Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

Trump’s latest controversy hasn’t been about taxes, tariffs, or even energy policy—this time it’s about statistics. The White House abruptly fired the Commissioner of the Bureau of Labor Statistics (BLS), Erika McEntarfer, following the release of an employment report that revised job creation figures for the previous two months down by 258,000. The number itself isn’t the main issue (revisions are common); it’s the narrative: Trump accused McEntarfer of manipulating the data—without any evidence—and announced he would appoint a new head “in three or four days.”

The move has triggered a wave of institutional criticism, from former BLS heads to ex–Treasury Secretaries, denouncing an unprecedented politicization of one of the most technical and reputable statistical agencies in the federal government. It’s true that constant revisions, always in the same direction, don’t help its prestige and credibility, but the official argument—that the revisions were too large—frames the problem as statistical rather than economic.

What’s at stake here is not a single number, but the credibility of the country’s most closely watched economic data. The BLS compiles employment, inflation, and wage figures, and if those metrics are perceived as politically driven, the damage could be structural, given that everything from monetary policy to bond markets depends on them. The deeper backdrop is clear: Trump is pushing every institution to its limits—from the Federal Reserve to the statistical services—in his quest to control the economic narrative amid a tariff offensive and a new fiscal package in the works. If the numbers don’t fit, change the messenger. Welcome to the Bureau of Loyalty Statistics.

Meanwhile, OpenAI is negotiating a new secondary share sale that would allow current and former employees to cash out part of their holdings, valuing the company at around $500 billion. The leap from today’s $300 billion is as aggressive as it is significant, reflecting two things: the meteoric acceleration of the business and the fierce pressure to retain talent amid the raging AI wars. While SoftBank continues trying to close its $22.5 billion contribution to the $40 billion primary funding round announced earlier this year, OpenAI is exploring ways to price its equity without yet going to the public markets. And with numbers like these, demand is hardly lacking. In the first seven months of the year, the company doubled its revenue, reaching an annualized run rate of $12 billion, and projects to hit $20 billion before the end of 2025—all with a product that, barely a year ago, was little more than a lab curiosity.

At the same time, ChatGPT now surpasses 700 million weekly active users (up from 400 million in February), making it, de facto, the largest human–machine interaction platform ever created. Big tech firms are entering a new phase of vertical integration in AI, with multi-billion-dollar talent grabs (such as Meta’s attempt to lure Alexandr Wang of Scale AI) and increasingly aggressive strategies to attract scarce profiles. OpenAI needs to compete in that game, and offering liquidity to its employees is one of the few effective tools it has without distorting its current structure. For now, the company maintains its capped-profit model, but it’s working on a restructuring that would pave the way for a potential IPO. And with a valuation already playing in the global tech big leagues, it might not even need one.

Gold in the U.S. experienced on Friday an episode straight out of the “tariff tantrum” playbook: after hitting a new all-time high in December futures ($3,534.10/oz), prices sharply pulled back when the White House leaked plans for an executive order to clarify its stance on potential tariffs on the most heavily traded gold bars in the U.S. market.

The clue came from a U.S. Customs and Border Protection ruling that opens the door to applying tariffs based on country of origin—a move that would put particular pressure on Switzerland, the world’s leading gold refining and transit hub, already subject to a 39% tariff on goods shipped to the U.S. The uncertainty has led some refineries—including a major Swiss player—to pause shipments to the American market while awaiting details.

As with copper, panic buying drove the spread between Comex futures and spot above $100 at the peak of the session, before easing to around $57.

