Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Beyond the model portfolio, starting next week, we will share in this weekly newsletter some classic value stocks that we consider attractive to study and monitor, with the aim of both providing educational content and illustrating our investment philosophy and analysis methodology.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The possible acquisition of Teck Resources by Anglo American marks a new chapter in the consolidation of the mining sector, and could also trigger a bidding war among giants in an industry where scale, geology, and jurisdiction are decisive factors. Anglo, which last year rejected a $49 billion takeover proposal from BHP, now seems ready to move to the other side of the table and acquire Teck in a deal valued at around $20 billion (mostly in stock). The key to the transaction lies in QB (Quebrada Blanca), Teck’s largest copper project under development in Chile, in which it holds a 60% stake. QB is not only the future of the Canadian company but is also strategically located near Collahuasi, one of Anglo’s crown jewels (together with Glencore and a Japanese consortium). Aligning both assets could unlock significant operational and infrastructure synergies, especially considering the technical problems QB has faced and the potential to share solutions in a region with challenging logistics and growing regulatory pressure.

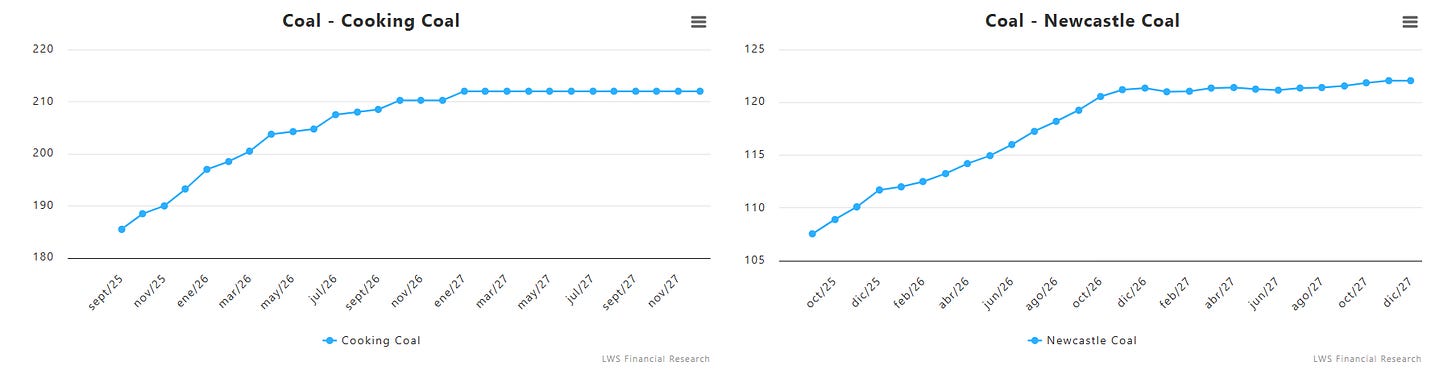

But this move does not occur in a vacuum: Glencore, which already acquired Teck’s steelmaking coal business in 2023 for nearly $7 billion, has reiterated its interest in acquiring the entire company. At the same time, both Anglo and Teck have been reshaping their portfolios. Anglo has exited platinum, is divesting coal assets, and wants to offload De Beers; Teck, for its part, has deferred growth projects until QB stabilizes. The common narrative is clear: focus on copper, which has become the quintessential strategic asset for the coming decade—not only because of rising demand (electrification, AI, critical infrastructure) but also due to structural scarcity and geographic concentration.

Teck has already sold its coal business at cycle lows and now seems ready to do the same with its industrial metals portfolio. A very good deal for Anglo (and potentially Glencore), as they will create significant value in the next bull market for these commodities.

Donald Trump has once again hinted that the containment policy toward Russia is only beginning. In a brief but significant exchange, he confirmed he is ready to move into a “second phase” of sanctions. He provided no details, as usual, but the gesture is not minor: it signals a potential plot twist after months of strategic restraint while he tried to position himself as a mediator in the Ukraine war. It now seems the conflict will not see a quick resolution.

So far, Trump has been ambiguous. He has criticized Russia but avoided truly disruptive sanctions, appealing instead to the prospect of a negotiated peace. Sunday’s rhetoric, however, suggests a change of tone—or at least a desire to reclaim narrative momentum. It is no coincidence this threat comes just as his administration faces growing domestic criticism over the lack of tangible diplomatic results. In parallel, the Treasury is beginning to set the stage: Secretary Scott Bessent has hinted at the possibility of imposing secondary sanctions on buyers of Russian crude, a measure that would directly hit economies such as India and, above all, China. The threat itself is not new, but its repetition in this context takes on new weight. Pressure now seems aimed at forcing Putin to the negotiating table through economic means.

