Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The new Section 899, included in the Republican tax bill that now awaits Congressional approval, would allow Trump to impose "revenge taxes" on countries that levy digital taxes on U.S. tech companies. Up to 17 countries, including Germany, have already announced such taxes, so this is not merely a theoretical exercise. The logic behind the bill is clear: if countries tax companies like Google, Amazon, or Meta, the U.S. will respond by taxing their companies and citizens operating on American soil.

The mechanism would be progressive: countries deemed “discriminatory” would be added to a blacklist, and their companies would see their U.S. tax burden increase by as much as 20 percentage points. Although this authority constitutionally belongs to Congress, Republicans are willing to delegate it to the Executive—a significant shift in the country’s fiscal architecture. Beyond the political noise, there is a structural interpretation: the administration is aiming to use the tax code as a tool of foreign policy.

This clause directly targets the international consensus promoted by Biden on the 15% global minimum tax, which many countries have embraced to justify taxes on American digital companies. The Republican goal is to break away from that framework and regain leverage for bilateral pressure. The measure could raise up to $116 billion over a decade, but the net effect is uncertain—likely negative—due to concerns about the U.S. losing its “business-friendly” reputation. Several analysts warn that taxing foreign entities could reduce investment in the U.S., raise the cost of financing, and weaken the dollar. For Trump, however, this might be a feature, not a bug: less foreign capital inflow means a weaker dollar and greater export competitiveness.

The clash between Elon Musk and Donald Trump marks a public and explosive rift between two of the most influential figures in the current U.S. political and economic cycle. It all began when Musk described Trump’s tax bill as a "disgusting abomination," harshly criticizing public spending and its impact on the deficit. This deeply strained his relationship with the former president, though the underlying issue likely also involves the elimination of electric vehicle subsidies in that same bill. That’s when the back-and-forth began—more akin to a schoolyard spat than the main stage of global politics and economics—with escalating accusations that culminated in a bombshell: Musk claiming that the reason the Epstein client lists haven’t been released is because Trump is on them. A true political and media suicide for the world’s richest man.

“I'm very disappointed because Elon knew the inner workings of this bill... He had no problem with it. All of the sudden he had a problem, and he only developed the problem when he found out we're gonna have to cut the EV mandate.”

— Donald TrumpThe conflict comes at a key moment: the legislative proposal faces a tight vote in the Senate, and Musk’s opposition complicates the Republican strategy. Although Musk has backed down from his threat to pull the Dragon capsule from the ISS, the possibility of mutual retaliation is already unsettling markets. Musk had previously contributed nearly $300 million to the Republican campaign and served as “Director of Government Efficiency” during the failed budget-cutting effort. His discontent is also fueled by the revocation of Jared Isaacman’s nomination (his ally) as head of NASA—a decision reportedly pushed from within by Sergio Gor, White House Chief of Staff, who is in an ongoing behind-the-scenes power struggle with Musk.