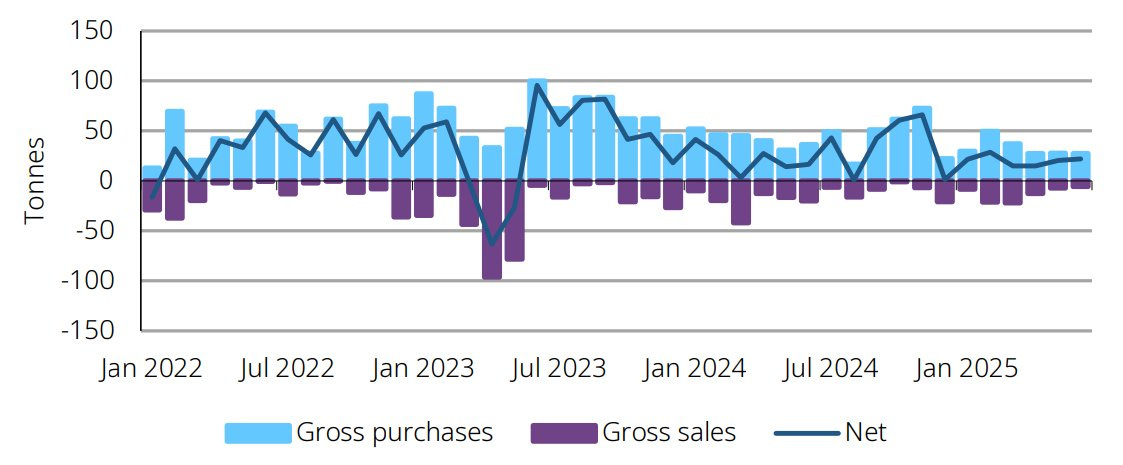

Meanwhile, central banks continue to accumulate gold, posting a slight month-on-month increase from May and marking two straight years of net purchases. The underlying drivers—multipolar geopolitics, heightened uncertainty, and de-dollarization—show no sign of fading; if anything, they are strengthening by the day, making it unlikely that this trend will reverse in the medium term.

Trump has also made a double-edged move at the Federal Reserve. He will nominate Stephen Miran—currently chair of the Council of Economic Advisers, an outspoken critic of the Fed’s current governance, and the intellectual architect of tariffs—to temporarily fill the seat vacated by Adriana Kugler after her surprise resignation. The interim term would last until January 2026 and requires Senate approval, with the chamber not returning to session until September—just before the key government funding deadline. This gives the president immediate influence at the Fed with someone aligned to his vision of cutting rates and “disciplining” the institution, while also keeping in hand the ability to choose both a 14-year governor and a new Fed chair (Powell’s term ends in May 2026).

Miran has proposed radical reforms such as shortening terms, increasing presidential control, and nationalizing the regional Fed banks—measures that would require congressional approval, making them unlikely to be enacted in such a short tenure—but they fit squarely within Trump’s escalating pressure on monetary policy. He is also a strong advocate for Bitcoin, giving fresh momentum to the crypto narrative. The record speaks for itself.

Along these lines, approval has been granted for cryptocurrencies to be included in 401(k) accounts, opening a massive new liquidity channel that can now invest in BTC and ETH ETFs (and, likely, more such vehicles down the line). Institutional adoption—first by corporations, now through these investment vehicles, and eventually by banks—is accelerating sharply, and ignoring this paradigm shift would be an extremely costly mistake.

Sibanye Stillwater, one of the giants in PGM production, has taken an unusual but very telling step by formally requesting that the U.S. government impose anti-dumping tariffs on palladium imports from Russia. This is not just any complaint—this is the only producer with active operations in the U.S. (the Stillwater mines in Montana), which has long been struggling with structural problems caused by persistently low prices and an environment of unfair competition.

The backdrop is clear. The South African company argues that Russia, and specifically Nornickel—which produces over 40% of the world’s palladium—is benefiting from covert state aid: preferential loans, subsidies, favorable tax rates, mining concessions at bargain prices, and so on. It’s a classic move in Russian industrial policy, but it becomes strategic at a time when geopolitical relations are already highly strained. The argument is also well chosen: in the middle of a subsidy-and-tariff cold war, the U.S. might not need much justification for a protectionist action that strengthens its only domestic producer. But the case is not trivial. Russian imports have risen 42% so far this year, and a tariff on that flow could trigger a significant imbalance in the physical market, which is already small, illiquid, and prone to episodes of extreme volatility. The palladium market, as is already the case with uranium and tin, is structurally distorted, and if Washington decides to intervene, the effect on prices could be immediate and sharp.

From a more strategic perspective, Sibanye’s move also reveals something else: the shift toward a new mining logic in the U.S., where self-sufficiency in critical materials is becoming a priority. Palladium—used mainly in automotive catalytic converters to reduce emissions—is a key component of the automotive industrial complex, a sector that, incidentally, Trump has placed at the center of his reindustrialization campaign.

Model Portfolio

The model portfolio's return is +13.06% YTD compared to +8.99% for the S&P500 (our portfolio mesured in € terms, which is weighting -14% in our portfolio this year vs the S&P in $), and +89.5% versus +57.6% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.