Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

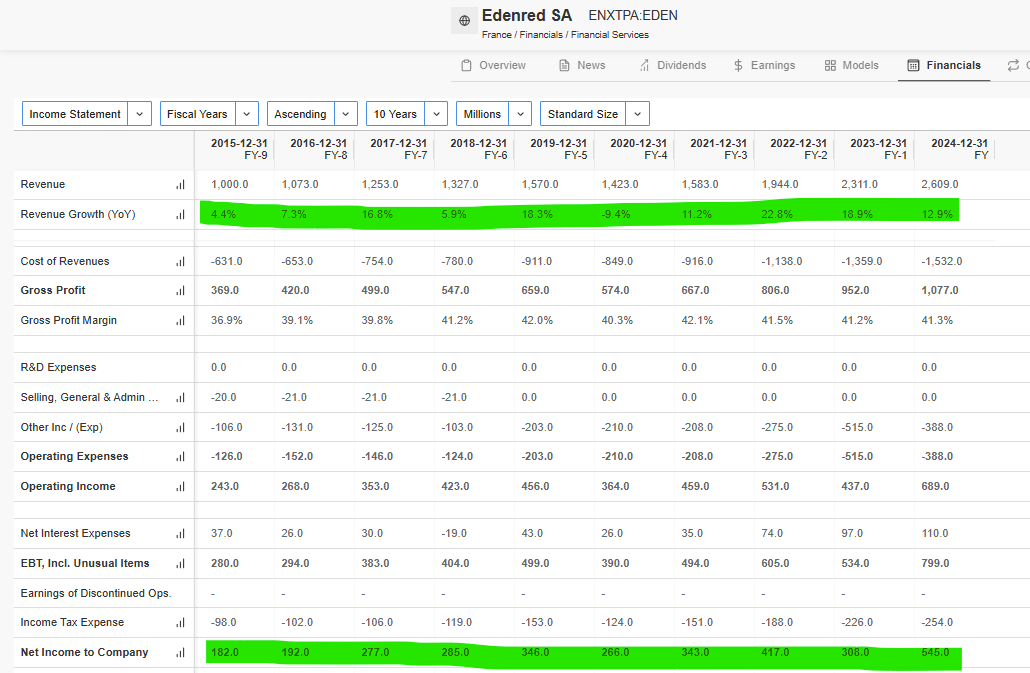

Beyond the model portfolio, we have started sharing in this weekly newsletter some classic value stocks that we consider attractive to study and monitor, with an educational purpose and to illustrate our investment philosophy and analysis methodology. For this week, we bring you $EDEN, the global leader in employee benefits, an extremely high-quality business (a toll-like model, comparable to Visa or Mastercard) though with regulatory risk. Historically, thanks to its defensive moat, low capital intensity, and growth, it has enjoyed very generous valuations (25–30x FCF), which have dropped over the past year (7x FCF). While regulatory risks are not negligible, the company’s quality and the attractive valuation make it ideal to dig deeper into and add to our watchlist.

