Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Black Friday

Friday was Black Friday. Many of you had reached out expecting some kind of offer—just like every other service, brand, and product—so you could finally subscribe after thinking about it for a while. But at LWS we are contrarians by nature (our investment philosophy pushes us in that direction), and we decided not to do what everyone expects, out of respect for our current subscribers who have paid a higher price. So not only will there not be any discount this week, but we are also CLOSING ENROLLMENT until further notice (and we may not reopen at all). We want to focus on delivering the highest-quality product and service, and after the significant growth we’ve experienced (we’re now over 1,100 subscribers and almost no one cancels…), we believe it’s best to limit new sign-ups. We want to offer a closer service to our existing subscribers and we believe this is the best way to do it.

Starting December 9th, NO new subscriptions will be accepted, and if enrollment reopens in the future, it will be at least 20% more expensive than now (€60/month or €600/year). And remember, the price you subscribe at, we won’t EVER hike. As a first example of the expanded content we’re bringing, we already have two very interesting publications prepared.

We have a watchlist of interesting companies in our Discord, but messages can easily get lost when they’re needed most. We’re going to start sending a PDF watchlist accompanied by an investment summary for each idea.

Every year we review how our ideas have performed and what we consider the most compelling opportunities for the year ahead—and 2025 will be no different. In the past, we’ve read the market context very well (commodities in 2022, gold in 2024…), and soon we’ll publish our ideas for 2026.

If you subscribe BEFORE December 9th—next Tuesday—you’ll get access to both publications (in addition to our usual content). And on December 9th, enrollment CLOSES permanently until further notice—and if it reopens, it will be 20% more expensive.

This is our Black Friday.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

Canada has achieved something that once seemed reserved exclusively for the European bloc: becoming the first non-EU country to join the EU’s military procurement fund, a €150 billion program aimed at strengthening Europe’s strategic autonomy and reindustrializing its defense base. Canada’s entry is more than a technical agreement; it is a geopolitical move that redefines Ottawa’s position in a world where alliances can no longer be taken for granted and where its relationship with the United States has cooled considerably.

Access to SAFE will allow Canadian industry to compete for contracts across the full spectrum of military equipment—from ammunition and drones to artillery systems—but the underlying issue runs deeper. Canada needs to diversify. It has arrived late to the race to rebuild military capabilities, and it is acutely aware that depending too heavily on the U.S.—for both defense and exports—leaves it in an uncomfortable position in an increasingly fragmented world. The security pact signed with the EU months earlier already pointed in this direction: reducing dependence on the south and building new industrial bridges.

The fact that the United Kingdom—Brussels’ natural partner for decades—ended up excluded after refusing to pay a €6.75 billion entry fee makes Canada’s move even more singular. Canada will pay less (the final figure is still under negotiation) and gains something politically valuable: access to a European market undergoing rearmament, and at the same time an incentive to attract European suppliers into its own industrial ecosystem. In other words, it positions its industry within the supply chain of the continent’s largest military investment plan since the Cold War.

While some countries attempt to restore old balances, Canada accepts that the architecture of Western security is shifting and places itself at the center of the axis that currently concentrates spending will and strategic autonomy. It is not merely an “enormous” economic opportunity, as McGuinty puts it; it is a strategic turn aligned with the new reality, where industrial resilience matters as much as formal treaties.

The talks in Moscow between Trump’s envoys—Steve Witkoff and Jared Kushner—and Vladimir Putin confirm what many feared: despite the climate of urgency and the growing pressure to halt the conflict, Washington and Moscow remain far from an agreement. After five hours of meetings, the Kremlin admits that “no compromises have been found” and that some U.S. proposals are unacceptable to Russia. There will be no Putin–Trump summit for now, a sign that the differences are substantive rather than merely procedural.

The main point of friction remains the territorial issue, a euphemism Moscow uses to refer to its demand for full control over Donbas. Although Russia claims the region as its own, Ukraine still controls around 5,000 km² and enjoys international recognition of its sovereignty. It is therefore unsurprising that Kyiv and European capitals are increasingly uneasy with Washington’s leadership in the negotiations. The leaked draft of 28 U.S. proposals already sparked alarm for being considered overly concessive toward Moscow, prompting Europe to prepare an alternative framework and forcing the U.S. and Ukraine to adjust their positions.

