Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

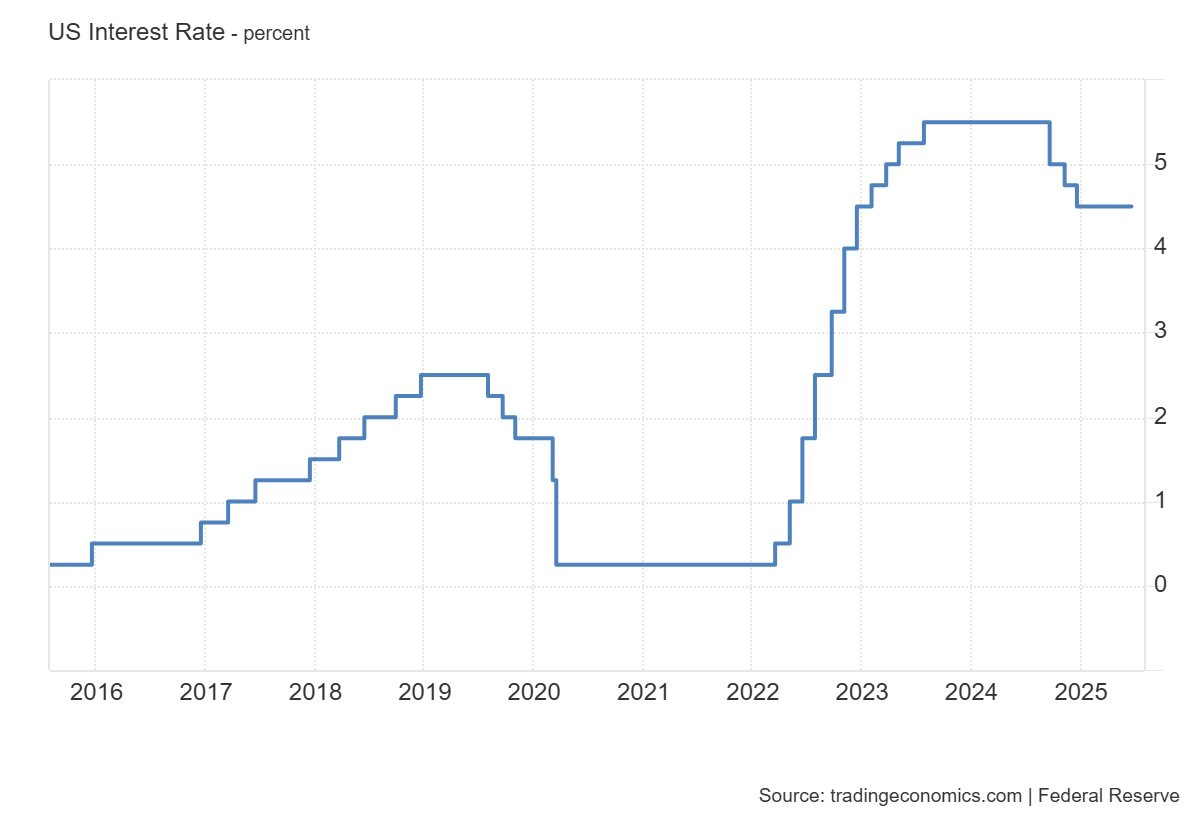

The Federal Reserve left interest rates unchanged at its June 18 meeting, in a context where the focus has shifted from past inflation to the risks ahead: stalled growth, pressure on the labor market, and a potential new inflationary surge tied to trade policy. Although the Fed’s projections still include a path of cuts — half a percentage point in 2025 and only a quarter-point in each of the two following years — the tone of the statement is more cautious, even skeptical about acting soon, and more aware of the fragility of the macroeconomic environment.