As a retrospective justification, Trump has recalled the tariffs imposed on India—one of Russia’s main energy clients—as part of “phase one,” and has promised that more cards remain to be played. As often with Trump, the concrete announcement matters less than the implication: a possible tightening of conditions for Russian energy buyers, adding further friction to an already fragmented and increasingly politicized market.

Against the backdrop of global geopolitical reconfiguration, this week’s virtual BRICS leaders’ meeting revolved around a theme increasingly central to the bloc: the growing use of unilateral measures as tools of economic and political pressure. Lula, with his usual direct style and without naming the United States, denounced the normalization of tariff blackmail as a means to capture markets and interfere in the domestic affairs of other nations. The mounting pressure on Brazil and India—both hit by Trump’s tariffs—has accelerated the urgency of diversifying their markets. The United States recently doubled tariffs on Indian goods to 50%, and did the same with Brazilian exports in retaliation for Bolsonaro’s trial. Trump has said it plainly: it is about defending a political ally, even if that means dismantling the normative framework of global trade.

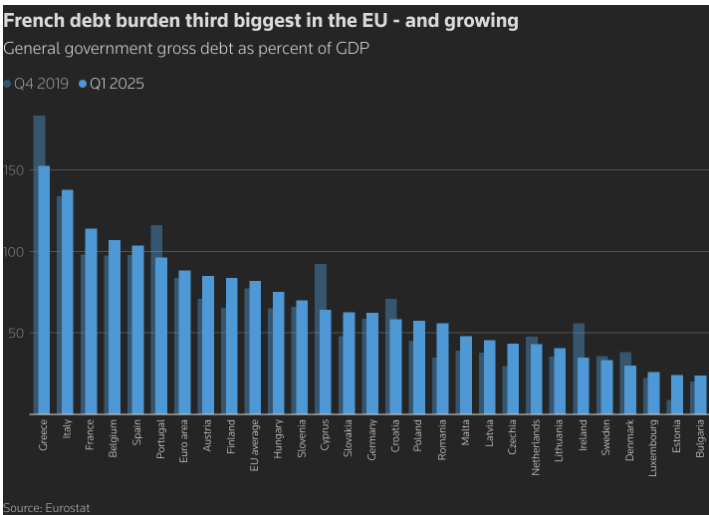

Emmanuel Macron is already looking for his fifth prime minister in less than two years after François Bayrou’s defeat in Monday’s confidence vote, where he lost by a wide margin (364 to 194). Bayrou, who took office with a mandate to implement a fiscal consolidation agenda demanded from Brussels, has ended up as the casualty of an unlikely parliamentary coalition of the left, greens, and far right, who brought him down over his budget-cutting plans.

The task now is as complex as it is urgent. His successor will have to achieve what Bayrou could not: build a parliamentary majority in a fragmented Congress and pass a 2026 budget amid rising social tension.

Despite the institutional gravity, markets have reacted with relative indifference. Bayrou’s fall was already priced in, and the real test will come this Friday, when Fitch announces its decision on France’s sovereign rating. The country’s fiscal situation is no trivial matter: with a structural deficit still above 5% and no political consensus for cuts or reforms, the agencies are growing impatient. It is a clear example of the failure of the current European welfare model.

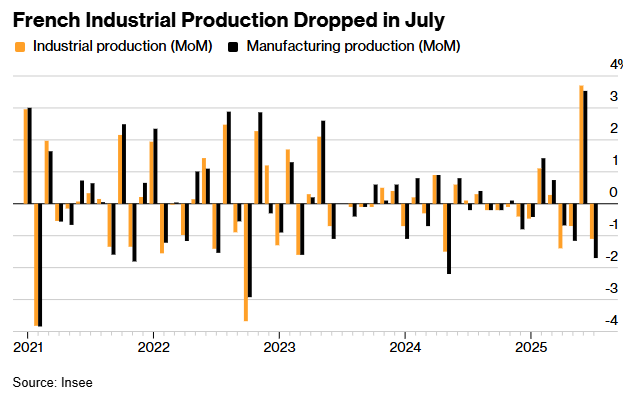

The country that for years acted as the euro’s anchor now combines political fragility with its long-standing fiscal weakness. Economically, failures are piling up as well. French industrial production fell 1.1% in July, a disappointing start to the third quarter for the eurozone’s second-largest economy. Manufacturing data, even weaker (-1.7%), reflects a partial reversal of June’s sharp rebound, when output had surprised to the upside at +3.7%.

Even so, the outlook is not entirely bleak. August’s manufacturing PMI suggests the sector has finally emerged from a technical recession that lasted more than two years. And second-quarter GDP growth exceeded expectations, indicating that, for now, domestic demand remains resilient despite the political noise.