Zelensky, speaking from Dublin, openly voiced his fear that the U.S. may lose interest and reach an agreement behind Ukraine’s back. His message captures the fragility of the current moment. Between a Russia that is raising the rhetorical temperature—Putin even warned that a conflict with Europe would be so swift that “no one would be left to negotiate”—and a U.S. president who needs a diplomatic achievement ahead of the election cycle, the asymmetry of incentives is clear.

Moscow is also playing a dual game, claiming it does not seek a war with Europe while simultaneously threatening to cut off Ukraine’s access to the sea after attacks on Russian oil tankers. Ultimately, the meeting makes one thing clear: the peace process is not moving backwards, but it is not moving forward either. The parties are talking, but not converging. The risk now is that political urgency in Washington collides with Kyiv’s red lines and Moscow’s strategic rigidity, creating a negotiation framework in which none of the central actors—neither Russia, nor Ukraine, nor Europe—feels it controls the board.

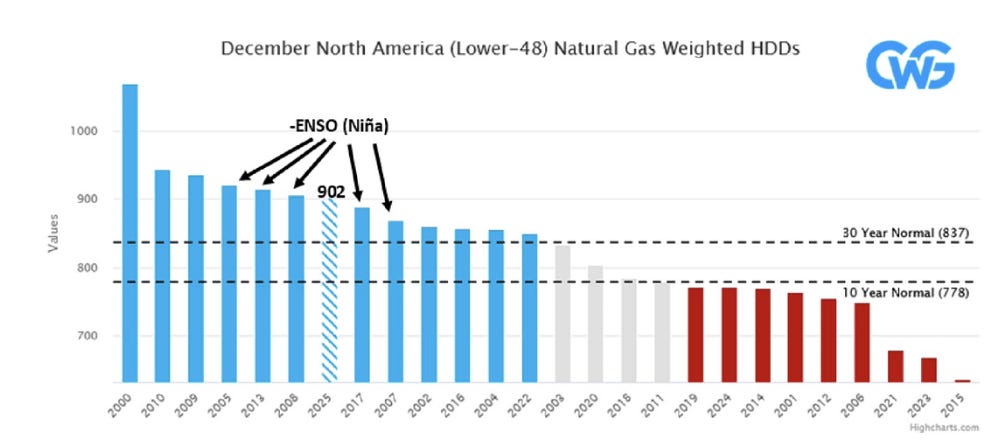

It has been a very cold start to the winter in the United States. Heating degree days (HDD), the standard indicator of gas consumption for heating, have surged due to several consecutive polar vortex events and blockages in the Alaska Ridge. As a result, this December—unlike 2021, 2023, and 2024, which were much warmer than average—is already behaving like a La Niña year, something that could significantly impact the country’s natural gas balances.

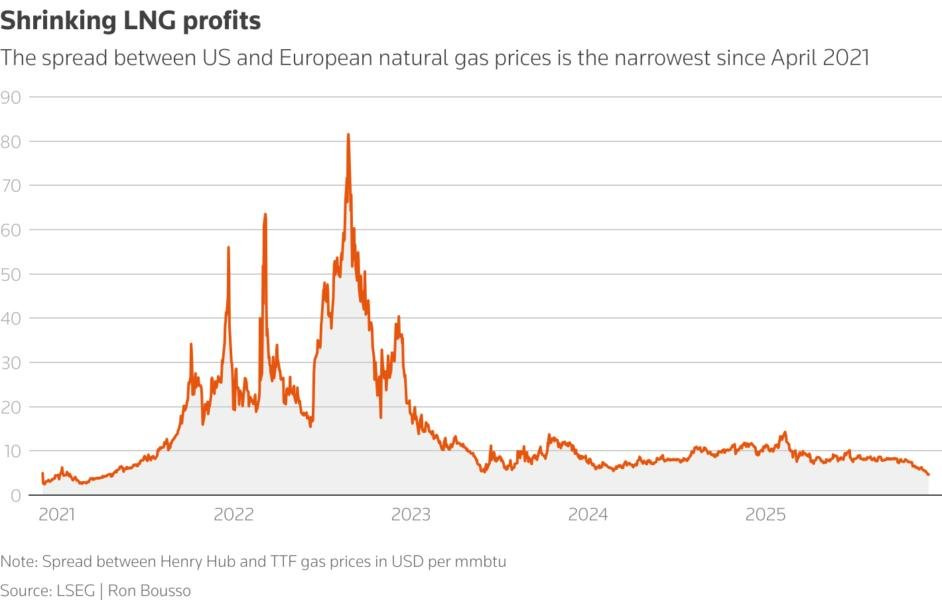

Despite the recent rally in U.S. natural gas prices, now well above their highs of recent years, there is one segment suffering heavily: LNG exports. Their margins have contracted sharply, both because of higher input costs (U.S. natural gas) and because selling prices in Europe and Asia have fallen substantially this December.

