Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The U.S. House of Representatives has passed two key pieces of cryptocurrency legislation, in what Republicans have rather grandiosely dubbed “Crypto Week.” These are the CLARITY Act (yes, another bombastic acronym) and the GENIUS Act, which aim, respectively, to establish a clearer regulatory framework for digital assets and to regulate the stablecoin market. Both bills received bipartisan support — 80 and 100 Democrats voted in favour, respectively — which is something of a rarity in today’s political climate.

The timing is no coincidence. Trump has made it clear he wants to fast-track his crypto agenda, seeking to appeal to young, tech-savvy voters and to distance himself from the anti-crypto stance many associate with the previous administration. In fact, he has already pledged to sign the GENIUS Act as early as this week, provided the Senate doesn’t introduce any last-minute changes. The strategy is clear: boost domestic innovation, attract capital and talent, and provide legal clarity to an industry that has been drifting in a regulatory limbo for years.

But not everyone is on board. The process briefly stalled due to resistance from a faction of the Republican Party demanding explicit guarantees to ban any development of a central bank digital currency (CBDC). In other words: regulation for private actors, but a complete veto on public alternatives. The spectre of a “programmable dollar” continues to provoke visceral reactions, especially among those who see CBDCs as a tool for state control rather than a technological upgrade. Unsurprisingly, the so-called Anti-CBDC Surveillance State Act is also about to be voted on.

The underlying message is that Washington wants to regulate crypto — but on its own terms. Freedom for stablecoins and exchanges; a hard no to the Fed entering the game. And all, of course, with grandiose acronyms. If there’s one thing the U.S. Congress excels at, it’s giving anything an epic name — in this case, with far more implications than it might seem.

Money continues to pour in, both into ETFs (with record weekly inflows) and at the corporate level, into both BTC and ETH (which now has its own “MSTR” in SBET, and has filed to expand its ATM to $5B). In fact, leading ETFs (BlackRock at the forefront) have requested permission to perform staking, which would attract investors looking not only for appreciation but also for yield. The final bullish catalyst came from the president himself, hinting at the opening of 401k retirement plans and pension funds to alternative investments like crypto.

Meanwhile, those who have spent the last decade declaring that BTC is a bubble continue insisting — hoping, perhaps, that one day they’ll be right. Early days.

The reality is simple: demand far outstrips new supply, and institutional pockets — unlike typical retail ones — are very deep.

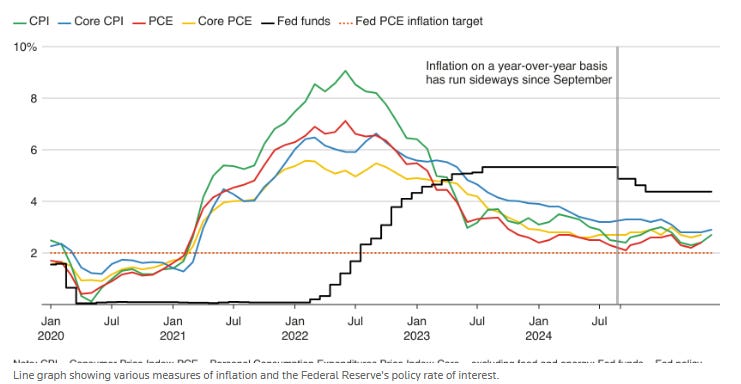

US inflation rebounded to 0.3% month-on-month in June (3.5% annualised), driven by price increases in durable and semi-durable consumer goods — audio equipment, furniture, clothing — categories that heavily rely on imports and had so far remained stable thanks to globalisation. But that narrative is shifting, and the culprit has a name: tariffs.

The CPI confirms what many economists had already anticipated: Trump’s new wave of tariffs is starting to show clearly in the inflation figures. Recreation, electronics, tools… all are rising. In the case of audiovisual equipment, the year-on-year increase of 11.1% is the highest on record — and speaks for itself.

This, in principle, wouldn’t be a problem if it were temporary. The real issue is the lack of visibility: Trump is threatening further hikes in August, including rates of 30% or more on countries like Mexico, Canada, and the EU. So the inflationary pressure is far from over — and the Fed knows it.

Although core inflation rose slightly less than expected (2.9%), price dispersion is increasing, and imported goods are experiencing “reflation”, even as services (especially housing) continue to cool. This is the ideal scenario for a rotation within the inflation basket: goods are picking up just as the momentum in services fades.