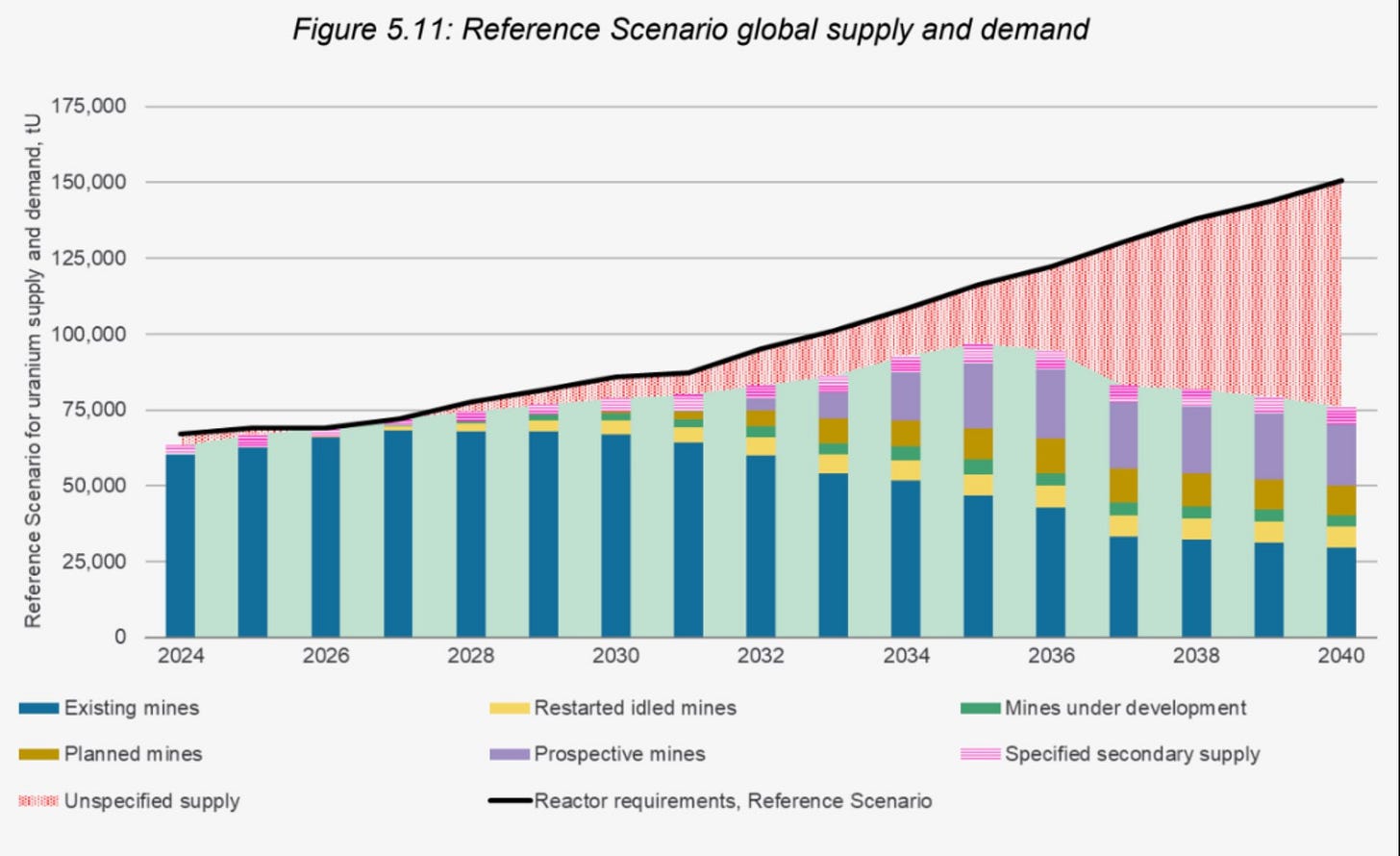

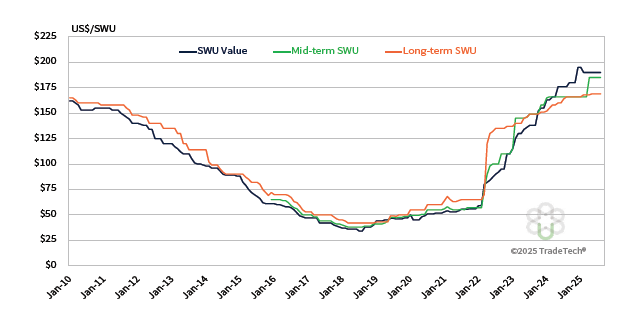

The annual WNA (World Nuclear Association) conference is where everything gets laid out clearly, and utilities are forced to face the fact that neglecting their procurement responsibilities is not a viable strategy. Recently we have seen the two largest producers in the market, Kazatomprom and Cameco, cut their guidance and cite various problems (technical, logistical, and geological) at their key assets. This has not gone unnoticed, and there is a growing consensus that — absent a sharp rebound in prices and investment — the deficits facing the uranium market will be insurmountable. It is not just a question of rising demand: the inherent decline of any extractive industry will gradually collapse production from current mines. The following chart illustrates both effects clearly — steady demand growth and the decline in existing supply.

