Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

After weeks of escalating trade tensions, Canada has backed down on implementing its Digital Services Tax (DST), which was set to take effect this Monday and would have directly impacted U.S. tech giants such as Amazon, Meta, Google, and Apple. The decision came just hours before enforcement and unblocks the immediate resumption of trade talks between the two countries.

The move has been interpreted as a strategic victory for President Trump, who had publicly denounced the Canadian tax as a blatant attack and had frozen negotiations until it was withdrawn. The pressure paid off after a call from Canadian Prime Minister Mark Carney to Trump, announcing the cancellation of the tax. With this reversal, negotiations are back on track, aiming to finalize a new trade deal before July 21. According to members of his economic team, Trump is determined to impose new tariffs ranging from 11% to 50% on countries that fail to reach agreements before July 9—the date when temporary exemptions granted in April expire. Trump has hinted he will not extend them, although markets still bet on the TACO scenario: that the president will ease or cancel the tariffs to allow more time for negotiations—except in specific cases.

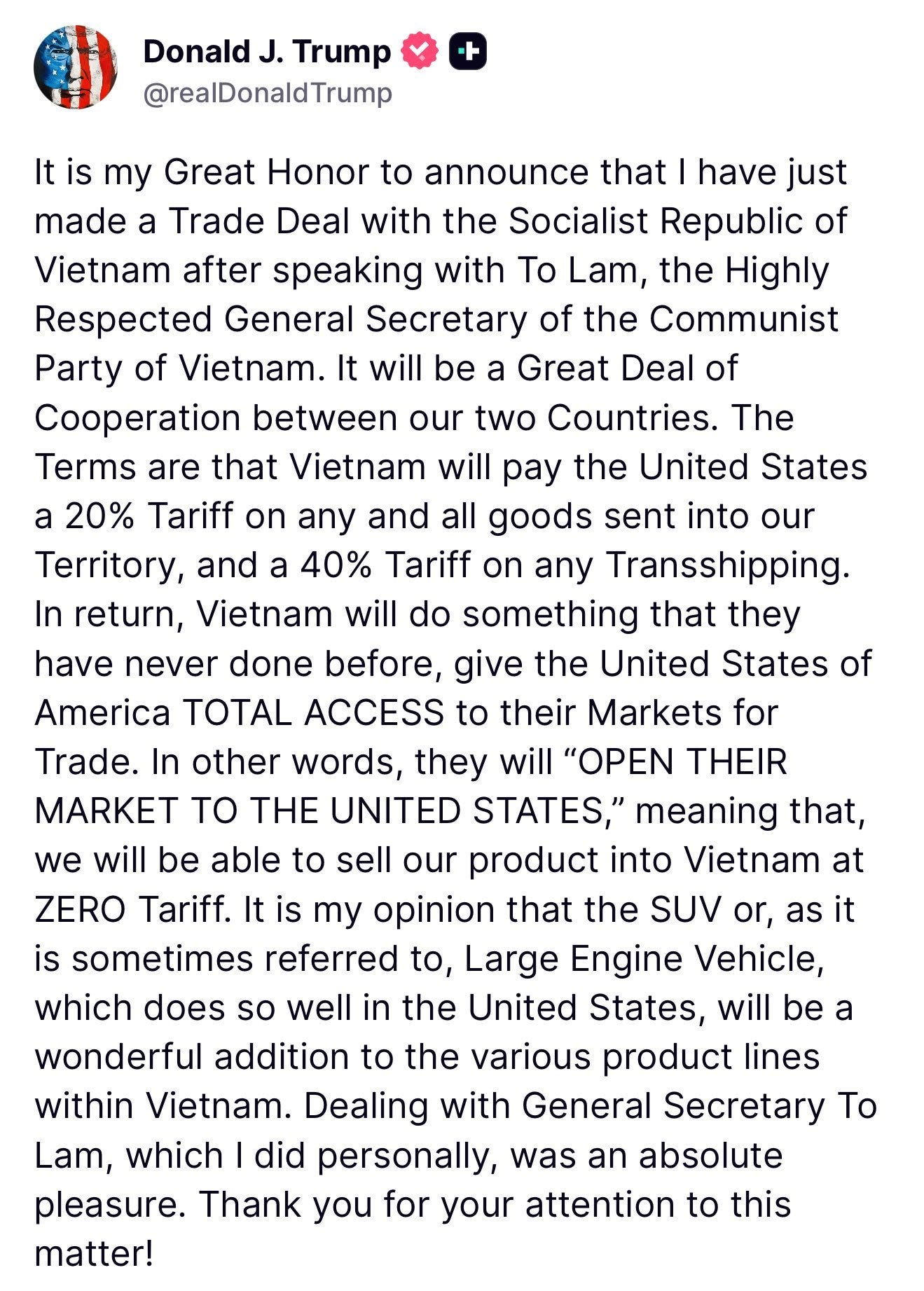

Some trade deals are beginning to trickle in, such as the one announced Wednesday with Vietnam. The deal is poor—especially compared to the previous status quo—but markets seem immune to fundamentals now, caring only about asset price inflation: Vietnam will face a 20% tariff and remove all its trade barriers. A well-negotiated outcome—unless you're Vietnam.

The U.S. Senate has narrowly passed Donald Trump’s new tax package (famously dubbed the One Big Beautiful Bill Act, or OBBBA among friends), an ambitious law combining tax cuts, expanded military and immigration spending, and deep welfare cuts. The vote ended 51–50, with Vice President J.D. Vance casting the tie-breaking vote. The bill, which now moves to the House of Representatives, would add $3.3 trillion to the national debt, pushing the debt ceiling to a new record after a $5 trillion increase.

The law extends the 2017 tax cuts and introduces new deductions for tipped income and overtime pay. It also increases defense and immigration enforcement spending, while cutting $930 billion from social programs like Medicaid and food assistance, and eliminates many of the clean energy incentives introduced under the Biden administration. The distributional impact of the law is clear: the main beneficiaries are households in the top 1% earning over $660,000 annually, while the poorest will face reduced access to food, healthcare, and basic subsidies.

