Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The trade war between the U.S. and China has been granted a 90-day extension, thus avoiding a leap to tariffs of 145% and 125% respectively — a move that would have amounted to a de facto embargo between the world’s two largest economies. The decision, announced by Trump on Truth Social and echoed by Beijing hours later, freezes duties at far more manageable levels (30% on Chinese imports and 10% on U.S. imports) just in time for the pre-Christmas peak in shipments.

The truce is not a definitive agreement — talks remain open to address trade asymmetries — but the relief was immediate in Asian markets and currencies, which rallied after weeks of lethargy. At the macro level, it offers a breathing space for supply chains and seasonal consumption, though trade figures reveal accumulated damage: Chinese exports to the U.S. down 21.7% year-on-year and the U.S. bilateral deficit at a two-decade low. The strategic backdrop remains unchanged: Washington is pushing to open up technology sectors and curb purchases of Russian crude, while Beijing diversifies markets and buys time. In this kind of standoff, the risk of returning to escalation remains, but both sides seem to have calculated that — at least until after Christmas — a tariff ceasefire is more profitable than another round of crossfire.

China’s latest economic data are far from encouraging, disappointing across nearly all metrics in July: retail sales up 3.7% YoY (vs. 4.6% expected), youth unemployment rising above 14%, and meager industrial investment figures. Risks to meeting the 5% annual growth target are mounting with little time left in the year.

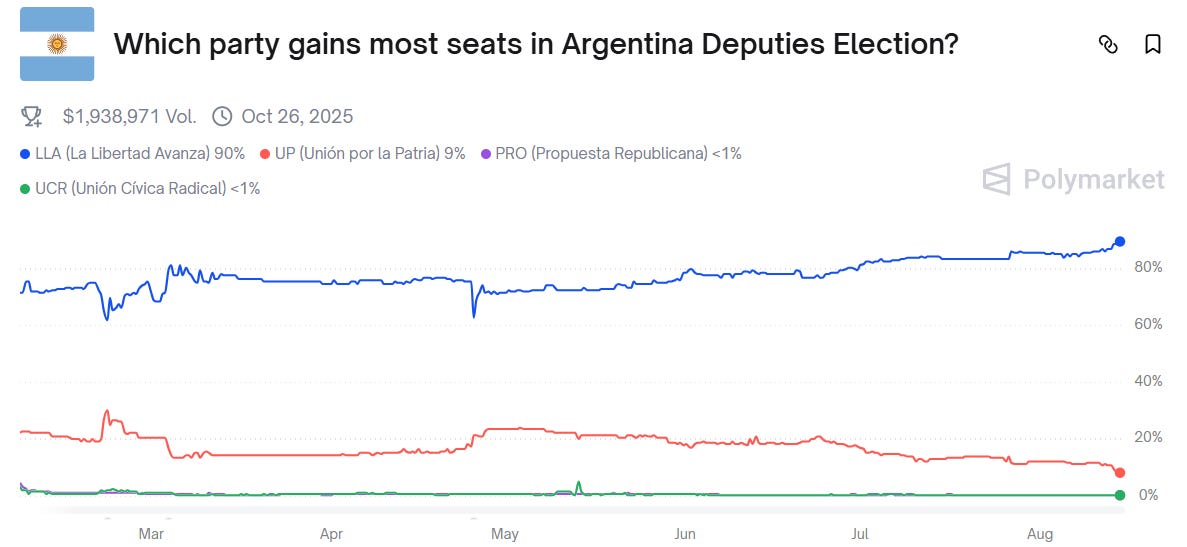

Argentina heads toward a key Q4 election, and July’s inflation figure surprised — not by its magnitude, but by its persistent calm: CPI rose 1.9% MoM, marking the third consecutive month below the psychological 2% threshold. In a context of accelerating currency depreciation and rising macro noise, this figure reinforces the government’s narrative that prices remain anchored… at least for now. The most interesting detail is not in the headline, but in the breakdown: core inflation (excluding seasonal and regulated prices) was just 1.5%, the lowest since January 2018. In parallel, seasonal prices — boosted by winter holidays and fruit/vegetable costs — surged 4.1%. In other words: without tomatoes and plane tickets, the rest of the system is still slowing down.