The last major uranium cycle had its spark with Cigar Lake, but this time the combination of supply and demand factors is even more explosive, with financial actors like Sprott acting as fuel. The paradox is that even if uranium prices were to rise to $200/lb, demand would not fall — the nuclear spring would continue. In fact, faced with the panic of running out of material, buying pressure would likely intensify. After a consolidation period, uranium prices are gaining momentum again. Over the past month, the spot price has risen by +$5.5/lb, the mid-term price by +$3/lb (to $80/lb), while the long-term price has held steady at $82/lb, acting as a magnet for the other time horizons.

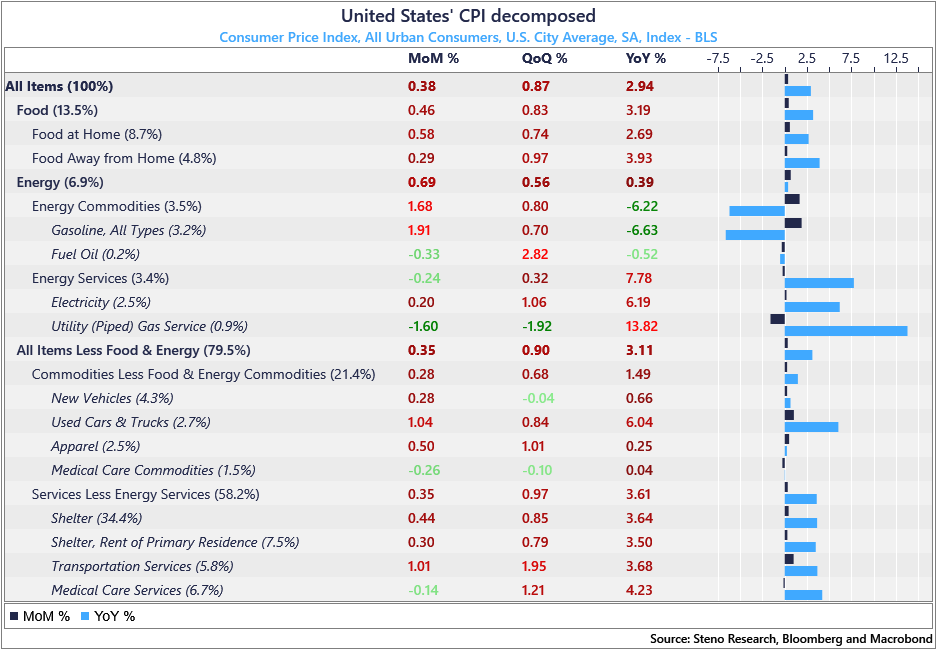

Inflation picked up again in August, with the consumer price index (CPI) rising 2.9% year-on-year, the largest increase since January. Although the core component (core CPI, which excludes energy and food) held steady at 3.1%, the figure reinforces the perception that disinflation is progressing very slowly, and that price pressures, while easing, have not fully disappeared. Part of the increase is attributed to the lagged impact of tariffs, which companies are now beginning to pass on to the end consumer, adding another layer of complexity to the Fed’s job—even though the producer price index (PPI), released on Wednesday, actually showed a decline in prices paid by producers.

Even so, markets don’t seem worried and are already pricing in a 100% chance of a rate cut at the Fed’s next meeting, driven less by inflation data and more by the clear deterioration in the labor market. A 50bp cut is even possible. Downward revisions to May and June employment figures—more than 250,000 jobs wiped from the official tally—have cast doubt on the strength of the labor cycle. In fact, with the latest negative revision for June, net job growth fell for the first time since December 2020. Meanwhile, the unemployment rate rose to 4.3%, its highest in more than three years.

Powell has publicly acknowledged that downside risks to employment are increasing and that, if they materialize, they could do so abruptly. With inflation not yet at the theoretical 2% target but seemingly under control, the Fed’s second mandate takes on greater importance. A sudden drop in labor demand often comes with mass layoffs and widespread contraction in consumption—something the Fed wants to avoid at all costs. In this context, a 25-basis-point cut seems the most likely path, but a bigger surprise would not be far-fetched.

For now, markets are cheering any data that supports the dovish narrative, even if inflation remains above the 2% target. Wednesday’s stock market rally, following the slight decline in PPI, is a clear example of how the market prefers to see the glass half full, even though the fundamentals are far from solid. Position accordingly.

Model Portfolio

The model portfolio's return is +15.16% YTD compared to -0.24% for the S&P500 (S&P in €), and +93.0% versus +44.2% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.