Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

As we announced this week, we have officially launched our website. We will be gradually migrating all content and subscriptions to the new platform. If you have an active subscription on Substack, we encourage you to cancel its automatic renewal (we have already transferred it to the website). We are no longer accepting new subscriptions via Substack—you’ll notice the high prices set there are meant to discourage new sign-ups. On our website, you can subscribe at the same prices we offered here (€50/month or €500/year).

In the short term, we understand that migrating your subscription may be a bit inconvenient, but we believe we’ll be able to deliver much more value on our own platform. Thank you for your trust, and sorry for the inconvenience!

What have we done to make this easier?

If you already had an account on LWS and used the same email as on Substack, we have automatically transferred your subscription. No action is needed.

If you didn’t have an LWS account or used a different email, we’ve created the account for you with a random password. You just have to hit “forgot password” and set the one you want.

How to proceed from now on:

Click on “Sign in.”

If you already had an LWS account, your Free subscription is already active.

If you didn’t have an account, click “Sign up,” complete the form, and your Free subscription will be automatically created.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

Treasury Secretary Scott Bessent has downplayed Moody’s sovereign rating downgrade, claiming it came 14 years too late compared to S&P’s blow in 2011. And in a sense, he’s right: the fiscal deterioration of the U.S. is no surprise, and Moody’s warning had been on the table since November 2023. What truly matters is not the downgrade itself, but the total lack of political response since then. Rather than correcting course, this year has only reinforced the drivers of deterioration: extended tax cuts, rising spending, and the absence of a credible consolidation plan. Nothing stops this train, as bond yields already reflect.

That said, it’s also true that the immediate market impact was minimal. Bonds, equities, and the dollar barely reacted on Monday. The reason is simple: the credibility of the U.S. Treasury no longer hinges on its formal credit rating, but on the existence (or lack thereof) of a safe and liquid alternative. As of today, there is none. Institutional mandates requiring holdings of only AAA-rated debt are no longer enforced in practice, and the dollar remains the safe-haven asset par excellence — though increasingly questioned.

The real concern, however, lies in the gap between official rhetoric and the objective assessment of risk. S&P Capital IQ’s internal model, which uses CDS prices as input, places U.S. sovereign risk at BBB+ — six notches below the official rating, barely within investment grade. That’s a troubling gap. What the market is saying is not that the U.S. will default, but that fiscal deterioration is no longer a future risk — it is a present reality, and it’s not being addressed through growth or fiscal discipline.

With this downgrade, the exclusive triple-A club loses one of its members.

The U.S. House of Representatives, under Republican control, has passed —by a single-vote margin— what is likely the most ambitious and polarizing fiscal package of the Trump era. With a 215 to 214 vote, all Democrats and two Republicans opposed, the approval of this package not only represents the legislative culmination of Trump’s second term, but also a direct blow to the country’s fiscal sustainability.

The bill, over 1,000 pages long, renews the 2017 tax cuts, tightens eligibility for programs like Medicaid and SNAP, rolls back much of the Biden administration’s green incentives, massively expands the defense budget, and strengthens deportation mechanisms at the border, allowing for the removal of up to one million people per year. All of this comes with an estimated cost of an additional $3.8 trillion in debt over the next decade, according to the CBO.

The timing could not be more controversial. The U.S. already carries a debt burden of $36.2 trillion — equivalent to 124% of GDP. Interest payments have now surpassed defense spending and are expected to account for one out of every six federal budget dollars over the next decade — even without this new package.

The official Republican argument is that the bill is necessary to avoid an end-of-year tax hike and to raise the debt ceiling by $4 trillion, thus averting a technical default this summer. But what the approved text truly reflects is a profound imbalance between populist spending promises and tax cuts with no clear offsets. Medicaid cuts will begin in 2026, and states that attempt to expand coverage in the future will be penalized. At the same time, new deductions are introduced that benefit high-income earners in states with heavy tax burdens.

The Republican narrative is hanging by a thread: they promise growth will offset the revenue loss, but the experience of the 2017 tax cut shows that claim doesn’t hold up. That plan generated nearly $1.9 trillion in deficits, according to the CBO — even after accounting for positive effects on GDP. Fundamentally, the U.S. fiscal deterioration is beginning to exert structural pressure on American assets. The dollar is losing appeal, real rates are rising, and the market is starting to price in that the U.S. is no longer a beacon of fiscal discipline, but a power unable to agree on how to correct its course.