Jerome Powell was clear in his press conference: “It’s not advisable to place too much weight on the projected path of rates, because everything will depend on the data.” If it weren’t for Trump’s tariffs, cuts would already be on the table. But according to Powell, the cost shock is imminent — and that calls for caution. Supply chains are grappling with the dilemma of who will absorb the hit: manufacturers, exporters, importers, or consumers. But as Powell himself acknowledged, someone will pay in the end — and much of that cost will fall on the end consumer. In other words, tariffs will not only make goods more expensive, but they could also delay rate cuts for months, even if the economy weakens.

The economic projections published by the Fed paint a near-stagflation scenario: GDP growth of just 1.4% in 2025 (down from 1.7% previously), inflation rising to 3% annually (vs. 2.6% currently), and unemployment increasing to 4.5% (from today’s 4.2%). Despite this, the Fed still anticipates rate cuts, although now more spaced out over time and with strong internal division: 7 out of 19 members see no need to cut rates this year — a clear sign of prevailing uncertainty.

Regarding the statement itself, there were slight changes in tone that reflect some improvement in the overall assessment:

The description of the labor market has been softened: the mention of its "stabilization at low levels" was removed and is now summarized by saying the “unemployment rate remains low.”

It acknowledges that uncertainty has diminished, although it “remains elevated.”

All references to increased risks of inflation and unemployment have been removed.

Meanwhile, Trump carries on as usual and hasn’t held back. Parallel to the meeting, he called Powell “stupid” and suggested halving interest rates — a proposal more reminiscent of emergency policies than of prudent cycle management. He even joked — or maybe not — about declaring himself President of the Fed. For now, the Fed continues to resist political pressure, but the noise is growing, and with it, the fragility of the environment. There’s still room for maneuver, but the window is narrowing. The key question is how long it will take for the inflationary impact of trade measures to materialize — and whether the labor market weakens before that.