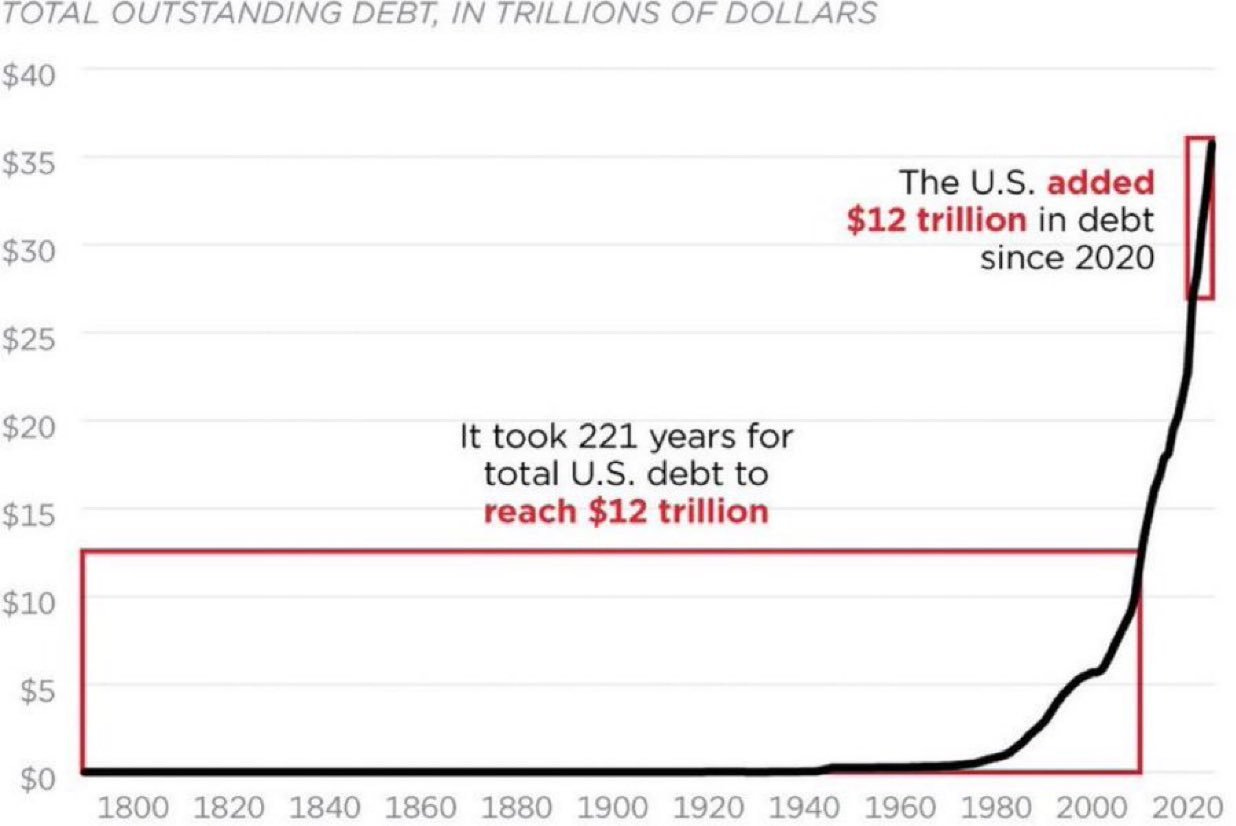

Fundamentally, Musk is right: the path of massive and growing deficits, along with initiatives to accelerate them and eliminate the debt ceiling, constitutes bad practice and will, as history repeatedly shows, end with the collapse of the American empire. However, the way he presented it and the red lines he crossed were inappropriate; Trump doesn’t forget.

What’s clear is that Tesla shareholders have been the biggest losers in Musk’s political adventure. He has diverted attention from management, alienated much of the Democratic electorate, and now turned against the administration—in a business that relies heavily on subsidies and legislation to thrive. The 15% drop over the week speaks for itself. Beyond the drama, the clash jeopardizes the bond between Trump and the tech world. If Musk follows through on his promise to reduce political support and Silicon Valley retreats, Republicans could lose a key source of funding ahead of the 2026 midterms. For Trump, the cost of this conflict could go beyond media noise: it may erode his margin in Congress just when he needs every vote.

Uranium prices closed May with a notable increase, driven by contractual signals that the Western market has yet to fully digest. The spot price for U₃O₈ rose by $3.50 to $72/lb, while medium- and long-term prices reached $75 and $80/lb respectively. In the nuclear fuel cycle, spot conversion prices dropped to $70, but enrichment remains strong: $190/SWU in the spot market and $169 in the long term (up $1).

The key catalyst was the forward pricing agreement between CGN Mining and its Chinese state-owned parent company, involving uranium deliveries at $94.28/lb in 2026, implying prices of $98 in 2027 and $102 in 2028. This represents an 18% increase over the last published long-term price ($80) and clearly exceeds market expectations, both in price level and in the higher share of volume contracted at spot prices.

The reaction in Asia was immediate: CGN Mining surged 28% in Hong Kong with 744 million shares traded (equivalent to US$200 million in volume), highlighting the importance of the deal. However, in the U.S. and Canada, the sector has yet to fully price in this signal—though it likely won't take long.