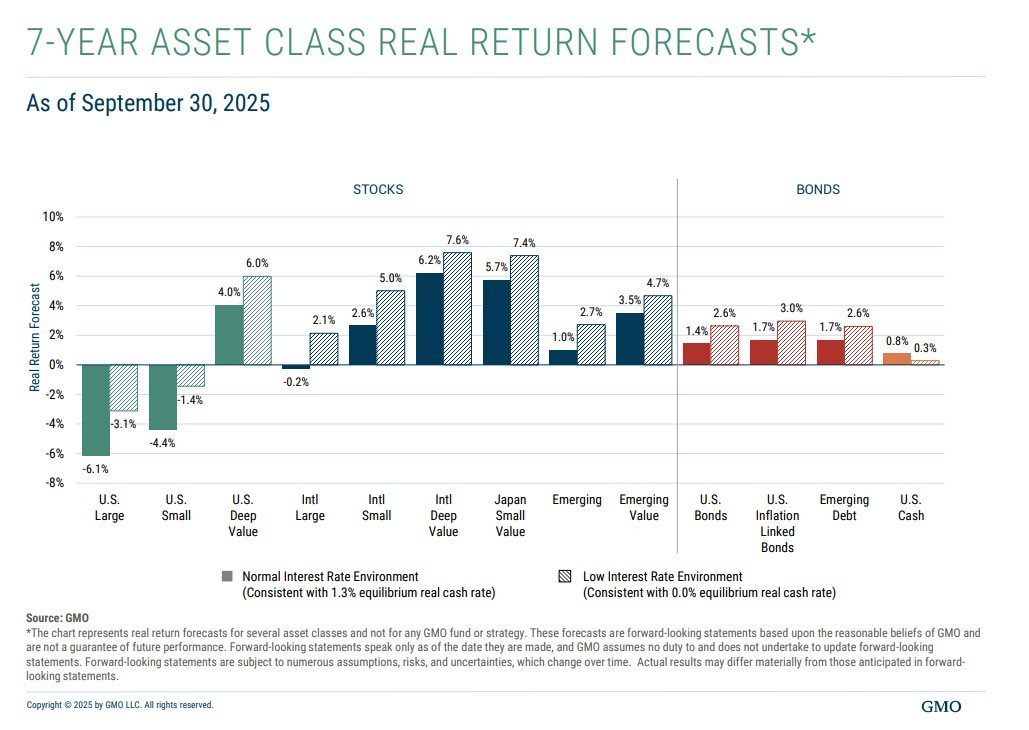

It is especially important to choose our ideas and positioning carefully (now more than ever, we are in a stock-picking market), since index valuations and much of the broader market point to mediocre returns ahead, with an expected return (CAGR) of 6.1% for large U.S. companies over the next 7 years.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The Central Bank of the Argentine Republic (BCRA) announced the signing of a $20 billion currency stabilization agreement with the U.S. Treasury, just days before congressional elections. The official statement was deliberately vague on technical details but confirmed that the pact will allow bilateral currency swap operations, expanding the tools available for monetary policy and international reserve management.

Although the U.S. Treasury has not issued its own note, Secretary Scott Bessent explained last week that the support will come from the International Monetary Fund’s Special Drawing Rights (SDRs) held in the Treasury’s Exchange Stabilization Fund, which will be converted into dollars. In theory, no new conditions will be imposed beyond maintaining Javier Milei’s austerity and structural reform program, aimed at fiscal consolidation and economic liberalization. The United States needs an ally in South America, and Milei’s government is the only one that fits the role.

The political timing is no coincidence. With Milei facing an adverse electoral calendar and several legislative setbacks, the agreement acts as a short-term anchor for the exchange rate and as a gesture of external support, although its sustainability will depend on the continuity of fiscal discipline. Washington’s backing also comes with frictions: according to the Wall Street Journal, banks such as JPMorgan, Bank of America, and Goldman Sachs have been reluctant to participate without explicit guarantees.

Ultimately, this is more a temporary injection of confidence than a structural solution. The deal eases immediate pressure on reserves and helps stabilize the market ahead of the elections, but shifts the risk onto the U.S. Treasury’s balance sheet and Argentina’s political calendar. If Milei sticks to his adjustment agenda and secures electoral backing, the agreement could solidify; otherwise, it will be just another fleeting episode in Argentina’s long history of currency bailouts. We will know soon enough.

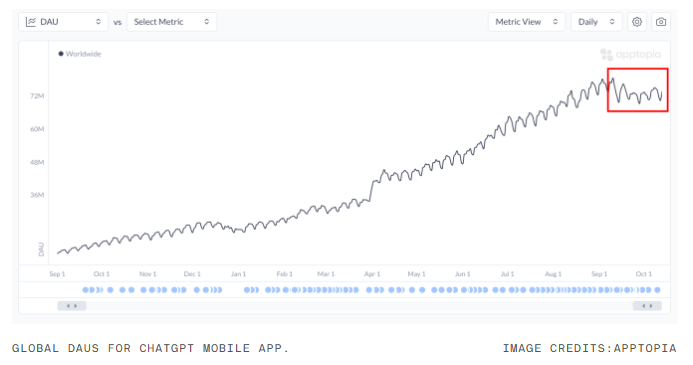

As we noted last week, the latest data from Apptopia indicates that ChatGPT’s mobile growth has peaked after a year of meteoric expansion. According to the firm, global daily downloads and daily active users (DAUs) have stabilized since April, and October points to an 8.1% month-over-month decline in new download momentum. In absolute terms, the app continues to add millions of installations, but the slowdown in percentage growth suggests that the explosive adoption phase is over.