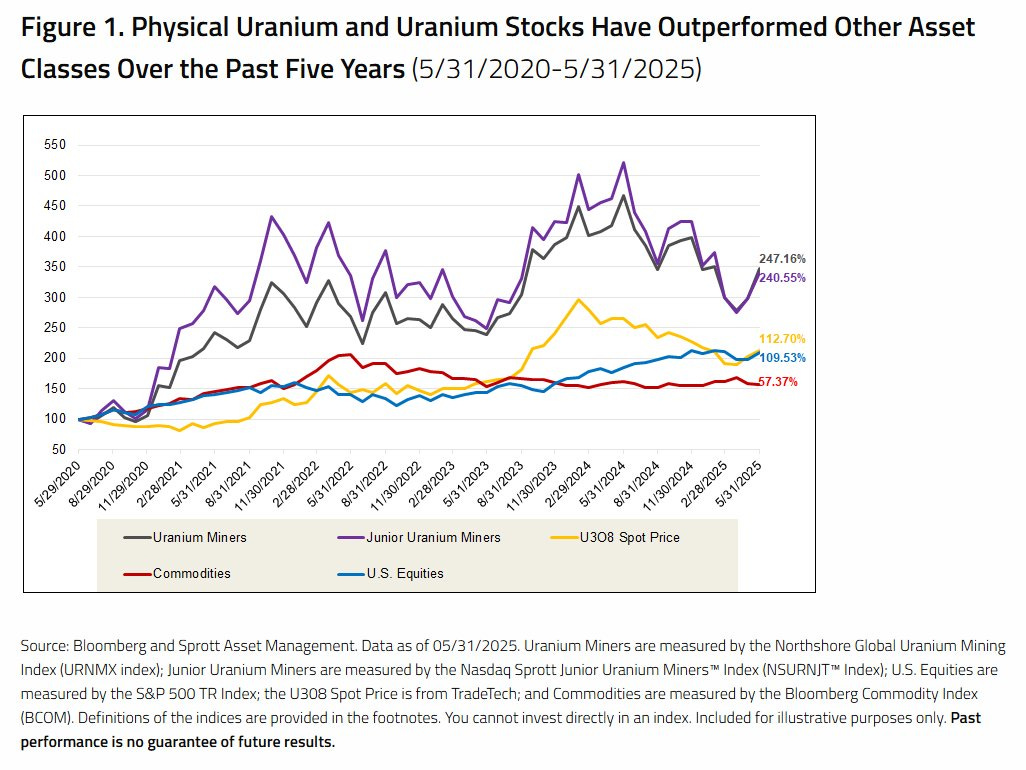

After a slow start to the year, the uranium market came roaring back to life in May, driven by renewed institutional demand — particularly through physical ETFs — and political momentum in the U.S. The most recent inflection point (further detailed in the model portfolio section) was marked by Sprott, which announced an upsized $200 million bought deal with the capacity to acquire up to 3 million pounds of physical uranium in the spot market. This is its first purchase since November 2024 and could account for up to 8% of the total forecasted spot volume for the year. The move coincided with a strong rally in the spot uranium price, which rose by 5.5% in May — the second consecutive month with gains over 5% — rebounding to $74/lb and erasing year-to-date losses.

Meanwhile, long-term contracts held steady around $80/lb, a clear sign that utilities continue to prioritize long-term stability and hedging over volume. Supply discipline and structural scarcity continue to anchor the market in a persistent deficit.

In parallel, uranium miners surged strongly, with large producers gaining +16.2% and juniors +14.2%. Since the April 7 low, miners are up 42%, highlighting the sector’s high sensitivity to spot price movements and its elevated market beta.

The carry trade has also returned, bringing liquidity and helping to narrow the spread between spot and long-term prices — improving market transparency and boosting investor confidence.

On the geopolitical front, the pro-nuclear momentum is accelerating:

The U.S. reaffirms its goal of 400 GW of nuclear capacity by 2050, with regulatory reforms at the NRC and faster approval processes.

The UK commits £12 billion to Sizewell C.

India plans to quadruple uranium imports by 2033.

Spain and Kazakhstan are evaluating new nuclear plants.

Meta has signed an agreement with Constellation to secure nuclear energy supply.

Multilateral institutions such as the World Bank and the ADB are beginning to relax restrictions on nuclear financing.

All of this points to new short-term support for uranium prices, with a recovery in utility buying activity and a strongly supportive political and financial environment. Moreover, the energy narrative tied to AI (as in Meta’s case) offers a new medium-term structural demand vector.

With fundamentals intact, institutional appetite returning, and a renewed pro-nuclear policy roadmap, uranium is positioning itself as one of the most structurally backed assets in the commodities market for 2025. The opportunity remains compelling.

The United States Senate has passed, by a wide bipartisan majority (68–30), the so-called GENIUS Act, the first federal regulatory framework for dollar-backed stablecoins. The bill will now go to the House of Representatives, where it is expected to be approved, paving the way for President Trump to sign it into law before August. The legislation requires that these assets be backed by liquid reserves such as cash or short-term Treasury bonds, and obliges issuers to publish the composition of such reserves on a monthly basis. This law marks a turning point for the crypto ecosystem, which has long called for regulatory clarity to gain legitimacy and institutional traction, as regulatory risk and legislative uncertainty had been major obstacles to adoption. It's no coincidence that all the good news is arriving now: during the 2024 midterms, the sector invested over $119 million supporting crypto-friendly candidates. Now it's reaping the rewards—not just in legislation, but in gaining direct access to a political environment openly favorable to it. Trump has made cryptocurrency a campaign— and personal—banner: his circle has promoted the $TRUMP token and is involved in World Liberty Financial, a crypto firm in which the president reportedly has an indirect stake.