The bill has also reignited divisions within the Republican Party: the Freedom Caucus criticizes the resulting deficit’s size, while moderate representatives are concerned about the social fallout of the cuts. Additionally, several lawmakers from high-tax states have demanded larger deductions for state and local taxes. From the White House, Trump has personally pushed the bill, appearing to pin any future deficit reduction on stronger economic growth that could ease the debt burden. Run it hot.

As discussed last week, the leading economic surprise index has started to price in an imminent macro improvement. While the labor market appears to be slowing, its leading indicators also point to recovery, suggesting that—perhaps for once—everything might go according to plan. Art of the deal.

In fact, this month’s jobs report shows a labor market that continues to hold up, although with clear signs of moderation. Nonfarm payrolls surprised to the upside with 147,000 new jobs created in June, above the 106,000 expected and also improving from May’s 139,000. However, the breakdown reveals important nuances: private payrolls added only 74,000 jobs, well below the estimated 100,000, which helps explain the divergence with the ADP figure. Much of the strength comes from public sector hiring, which distorts the perception of underlying momentum.

The unemployment rate dropped by one tenth to 4.1%, still a historically low level, although average weekly hours declined to 34.2 from 34.3, signaling a slight softening in labor demand. Overall, the labor market continues to show resilience, but it is gradually normalizing. The drop in hours worked, wage moderation, and slowdown in the private sector suggest that labor demand is starting to adjust to a more restrictive macro environment. In the short term, initial jobless claims remain the best indicator to anticipate sharp changes, and for now, there are no signs of a spike in layoffs, providing some cushion against fears of a sudden downturn.

The relationship between Donald Trump and Elon Musk has reached a new breaking point. The U.S. president has threatened to cut the billions in subsidies received by Musk’s companies—including tax credits for electric vehicles, federal contracts for SpaceX, and other incentives tied to the energy transition—following a series of public criticisms by Musk of the new tax package passed by the Senate. Musk, who just months ago financially supported Trump’s re-election campaign and was considered one of the key factors behind his electoral victory, has harshly criticized the law’s impact on the public deficit and the cuts to subsidies for the power sector. Although Musk has long claimed to oppose public subsidies, the reality is that Tesla has heavily relied on them to sustain its business model, including the $7,500 tax credit for EV purchases and the sale of regulatory credits to less “green” automakers.

Trump, visibly irritated, responded by saying that Musk may be the single largest recipient of subsidies in history and suggested that without SpaceX, Tesla, or tax credits, the country would save a fortune.