Meanwhile, China is sticking to its nuclear roadmap, with 10–12 new reactors approved annually and highly competitive unit costs (US$3–4 million per MW). Its nuclear capacity is expected to surpass that of the U.S. before 2030. This combination of sustained growth and a push for secure supply is starting to translate into more aggressive contracts—potentially revaluing the entire price structure of the sector in the near future and acting as the major catalyst we've been waiting for.

May’s employment data came in stronger than expected, with 139,000 new payrolls—beating forecasts and approaching the 12-month average of 149,000. At first glance, the report supports the narrative of a still-resilient labor market. However, beneath the surface, less optimistic nuances emerge. Job growth was once again concentrated in sectors like healthcare, leisure, hospitality, and social assistance—areas that, while labor-intensive, are generally associated with relatively low wages and lower marginal productivity. This composition limits the broader economic impact of employment gains.

At the same time, federal government employment continues to decline, marking four consecutive months of contraction. This trend, more than just a sectoral rotation, may reflect ongoing budgetary pressures or a structural adjustment underway within the public sector.

In the long term, some shadows are starting to appear that could fundamentally reshape the social, economic, and labor landscape, making social mobility increasingly difficult. Amazon is developing software for humanoid robots capable of performing deliveries, with the goal of having them jump straight from vans and deliver packages autonomously. The project, still in testing, is being developed in a "humanoid park" inside an office in San Francisco, where the robots practice on an obstacle course the size of a café. While the hardware is being built by other companies, Amazon is focusing on the development of the AI that will allow these robots to operate in the real world. One of the goals is for these robots to ride in Rivian vans (of which Amazon already has more than 20,000) and carry out deliveries while the human driver covers other routes. There’s even talk of future tests in real-world environments, beyond the controlled conditions of the test park. And the ambition doesn’t stop at humanoids: the company has also been authorized to test drones beyond visual line of sight in the UK, suggesting a coordinated push to dominate the last-mile delivery segment.