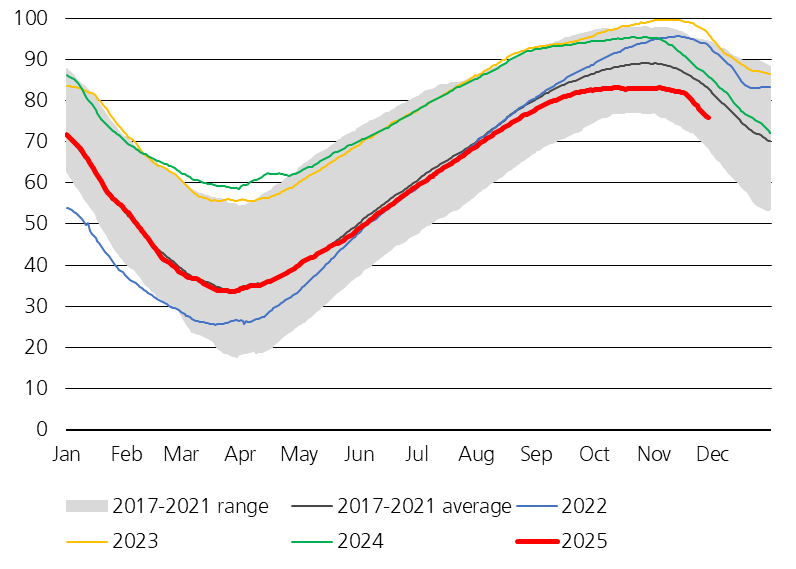

A milder-than-usual start to winter in Europe and Asia (especially northern Asia) has reduced natural gas demand, and we have seen TTF (and JKM) prices register significant declines in recent weeks. On the positive side, inventory levels across the European continent are much lower than in prior years, meaning that any cold snap could restore strong fundamentals to the domestic market (and support profitability for major LNG exporters).

As Huang said in his recent podcast with Joe Rogan, energy is the most important short-term bottleneck for AI demand, and natural gas acts as a key bridging energy source while a new fleet of nuclear reactors is rolled out.