The paradox is that the very lawmakers lamenting the weight of the debt are using that argument to justify yet another wave of imbalance. The Titanic is headed for the iceberg — but instead of changing course, more coal is being thrown into the boiler.

Donald Trump has once again stirred uncertainty in global markets with his latest protectionist turn. This time, the former U.S. president has set his sights on Apple, threatening to impose a 25% tariff on all iPhones sold in the U.S. but manufactured abroad. If enacted, the measure could potentially affect more than 60 million devices a year in a country that, ironically, has no smartphone assembly plants. Simultaneously, Trump has proposed a 50% tariff on all imports from the European Union, directly impacting sectors such as luxury goods, pharmaceuticals, and industrial manufacturing.

Markets reacted swiftly: S&P 500 futures dropped 1.5%, the EuroStoxx 600 fell 2%, and Apple shares declined 3.5% in premarket trading. The threat comes just after a few weeks of relative trade de-escalation, during which Trump’s team had granted partial exemptions following the financial turmoil triggered by his April tariffs, some of which exceeded 100% on goods from China.

The Apple case perfectly illustrates the clash between Trump’s populist drive for industrial reshoring and the reality of globalized supply chains. The company has accelerated plans to assemble most iPhones sold in the U.S. in India by 2026, precisely in response to regulatory risks in China and an increasingly unpredictable tariff landscape. However, the issue goes beyond Apple. Trump’s threat sends a clear signal to the broader market: trade policy could once again become a source of systemic volatility if he returns to power, and no one – not even tech giants – is shielded from Washington’s whims.

Regardless of whether he has the legal authority to impose tariffs on an individual company, the mere announcement rattles markets, increases the risk premium on U.S. assets, and reinforces the idea that the November elections will also serve as a referendum on the future of global trade. And on that board, tech firms already reconfiguring their production could be seen as the first to act – or the first to fall.

After a decade of free money and loose credit conditions —which artificially lowered the cost of capital for many projects and thus led to poor investment decisions— logic finally seems to be making a comeback. A new nuclear spring is emerging in Europe, even in countries that were until recently entirely opposed to it, such as Germany. Last year, newly added nuclear capacity surpassed offshore wind for the first time in years, despite the latter being technically and efficiency-wise a far inferior option.

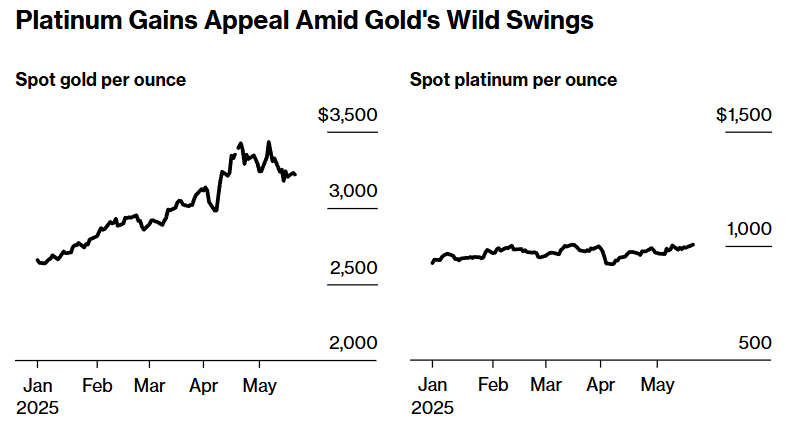

The surge in Chinese platinum imports marks a shift in behavior among jewelers and investors in response to gold’s extreme volatility. In April, China —the world’s largest consumer— imported 11.5 tons of platinum, the highest monthly volume in a year. This movement reflects a dual dynamic: gold has ceased to be a reliable short-term hedge due to its volatility, while platinum, still trading at relatively low prices, is beginning to attract capital thanks to its greater stability and structural appreciation potential (remember, it’s also a precious metal and, in fact, is 10x rarer than gold in the Earth’s crust). The Shuibei market in Shenzhen offers a snapshot of the trend. The number of platinum-focused retailers has tripled in just one month, with specialized workshops overwhelmed and facing unprecedented wait times. This shift is no minor change: crafting with platinum requires different techniques, making the transition challenging for traditional goldsmiths. Still, price dictates action. Gold’s overvaluation has forced many to diversify their offerings, even if the technical transition is far from trivial.