The problem is that this convergence of politics, legislation, and personal business has sparked strong criticism, especially from the progressive wing of the Democratic Party (as you know, we’ve been playing this through several SPACs via our Research…). For instance, Elizabeth Warren has called the law a Trojan horse that, under the guise of financial innovation, facilitates institutional looting by Trump. She also argues the bill fails to impose clear limits on stablecoin issuance by Big Tech and doesn’t reinforce anti-money laundering controls (Amazon and Walmart have already hinted at launching their own stablecoins). Meanwhile, state banking regulators—historically very protective of their authority—have warned that the law grants excessive powers to uninsured banks to operate nationwide without their oversight.

The truth is that this legislative breakthrough comes at a moment where political urgency has overtaken technical caution. The fact that the first major law on crypto assets in the U.S. is emerging under a political leadership so symbolically and economically tied to the sector raises doubts as to whether this is serious regulation—or merely the legal formalization of a new financial lobby. The line between fiscal policy and personal promotion has never been blurrier.

Although the initial promise was “90 deals in 90 days,” so far there’s been one—and barely. Trump and Starmer have formalized a partial trade agreement between the U.S. and the U.K., lowering tariffs on automobiles and completely removing them for the British aerospace sector. While it falls short of a comprehensive treaty, the move helps avoid a new tariff front in the middle of an election campaign and provides political oxygen to both sides. Key points of the agreement include:

Automobiles: The U.K. can export up to 100,000 vehicles per year to the U.S. at a 10% tariff, compared to the 25% rate applied to other countries.

Aerospace: All tariffs on British aircraft and parts are eliminated.

Steel and aluminum: A tariff-free quota is established (25% limit), conditional on guarantees regarding supply chain security.

Meat exports: A reciprocal agreement is reached for 13,000 tons of beef and ethanol, subject to U.K. food safety standards.

The deal is being presented as a victory for key U.K. industrial sectors—automotive and aerospace—at a time of high global trade tensions, but sensitive sectors such as pharmaceuticals remain excluded, with preferential terms still under negotiation. There is also ongoing risk of new tariffs as the U.S. pursues active investigations.

The symbolism of the deal outweighs its real scope. Trump even confused the treaty with the EU, and his comment that “the U.K. is protected because I like them” illustrates the fragile institutional grounding of the agreement. Still, it’s the only deal so far—so better than nothing...

The escalation between Iran and Israel has entered a critical phase. While mutual attacks continue—including a new Israeli offensive on Iranian nuclear facilities—diplomatic efforts led by Europe have failed. Any path toward a ceasefire remains blocked by deep mistrust and domestic pressure on both sides not to back down.

On the ground, the conflict has already left at least 430 dead and 3,500 injured in Iran, according to the regime’s own figures, though independent organizations put the number at 639. In Israel, Iranian attacks have caused 24 deaths.

Civilian infrastructure has also suffered. Iran accuses Israel of targeting hospitals, ambulances, and causing the deaths of several healthcare workers and a child. Israel, for its part, defends its strikes as precise and limited to military targets, though it admits the possibility of collateral damage.

The nuclear dimension adds further gravity to the conflict. Israel justifies its attacks as preemptive measures to halt a program it claims is just weeks away from producing nuclear weapons—something the U.S. has not confirmed. The IAEA has verified that a centrifuge workshop in Isfahan was hit, though it contained no active nuclear material.

On the international front, while Turkey, Russia, and China are calling for immediate de-escalation, Trump has stated he will take two weeks to decide whether the U.S. will provide military support to Israel. Israel, for its part, has made it clear it will not halt its offensive until Iran’s nuclear and ballistic capabilities are fully dismantled, a goal that could extend the conflict for weeks. Once again, the region faces the real possibility of an open regional confrontation, with no effective containment mechanisms in sight. In the background, oil prices are reacting sharply to headlines and have accumulated a strong geopolitical premium, pushing them back toward $80/barrel—something unthinkable just weeks ago, when prices were flirting with $50/b! Producers are seizing this period of extraordinary profits to mask what has otherwise been a very weak year for the oil & gas industry...

Model Portfolio

The model portfolio's return is +7.15% YTD compared to +1.65% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +79.6% versus +47.0% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.