This introduces noise — not just in the macro narrative but in rate pricing. Futures markets, which had priced in a rate cut for September, are now in coin-toss territory. The market is uncertain — and rightly so. Powell had said this summer would be the test to see whether tariffs would affect inflation. Well, June failed the test. The net effect is a quiet yet visible transfer: consumers pay more for goods, companies cut margins or pass on the costs where they can, and the Fed, caught between moderate growth and stickier inflation, opts to wait.

What is clear is that tariffs are reshaping the relative relationship between goods and services prices. And this, in terms of portfolio allocation, gives a strong signal: we remain in an optimal zone for assets linked to reflation — commodities, crypto, and commodity-linked FX — while the Fed stays in wait-and-see mode.

Last week, the US Department of Defense made an unusual but strategically significant move: becoming the largest shareholder in MP Materials, the country’s leading rare earths producer. The deal, backed by a range of financial support measures, marks a turning point in US industrial policy and is based on a key principle: sharing risk with the private sector to rebuild a domestic supply chain that currently depends almost entirely on China.

This investment is not isolated. Since 2022, the Pentagon has allocated over $540 million to critical minerals projects, and the plan is to continue along this path for as long as Congress allows. The rearmament is not just military — it is industrial too.

What stands out is not just the amount, but the legal framework chosen. The MP investment was channelled through the Defense Production Act, a Cold War-era law that allows the government to directly intervene in sectors deemed essential to national security. The new Office of Strategic Capital also participated — a kind of military sovereign wealth fund designed to support strategic industries with long-term horizons and high risk tolerance.

Why now? Because the US can no longer afford to be entirely dependent on China for rare earth magnets — critical for defence electronics, electric vehicles, and guided missiles. While Chinese environmental and labour practices remain questionable, the US wants to build its own slower but safer and more controlled industry. Will we see more deals like the MP one? Very likely. And beyond the direct impact, the implication for investors is obvious: companies with advanced rare earth or strategic metal projects in allied jurisdictions are likely to begin trading at a geopolitical option premium. Uncle Sam is now covering the asymmetric risk.

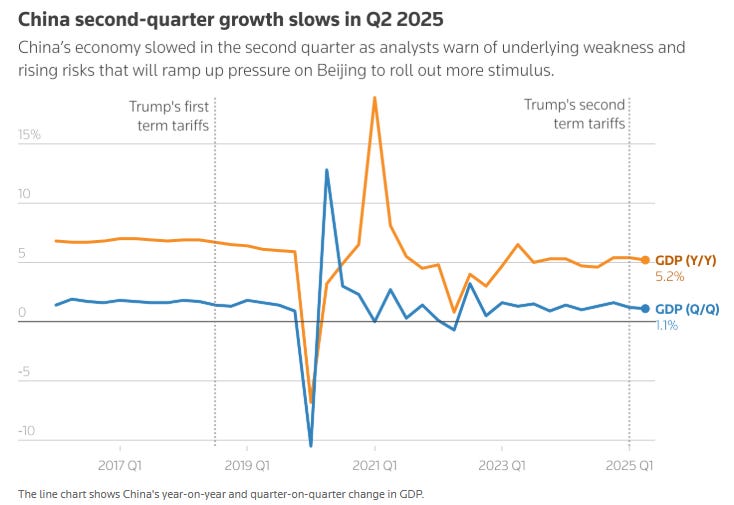

China’s economy grew 5.2% year-on-year in Q2, slightly above expectations (5.1%), confirming that despite the drumbeat of slowdown warnings, the Asian giant continues to avoid a hard landing. But let’s not be fooled by the headline: the resilience lies more in the data than in the real economy.

Growth is partly fuelled by stimulus measures and a favourable statistical base (the well-known “frontloading” of exports, which will fade in H2), but internal weaknesses are increasingly evident: falling prices, stagnant consumption, and a property sector that’s yet to bottom out. If consumption recovers at all, it will be uneven and limited.

That’s why market focus is now shifting to the Politburo, which meets in a few weeks and is expected to announce new stimulus measures. Beijing has already deployed parts of the classic playbook — more infrastructure, consumer subsidies, some monetary easing — but hasn’t yet addressed the core issue: household balance sheets. At this pace, the 5% annual growth target may remain more aspiration than reality.