Even more relevant is the drop in engagement: in the U.S., average time per active user has fallen 22.5% since July, while daily sessions per user are down 20.7%. In other words, users are opening the app less often and spending less time on it. Churn, however, has stabilized, which implies that the core user base remains intact, but the app is no longer attracting the casual audience that initially tested it out of curiosity. The causes are multiple. On one hand, competition from Google Gemini — boosted after the launch of its Nano Banana model in September — has taken away some attention. But the downward trend started earlier, coinciding with the April and August (GPT-5) updates, which softened the model’s tone and “personality,” reducing the conversational flair that many users found appealing, along with the novelty effect, since incremental improvements are no longer perceived as major leaps.

Apptopia’s assessment is that the experimentation phase has ended. ChatGPT has shifted from being a viral novelty to a recurring tool, integrated into specific routines — queries, drafting, summaries — but without the initial emotional or media buzz. In this context, OpenAI will need to adopt a maturity strategy, relying on marketing, functional enhancements, or new integrations to reignite interest, much like any other established app.

Once again, the risks tied to the return on massive investments in artificial intelligence — and the rapid obsolescence and depreciation of hardware — come to the forefront, and it would be a serious mistake to ignore them.

The planned meeting between Donald Trump and Vladimir Putin has been postponed indefinitely, after Moscow rejected the U.S. proposal for an immediate ceasefire in Ukraine. The White House confirmed that there are no short-term plans for a summit, following an unproductive call between Secretary of State Marco Rubio and Russian Foreign Minister Sergey Lavrov.

The move marks a temporary halt to Trump’s attempt to revive negotiations launched at the Alaska summit in August, which had already produced few tangible results. Russia has reiterated, in an informal diplomatic document, its demand for full control of the Donbas, meaning it seeks to retain its gains in Luhansk and most of Donetsk. In practice, Moscow continues to reject Washington’s proposal to freeze front lines as the basis for a ceasefire.

From Europe, the message has been one of support for the U.S. position, but also of unease. Several diplomats have admitted concern that Trump might pursue a summit without real guarantees, repeating the pattern of past encounters with Putin that yielded no concrete concessions. For now, the EU and NATO insist on an immediate halt to hostilities with current front lines as the starting point for any negotiation, and Secretary General Mark Rutte traveled to Washington to coordinate positions ahead of any new diplomatic push.

The political context adds another layer of complexity. Trump, who has made peace in Ukraine a central campaign theme, needs visible results, but Putin shows no sign of giving ground and the EU fears an asymmetric negotiation that could legitimize the occupation. The postponement, therefore, does not signal the abandonment of diplomacy, but rather the recognition that minimum conditions for a meaningful summit are not yet in place.