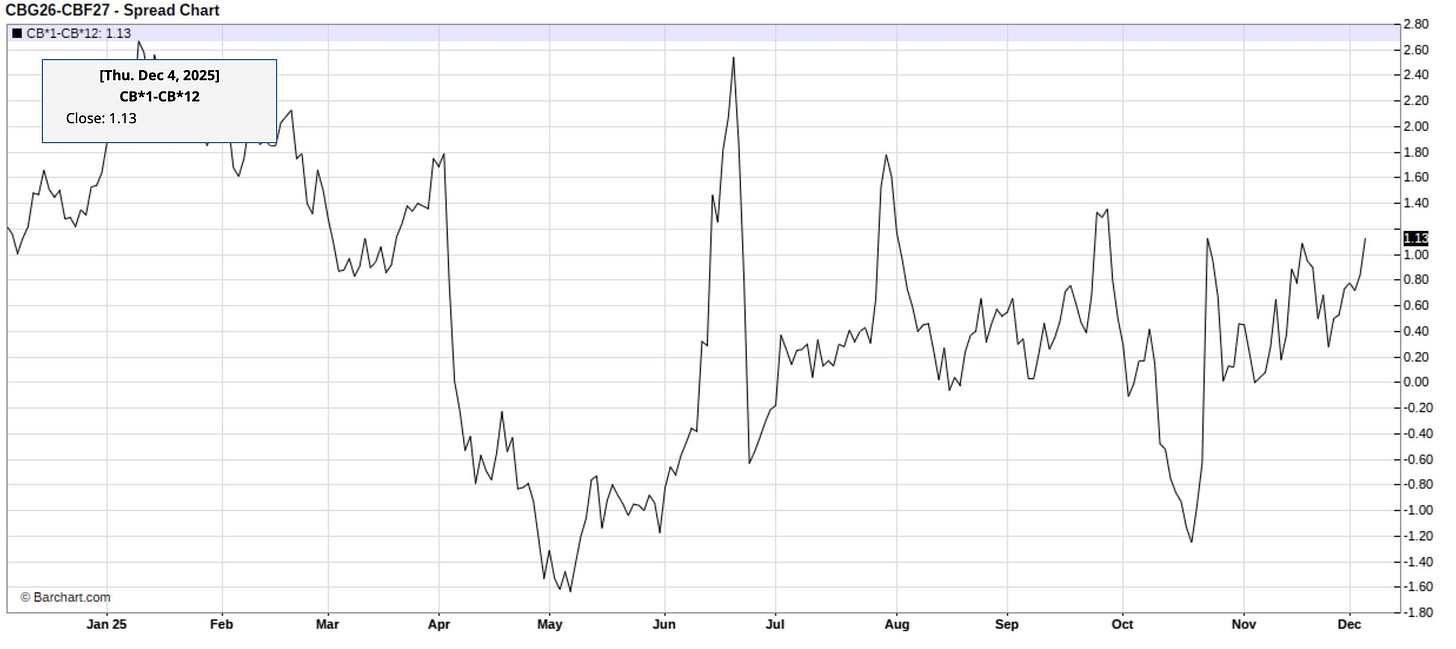

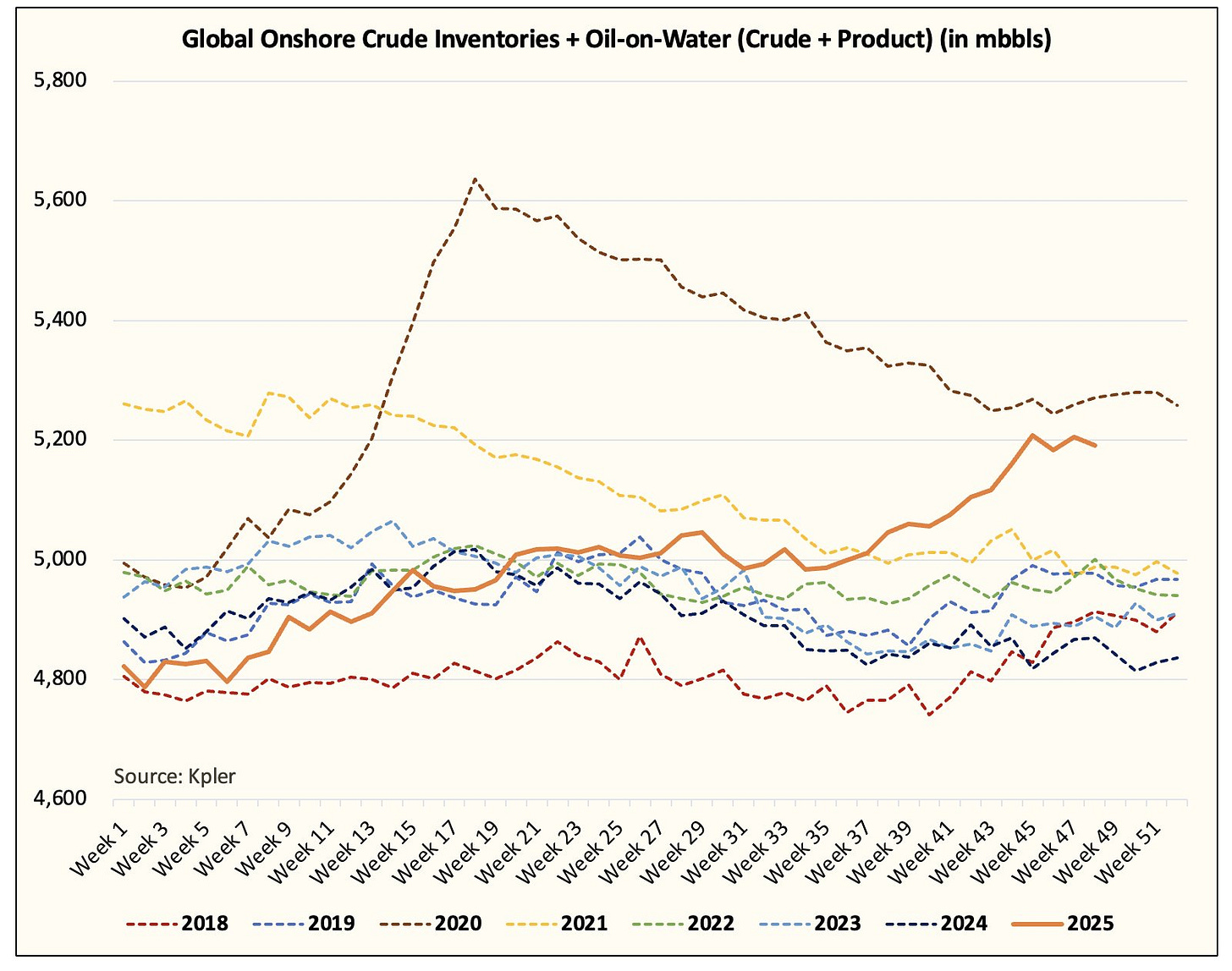

The physical indicators of the oil market—among which we always highlight the Brent 1–2 spread—do not seem to forecast the major oil surplus (up to 4Mb/d, according to the IEA) expected for the end of 2025 and start of 2026. In fact, after a very weak October, the futures curve has returned to a comfortable backwardation, which is the opposite of what we would expect if those forecasts were actually playing out.

Although inventories are indeed rising, they are doing so at a fairly moderate pace, indicating a slight surplus rather than a major oil glut. And almost all of the increase is in oil in transit, whose ultimate impact is not even that clear. As almost always, the likely error in the IEA’s forecasts will come from the demand side. If we look at the agency’s track record, we see that it has spent 18 years underestimating this side of the market, and as recently as this May it revised demand for 2022, 2023, and 2024 upward by +350Mb (no small adjustment…). In my view, this time is no different, and they are introducing a similar bias.