The narrative of platinum as an alternative asset is also gaining traction on the industrial front. Retail purchases of bars and coins in China more than doubled in Q1, placing the country ahead of North America as the leading market for physical platinum investment. According to the World Platinum Investment Council (WPIC), global demand is expected to outstrip supply for the rest of the decade, increasing pressure on inventories after three consecutive years of deepening deficits. The market was already strained due to a prolonged life cycle of diesel vehicles, which still rely on catalytic converters —platinum’s main industrial use— amid the slowdown in electric vehicle adoption and the rise of hybrids, which actually require more PGMs than traditional internal combustion vehicles.

The metal’s rally (+10% year-to-date) comes despite prices still being far below the 2021 highs — and it pales in comparison to gold’s, which, as Mourinho might put it, “shows us the way”.

When we say that the IEA is a propaganda agency, it's not an exaggeration—it's a proven reality. Its most recent revision marks a complete turnaround in the recent narrative of the oil market. For the past three years—2022, 2023, and 2024—the agency had estimated a cumulative build in global crude inventories of 220 million barrels. Now, after a thorough revision, it claims that nearly 75 million barrels have actually been drawn down. This net adjustment of nearly 300 million barrels is equivalent to three-quarters of the U.S. Strategic Petroleum Reserve—a figure that is far from insignificant and completely reshapes the supply-demand balance narrative over this period.

Beyond the accounting error, the key issue is the structural implication: inventories have not served as a buffer, but have instead been quietly depleted while the market believed they were building up. In a context where inventories are one of the key variables for assessing upward or downward pressure on prices, this correction could reinforce the case for a tighter market than previously thought.

At the same time, it has revised demand figures upward by +0.3Mb/d for the 2022–2026 period. One might think that, after consistently erring in the same direction, they would have learned their lesson—but nothing could be further from the truth. For the first quarter of 2025, they report an inventory build of +0.01Mb/d. However, since this figure doesn’t align with observed data, they add an “adjustment” of +0.96Mb/d. In reality, this implies a nearly 1Mb/d decline… the harder the fall will be.

Model Portfolio

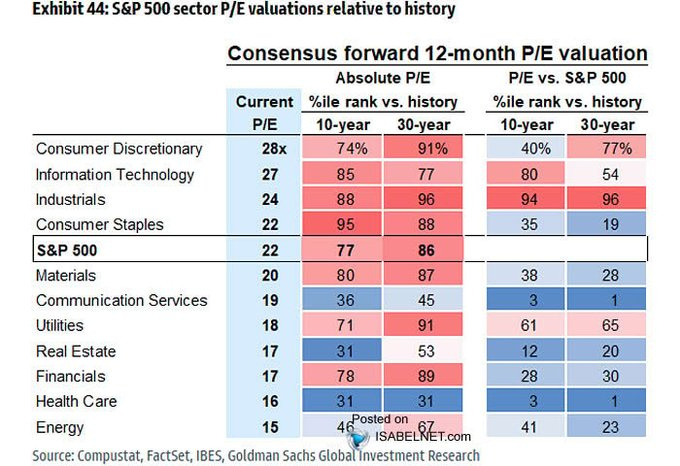

The philosophy that underpins everything we share and do is value investing. We believe that buying cheap will never go out of style and remains the clearest path to achieving extraordinary returns. While opportunities must be selected individually using a bottom-up approach, it helps to look at overall sector valuations — and energy stands out as particularly attractive.

Retail investors have grown used to buying every dip over the past decade, as it has been a highly effective strategy. This time, they’re behaving the same way, with the largest capital inflow in the past 10 years recorded this week. However, as we've been saying since the end of last year, I don’t believe this strategy will work going forward — at least not in the form of indiscriminate buying. Stock picking will regain the prominence it rightfully deserves.

The model portfolio's return is -2.58% YTD compared to -0.15% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +62.6% versus +44.4% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.