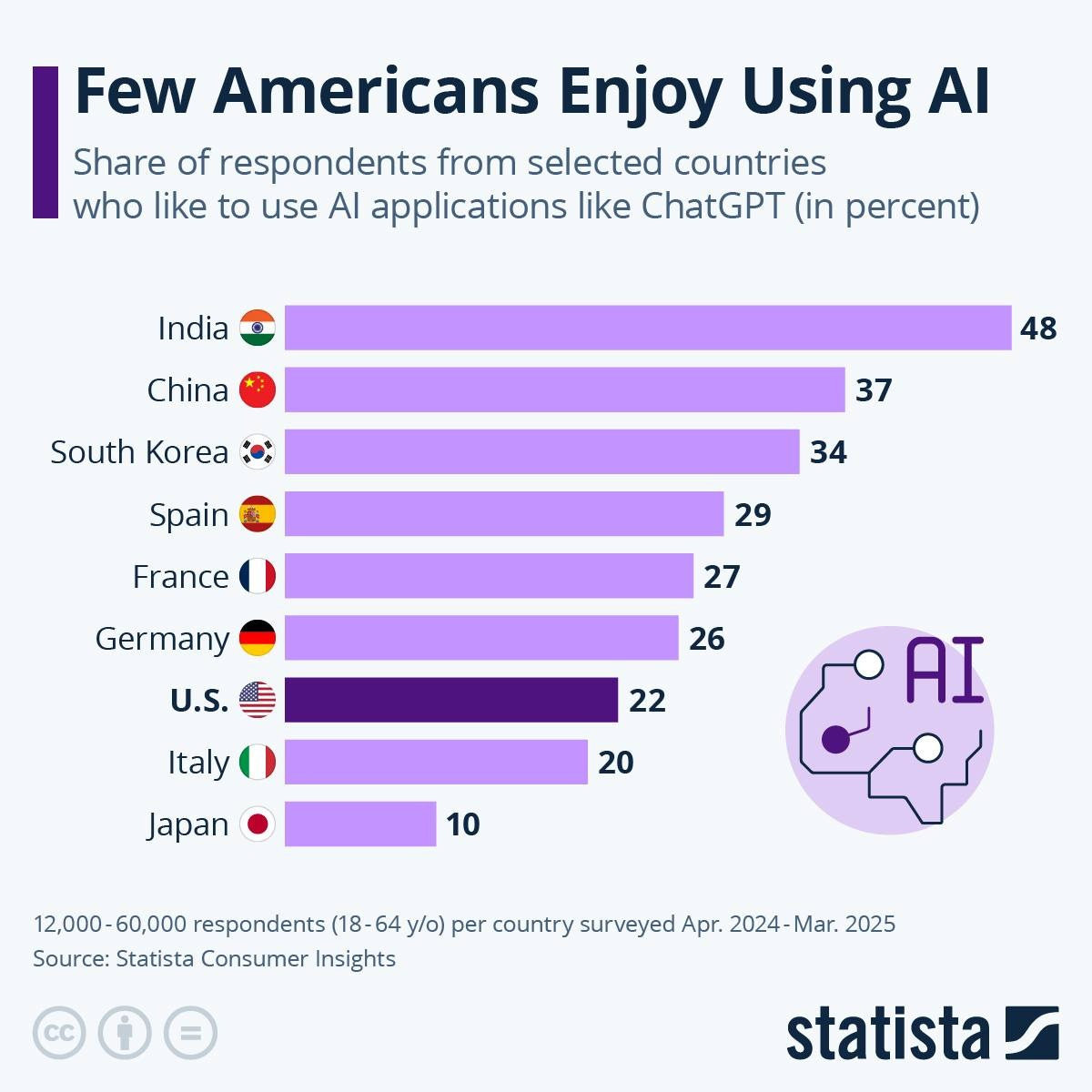

For now, AI’s impact remains relatively marginal (~20% of the population using it in many economies), but like the internet, it is poised to change rapidly and exponentially.

There’s been a lot of talk about OPEC+ production increases (disunity, price wars, the intent to regain market share...), especially after the decision to add another +411,000 barrels per day in July, bringing the total reinstated production to +1.37 million b/d. If the same pattern continues with additional phased increases in August and September, the total volume of oil returned to the market could reach around 2.2 million b/d by the end of September—effectively the full amount of the current voluntary cut.

At first glance, this seems contradictory in an environment dominated by uncertainty over global demand, further strained by trade tensions. However, the strategy makes sense when considering the four key objectives guiding OPEC+ (as outlined by HFI Research):

Appease Trump (and avoid political or economic retaliation): The gradual increase in production can be seen as a gesture to calm the U.S., where fuel prices play a major role in domestic politics.

Undermine investor sentiment toward new oil projects: The incremental return of barrels creates price uncertainty, potentially deterring other producers from committing capital to new developments, especially in U.S. shale.

Avoid visible increases in physical inventories: Even with higher output, internal summer demand for crude (particularly in countries like Saudi Arabia due to electricity consumption) and moderate exports help prevent stockpiling, keeping the physical market tight.

Reinforce internal cohesion within OPEC+ and formalize the return of “cheaters”: Raising the production ceiling in an orderly way legitimizes the output of members already exceeding their quotas and helps keep the group unified. It’s a way to institutionalize non-compliance without breaking the pact.

In this context, the orderly return of production does not imply a bearish market. In fact, net crude exports from OPEC+ won’t change much this summer, and global inventories are expected to fall during the Northern Hemisphere’s driving season. Since many cartel members were already producing above their quotas (cheating), these “paper” increases simply normalize and legitimize the current real situation.

Meanwhile, the structural outlook is turning more favorable for oil:

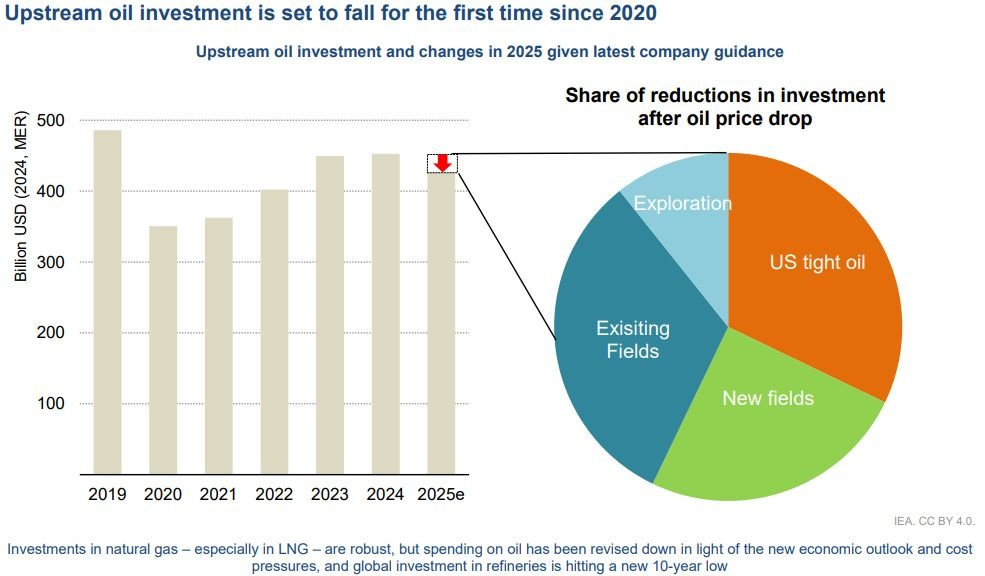

Global upstream investment is expected to decline by 4% in 2025, the first drop since 2020

U.S. shale investment will fall by 10%

Cost-adjusted upstream activity is down by 8%

In other words, the backdrop points toward future supply tightness, even as barrels are reintroduced in the short term. OPEC+ is playing a balancing act—discouraging outside investment while managing the market without triggering panic.

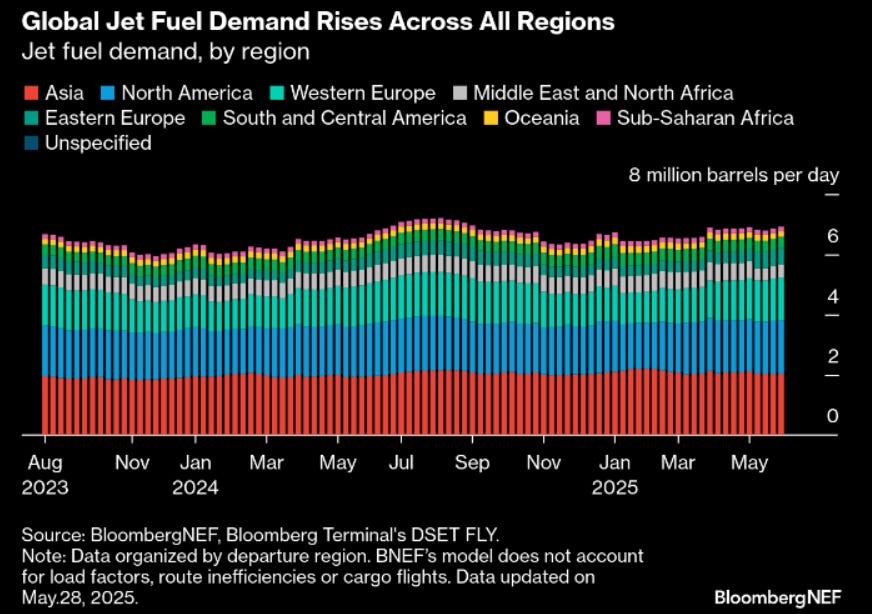

As always—and even if slightly anecdotal in this case—it’s worth not getting stuck in surface-level narratives, such as the idea that gasoline and diesel consumption will inevitably fall as electric and hybrid vehicles gain market share. While true, many other demand drivers—like jet fuel and petrochemicals—are expected to continue growing over the coming decades, with no simple or natural technological substitute. The following chart is particularly interesting, as it not only shows overall growth but also highlights how some demographically important regions (like Africa and Latin America) still consume far less per capita than more advanced economies, leaving ample room for demand growth.

Model Portfolio

The model portfolio's return is +0.97% YTD compared to +2.02% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +69.2% versus +47.5% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.