Adding to this is the deterioration in exports, which had so far weathered the storm thanks to a tariff truce with the US, but are likely to hit the Trump tariff wall in H2. If we add the collapse in property investment (–9.2% YoY in construction, prices falling at the fastest rate since October), the outlook darkens. The government knows it, and some analysts are already talking about a possible expansion of the fiscal deficit. But beware: increasing stimulus in a context of negative inflation and rock-bottom industrial prices might not have the intended effect. The dilemma is clear: more stimulus means more medium-term imbalances. Less stimulus means slower growth.

In one of the few deals concluded ahead of the looming 1 August deadline, Indonesia has secured a reduction in the proposed US tariffs from 32% to 19%. President Prabowo Subianto did not hesitate to describe Trump as a tough negotiator following a direct phone call, during which, in his own words, there was no room left to offer more.

The agreement, although still lacking specific public details, follows the same pattern as the recent deal with Vietnam: a guaranteed purchase of US goods ($15bn in energy, $4.5bn in agriculture, and 50 Boeing aircraft) in exchange for preferential access and a clampdown on the covert re-export of Chinese goods via Jakarta. In parallel, the deal includes a clause to penalise trans-shipments from China — one of the Trump administration’s favourite targets in its crusade against Asian dumping.

Market reaction? Largely positive: Jakarta’s benchmark index rose by 0.8% and is now up 10% since April. The central bank welcomed the deal with an interest rate cut, arguing it removes uncertainties and improves the country’s export outlook. And that’s no small matter: Indonesia posted a $17.9bn trade surplus with the US in 2024, and the threat of 32% tariffs was jeopardising a key pillar of its growth.

The fine print? Despite the official optimism, the impact will be mixed. Labour-intensive sectors such as textiles and footwear will feel the hit of the 19% tariffs. In return, energy and agriculture will benefit, and Jakarta gains something even more valuable in this cycle: a place on Trump’s positive radar.

At the regional level, Indonesia scores a point against its neighbours, who are still negotiating with Washington under threat — or without a safety net. As analyst Matt Simpson put it: “19% is better than 32%.” And in times of trade realpolitik, that already counts as a win.

BP has finalised a deal to sell its US onshore wind business to LS Power, as part of its $20bn divestment programme. The transaction marks yet another shift in the British giant’s strategy of refocusing on oil and gas, aiming to boost profitability and appease an increasingly impatient shareholder base (BP, once jokingly said to stand for Beyond Petroleum, now seems to mean Back to Petroleum). Financial details of the sale have not been disclosed, although previous estimates valued the business at up to $2bn — though current sector valuations likely put the final figure significantly lower.

The timing is no coincidence. After more than a year of share price declines (-10% over 12 months) and mounting pressure from activist hedge fund Elliott Management (which has taken a stake in the company), BP has been scaling back its more aggressive commitments to the energy transition. The sale also forms part of a broader wave of strategic restructuring: BP is reportedly considering selling Castrol, its lubricants business, for a potential $8bn. However, there is scepticism as to whether the market is willing to pay high multiples for low-growth businesses.

From a corporate narrative perspective, the message remains one of maintaining “some green exposure,” but only where BP believes it can deliver differentiated value. The onshore wind business no longer fits that thesis. William Lin, head of the gas and low-carbon energy division, admitted as much, stating that while the assets are solid, “we are no longer the best owners to take this forward.”

At its core, BP is engaged in a delicate balancing act: trying to present itself as a green-friendly oil major to regulators and certain institutional investors, while clearly retreating back to oil in front of the market. The wind divestment is not an isolated move, but rather part of a broader narrative: improving return on invested capital, refocusing on core operations, and shedding businesses with no clear synergies or with heavy CAPEX requirements.

The key question now is whether this strategic shift will convince the market — and, more importantly, whether it hasn’t come too late. Because when even Shell has felt compelled to publicly deny rumours of a BP takeover bid, it suggests that something fundamental has broken in perceptions of the group’s strength.

Model Portfolio

The model portfolio's return is +15.83% YTD compared to +7.34% for the S&P500 (our portfolio mesured in € terms, which is weighting -13% in our portfolio this year vs the S&P in $), and +94.1% versus +55.2% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.