The contrast matters. Although the improvement is clear, annual inflation still stood at 36.6% (a low since 2020), with year-to-date inflation at 17.3%. For a country coming from 211% annual inflation barely a year ago, this is a statistical anomaly — yet still an uncomfortably high level for daily life. In theory, the peso’s sharp depreciation (13% in July alone) should already be having an impact, but the government argues there aren’t enough pesos in circulation to validate price hikes, while companies claim that consumption is so weak that passing costs on to consumers would be suicidal. The contained inflation is, for now, the result of price repression via trade liberalization, falling real incomes, and record imports of consumer goods. If the exchange rate hasn’t yet fed into prices, it’s because the economy is anesthetized. Or, in other words: there is no inflation because nobody is buying anything.

The starting point was so fragile that Milei’s adjustment plan inevitably involves initial pain, but the improvement is so tangible that the country is likely to reach the elections with a radically improved public perception.

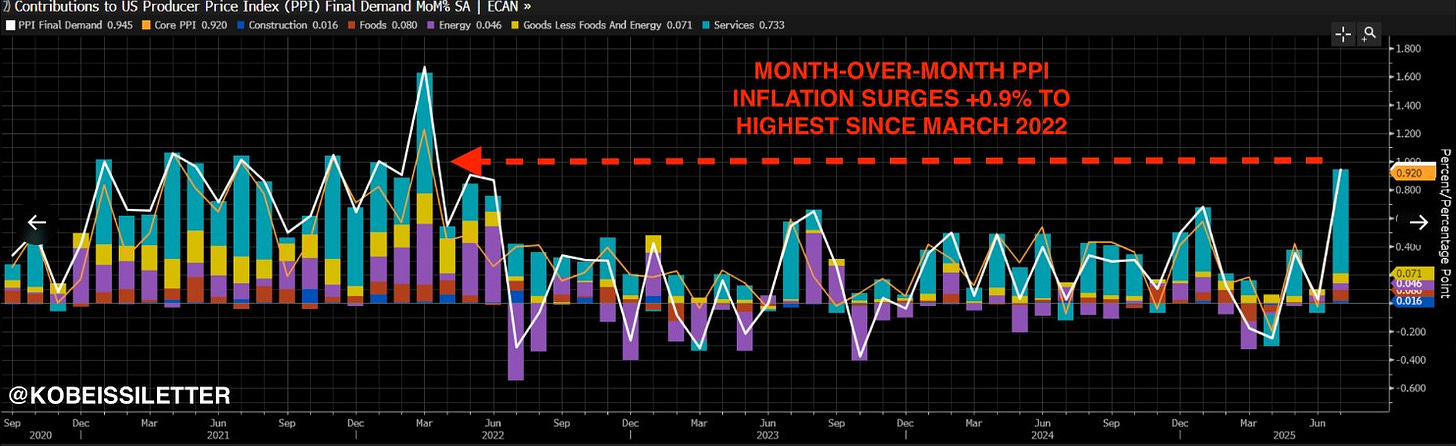

U.S. wholesale inflation data once again clouded a narrative Wall Street had been eagerly embracing — that of imminent Fed rate cuts. July’s PPI jumped 0.9% month-on-month — four times higher than expected — and 3.3% year-on-year, shattering the moderation script many had taken for granted and nullifying the previous day’s statements and hopes, with Bessent suggesting a 50bp cut in September. The blow was twofold: first to monetary policy expectations, then to stock prices, which corrected sharply.