If confirmed, although being in a surplus is not positive for the oil market, a slight surplus that—if my view is correct—corrects in the second half of 2026 would mean the sector suffers far less than the current consensus expects.

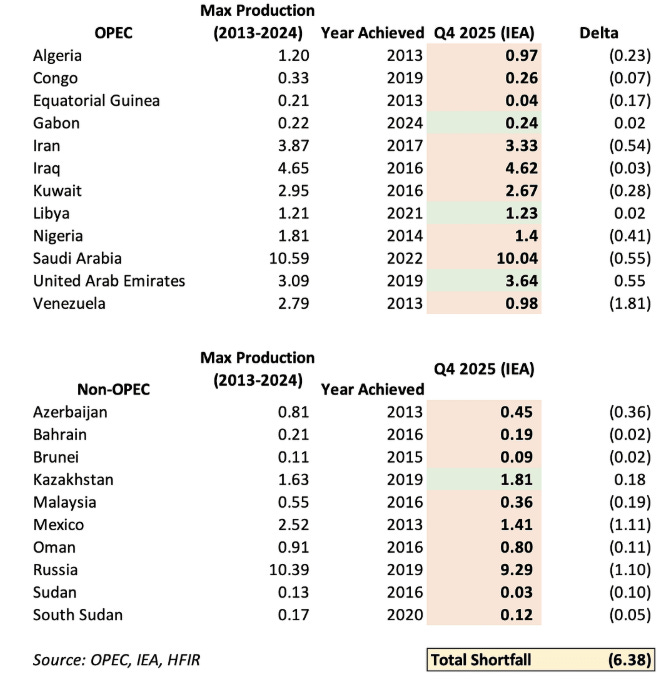

Moreover, this week we learned of a potential unexpected catalyst for the crude market. OPEC+ members will have to undergo a maximum production capacity test, which will determine their production quota for 2027. If we compare the most recent figures with their historical production peaks, we can see a large accumulated deficit that points to reserve depletion and geological deterioration for most countries. Market consensus assumes spare capacity that simply does not exist — and this is about to be confirmed.

Model Portfolio

The model portfolio's return is +43.91% YTD compared to +5.1% for the S&P500 (S&P in €), and +141.2% versus +52.0% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

⚠️Past performance does not guarantee future results. The historical performance of the model portfolio is shown for informational and educational purposes only and does not constitute investment advice or an offer to buy or sell securities. The returns shown may not include fees, taxes, or other associated costs.