The consequences of this clash are already visible. Tesla shares dropped more than 5.5% on Tuesday. Beyond Tesla, the risks also extend to SpaceX (which, incidentally, benefits ASTS), as it holds over $22 billion in federal contracts. If Trump’s offensive escalates, the potential damage to Musk’s companies could be massive. This rift not only raises questions about the immediate future of Tesla and SpaceX, but also about the sustainability of a business model that has depended more on political favors than on pure operational profitability. The irony is that Trump—the very person who championed many of those subsidies—could now be the one to dismantle them.

At a time when the competition for AI talent is heating up, Sam Altman has responded in a direct and strategic way to Meta’s recent attempt to lure some of OpenAI’s top researchers (with a $100M offer, of course). The CEO made it clear that, despite a few departures, OpenAI continues to attract and retain those who truly believe in its mission to build beneficial artificial general intelligence (AGI) for humanity. In his internal message, Altman emphasized that while Meta may have recruited some interesting profiles, it has failed to win over OpenAI’s heavyweights—something he attributes to a structural difference in vision, mission, and culture. He also noted that Meta has had to reach further down the list of candidates, despite having spent considerable time trying to assemble its superintelligence team. Once again, Zuck plays the villain, sticking to his usual tactics.

Altman goes beyond simply defending his researchers—he offers a counter-narrative. In contrast to Meta’s mercenary logic, he appeals to the commitment of the “mission-driven”: those who aren’t just looking for immediate compensation, but who are aligned with a higher purpose. And with pragmatism, he doesn’t shy away from the financial side: he confirms that OpenAI is reevaluating researcher compensation and claims the company’s equity potential far exceeds Meta’s—though he emphasizes that such upside must be tied to real success, not opportunistic maneuvers.

This week’s EIA inventory report was clearly bearish for the oil market. Total inventories rose by 9.6 million barrels, driven by a 4.1 million barrel increase in crude and a 4.2 million barrel rise in gasoline. While part of this build may be attributed to calendar effects—the week of July 4th often distorts supply and demand patterns—the underlying data are not particularly encouraging.

The market remains tense, with growing concern that supply may rebound faster than expected. However, this narrative stems from a misreading of the OPEC+ production agreement. From the beginning, there was never a cohesive cut by the entire group—only a unilateral reduction by Saudi Arabia. Therefore, referring to a "phased increase" in production is more of a semantic twist than a true fundamental shift. The market is misinterpreting this as bearish when, in fact, it reinforces the idea that effective supply has not risen.

In fact, since the plan to increase output by 411,000 barrels per day was announced in April—coinciding with the start of the tariff conflict—actual crude exports from the OPEC+ group have shown no significant growth. In other words, more production was promised, but the volume reaching the market remains unchanged.

The upcoming July 6th meeting of the V8 group (OPEC+ core members) may announce another nominal increase of +411,000 b/d, but if current trends continue, it will be largely symbolic. In this context, fundamentals still point to a tighter market than current prices suggest, although the bearish narrative—fueled by confusion and overinterpretation—continues to weigh on sentiment.

This means that, formally, the group is entering the final phase of its supply containment strategy, but the actual market impact will likely be much weaker than the official messaging implies. Over the next two months (July and August), OPEC+ crude exports are expected to remain subdued due to increased domestic demand for power generation, especially in countries like Saudi Arabia, where air conditioning usage spikes in summer.

However, it’s important to note that despite stagnant exports, the group’s total production volume is about 1 million barrels per day higher than the same period last year. This year-over-year growth suggests that OPEC+ has already loosened its discipline, albeit in a discreet way so as not to further destabilize prices.

Thus, the perception of a controlled market clashes with the reality of rising production. In the short term, seasonal demand will offset some of the surplus, but unless the prevailing narrative adjusts and expectations are revised, the market will remain under bearish pressure—driven more by psychology than by structural fundamentals.

It’s also increasingly clear that a "drill, baby, drill" scenario is off the table, as shown by the continued decline in drilling rigs. Despite technical improvements, rig counts still correlate closely with production capacity. The persistent drop in rigs sets the stage for a potential major oil bull market next year—unless a sustained price spike occurs, although even that may not be enough at this point to rescue the year or salvage companies’ CAPEX plans.

Model Portfolio

The model portfolio's return is +8.82% YTD compared to +6.96% for the S&P500 (our portfolio mesured in € terms, which is weighting -12% in our portfolio this year vs the S&P in $), and +82.4% versus +54.6% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.