The market, which had been fully pricing in a 25bp cut in September and flirting with the idea of a deeper easing cycle by year-end, is now starting to doubt. The implied probability fell from 63 to 58 basis points of total cuts in 2025. Not a collapse, but a clear change in tone. Meanwhile, the Fed has already stepped in to set boundaries: Mary Daly ruled out a half-point cut and warned that the battle against inflation is still ongoing. As always, a central bank that hikes quietly and cuts begrudgingly.

The figure was ugly enough to abruptly halt the optimism that had driven the S&P and Nasdaq to fresh record highs earlier this week. Gains had been fueled by the belief that inflation was tamed, the labor market was showing cracks, and cuts were imminent. But the reality is that part of the market is so thirsty for liquidity it will buy into any excuse — until a hard number like this PPI comes along and brings everything back to earth. A very 2022 déjà vu triggered by tariffs.

Meanwhile, labor data remain resilient. Weekly jobless claims fell again, adding another layer of complexity to the macro diagnosis: no collapse, but no clear easing of pressures either. Just enough to keep the Fed in an uncomfortable position.

The message is the same as ever, but with new arguments: the “soft landing + orderly cuts” narrative is more wishful thinking than an actual diagnosis. Despite the extra revenue from tariffs, this year’s deficit is 10% higher than last July’s — and that’s why not being invested in real assets is a suicidal position.

In other news, startup Perplexity AI has made an unsolicited all-cash public offer of $34.5 billion for Chrome, Alphabet’s web browser. Yes, you read that right: a three-year-old company worth less than half that amount wants to buy one of Google’s most strategic assets. In any other context, it would seem delusional. But in today’s environment, where browsers are once again at the center of the war for AI and data, the move is less absurd than it appears.

Perplexity pulled a similar stunt a few months ago with TikTok, attempting to capitalize on the political noise surrounding its Chinese ownership. This time it’s going further: Chrome is not just a browser with over 3 billion users — it is, for Google, the anchor securing the dominance of its search engine, the channel through which it pushes its service ecosystem, and, in this new phase, the gateway to its generative AI integrations like Overviews. Selling it would be akin to self-disarmament.

That’s why the offer is dead on arrival. Google hasn’t responded, and won’t, because the aim isn’t to sell but to avoid being forced to do so by a judge. The backdrop is legal: the U.S. Department of Justice has proposed the possible breakup of Chrome as an antitrust remedy following a ruling that declared Google’s search market control illegal. Alphabet will appeal — as expected — and all signs point to a long legal battle that could reach the Supreme Court. Meanwhile, Perplexity is positioning itself.

What’s interesting is what this reveals about the current market moment. In an environment where chatbots are beginning to replace traditional search, the browser is once again a power asset. It’s no longer just a passive tool, but the place where the user’s relationship with AI begins. Perplexity has its own browser (Comet) but lacks scale. Chrome would give it that. OpenAI is building its own. Microsoft has Edge, reborn with Copilot. The war is not just over data, but over the point of entry. For Google, the dilemma is existential. Regulatory pressure is mounting, competitors are multiplying, and user loyalty is becoming a scarce commodity. Chrome is its defensive line.

We keep reading the narrative about deep business pessimism in the United States, the uncertainty of the outlook, and the problems companies face — but the reality they show is quite different, one of much greater confidence (the effect of thinking everything is going badly for others but not for us), with a record in share buybacks in 2025 ($926B YTD), well above the pace seen in 2022.

It is true that the market is highly uneven and increasingly less homogeneous, as can be seen in profit growth since 2019: the top 10 companies have increased earnings by 180%, while the rest have grown only 45%. Far from narrowing, this trend has accelerated, making the current valuation level particularly risky: any slowdown among this group of leaders has the potential to drag the market down significantly. In fact, in the second quarter just ended, 52% of companies reported margin declines — a perfect market for stock pickers.

