025 and in 2026. Jam today, famine tomorrow.

By country:

United States: Growth revised upwards (1.9% in 2025, 2% in 2026) thanks to a new fiscal package with tax cuts… and a $3.3 trillion deficit. The fiscal gap rises by 1.5 pp of GDP, although part of it is offset by tariff revenues.

Eurozone: Slight improvement for 2025 (+0.2 pp to 1.0%), thanks to Ireland and its surge in pharmaceutical exports. Without Ireland, the improvement would have been half.

China: Strong upward revision (+0.8 pp in 2025) due to a recovery in activity and the mini tariff thaw with the US following the truce.

Emerging markets: Still leading, though decelerating: 4.1% in 2025 and 4.0% in 2026.

Global trade: Revised upwards for this year (2.6%, +0.9 pp), but down in 2026 (1.9%, -0.6 pp). A clear sign of the structural volatility imposed by tariff wars.

The falling dollar adds another layer of complexity: it softens the global financial shock but worsens the tariff burden for the rest of the world. Growth is holding up, but more due to inertia than internal strength. If tariffs remain — and all signs point to that — the world will grow less, more unevenly, and with entrenched inflation.

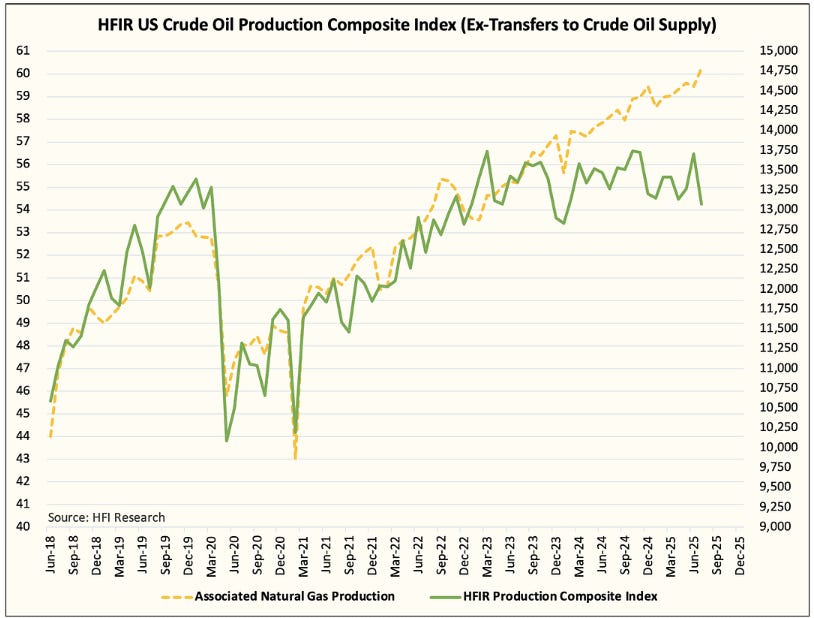

Despite the poor quality of data reported by the IEA, it is increasingly difficult to deny the stagnation and decline of oil production (particularly in the shale segment) in the United States. Additionally, as geological depletion progresses, the production of associated natural gas increases, putting downward pressure on Henry Hub prices — though this should not be permanent, as LNG export capacity (as noted in the section on agreements and tariffs) still has room to grow.

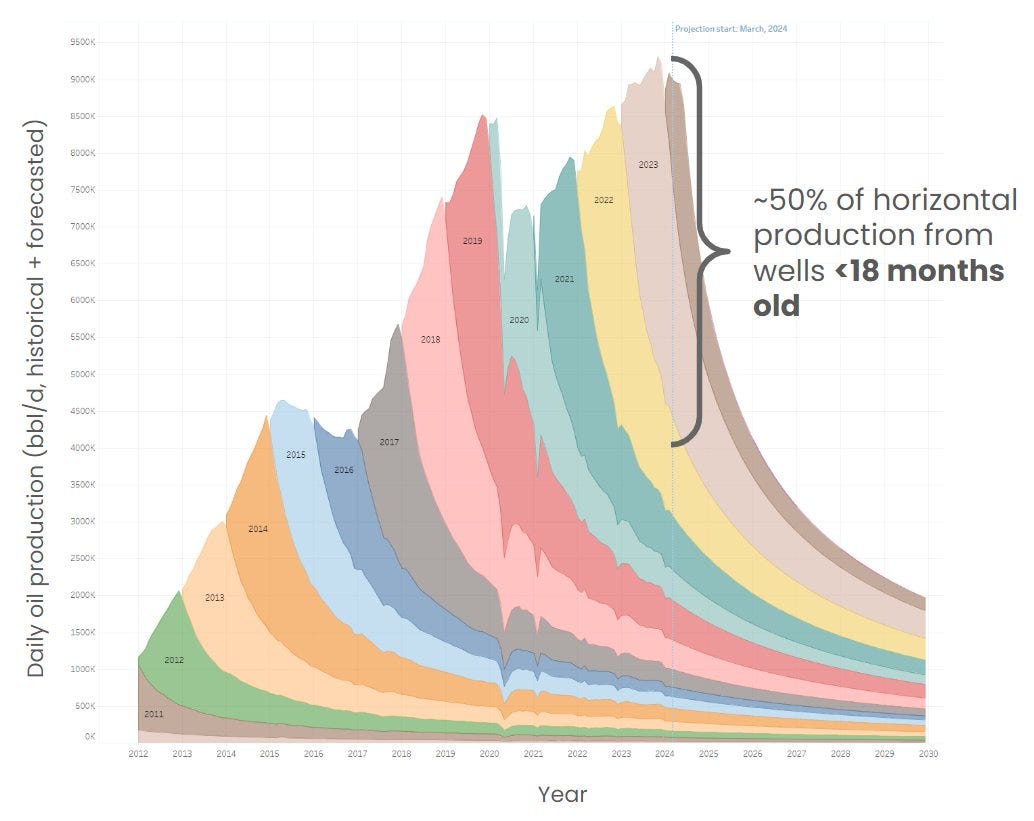

Understanding the issue of shale decline and reinvestment is key — and one of the best ways to grasp it is visually. Looking at well cohorts by vintage, the decline is dramatic; and if there is no reinvestment to replenish them (which is difficult now that the best parts of the inventory have already been depleted), production collapse is immediate. Demand, if we trust global economic improvement forecasts such as those from the IMF, will remain resilient — especially with support measures like those from the Trump administration aimed at curbing the rise of EVs.

Model Portfolio

The model portfolio's return is +12.55% YTD compared to +6.34% for the S&P500 (our portfolio mesured in € terms, which is weighting -13% in our portfolio this year vs the S&P in $), and +88.6% versus +53.8% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.