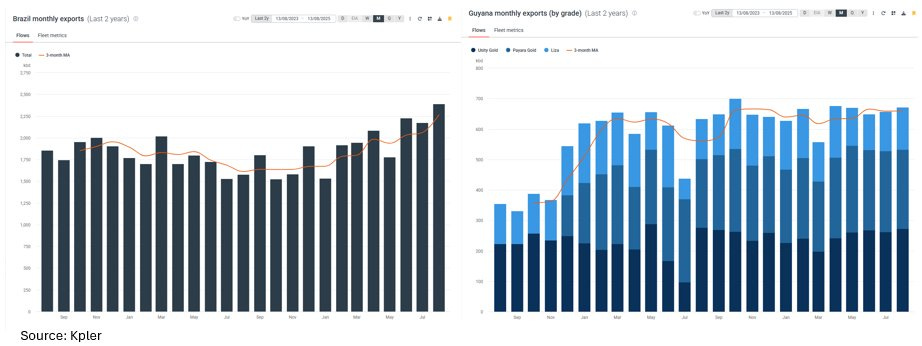

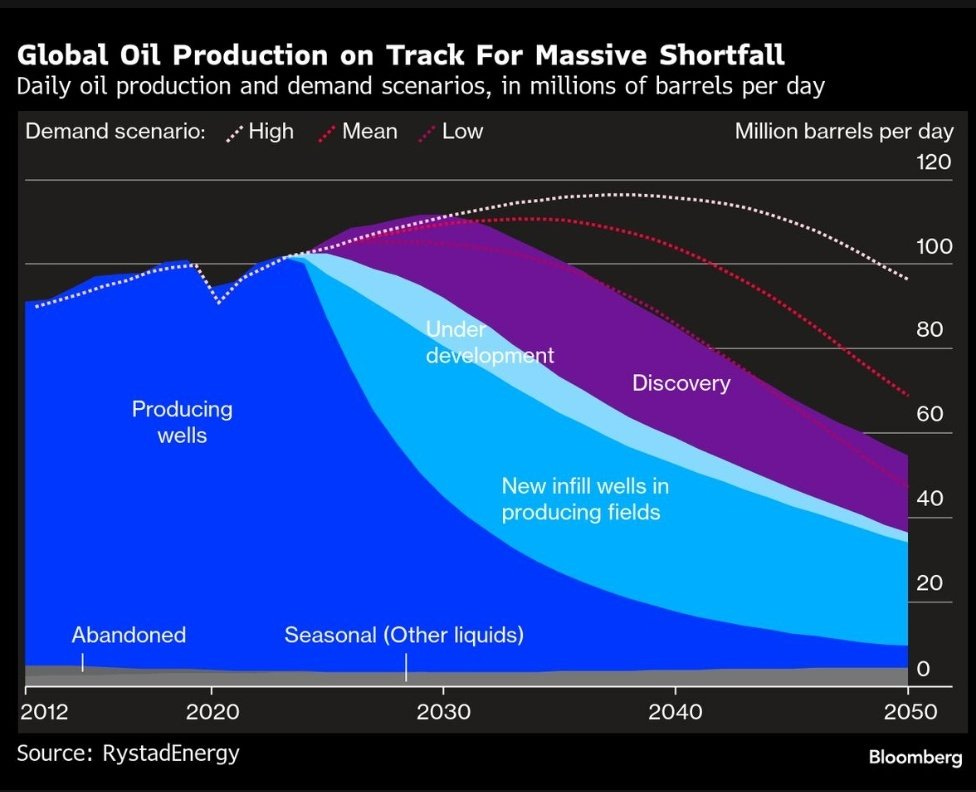

The EIA has released its new STEO (Short-Term Energy Outlook), with the most pessimistic conclusions to date regarding market surpluses and prices (forecasting WTI below $50 in 2026). Even so, it raised its demand estimate for 2025 to +0.98Mb/d (vs. 0.81Mb/d previously) and to 1.19Mb/d in 2026 (vs. 1.05Mb/d). At current prices, as we have seen many times before, U.S. shale has little incentive to grow (even less so at $50…), and in the latest STEO supply growth estimates were once again revised downward. In fact, only Brazil and Guyana are contributing growth this year, far below the estimates made at the start of the year.

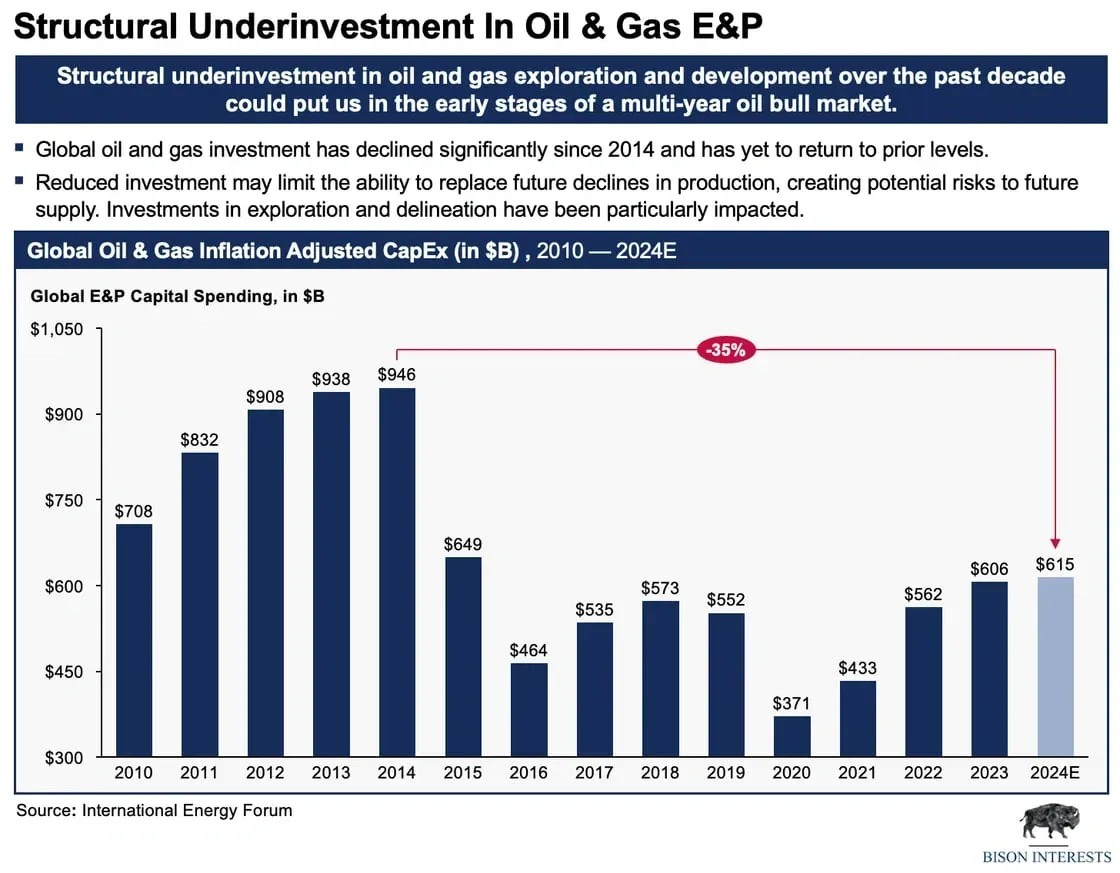

Although exploration and production investment figures have recovered since 2016–2020, they remain well below the levels seen during the last oil boom, and clearly insufficient given the geological decline of many major fields and basins.

In fact, non-OPEC production is already expected to peak in early 2026—and where will supply come from after that? It is frustrating to see how only geopolitical headlines seem to have any effect on the market, instead of a fundamental discussion, which in the end is the only thing that truly moves the needle. I still believe that in this decade we will see new all-time highs in oil prices (> $140/b).

Model Portfolio

The model portfolio's return is +12.16% YTD compared to +10.06% for the S&P500 (our portfolio mesured in € terms, which is weighting -14% in our portfolio this year vs the S&P in $), and +88.0% versus +59.1% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.