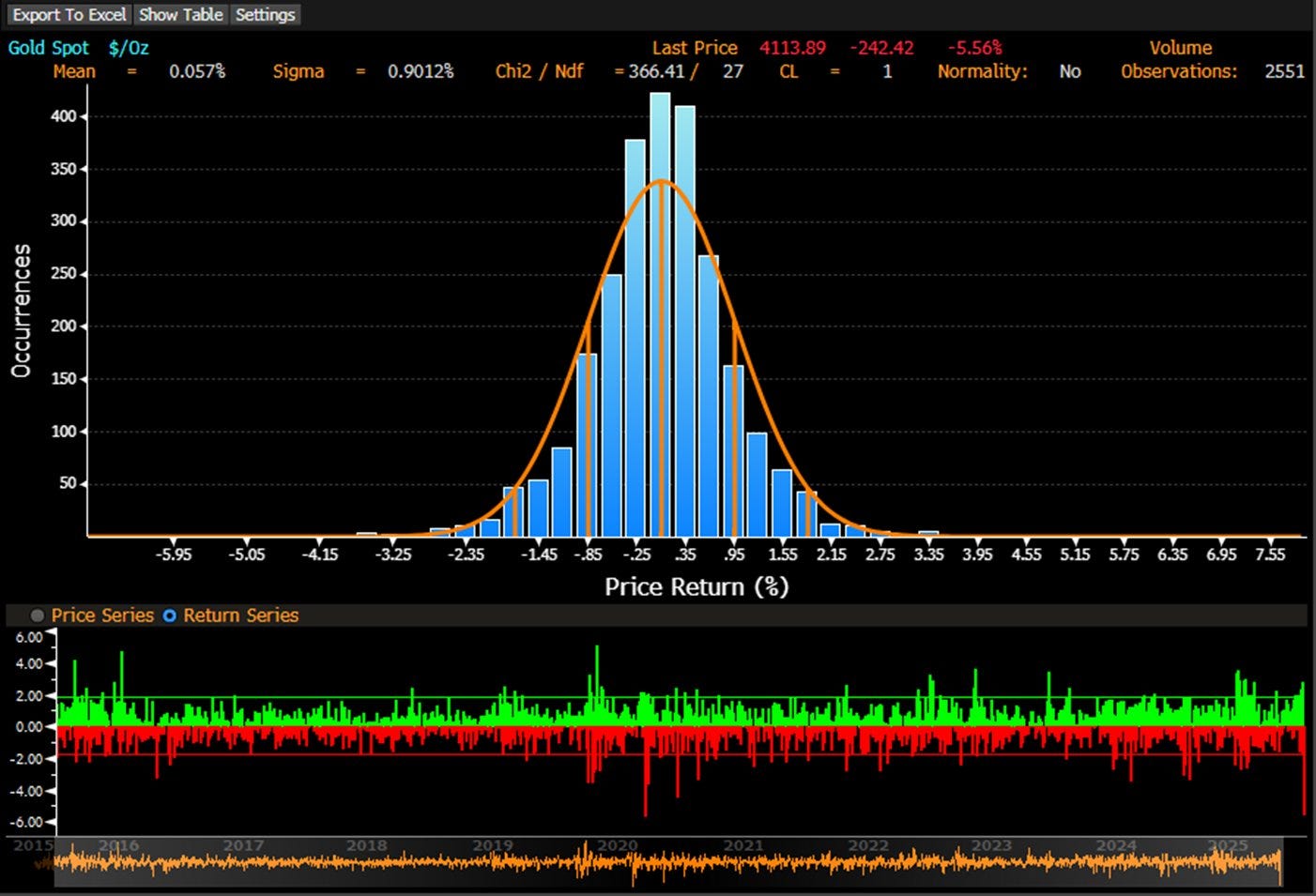

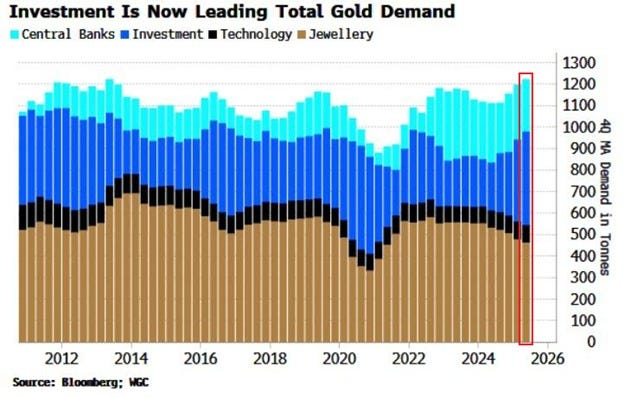

Gold has had a very weak week, extending the correction after its largest daily drop in more than five years. In fact, putting the move into context, it was a 5-sigma decline — something that statistically should only occur once every… 13,932 years!

Despite the adjustment, the metal remains the best-performing asset of the year, up more than 50% and on track for its strongest performance since the 1979 oil crisis. Not only has the price action been highly positive, but looking at demand flows, both central banks and, above all, investment demand continue to show growth and new record highs.

This correction was more than expected, following a parabolic rally and scenes that, while not necessarily marking a peak, do reflect the greed and herd instinct of human nature: throughout last week, lines like the one in the picture below were seen, with retail buyers waiting their turn to purchase physical gold and silver (likely after watching the price surge on the evening news…). Probably nothing.

The European Union seems to have found a rare point of consensus: bureaucracy must be reduced —and urgently. Ahead of the Brussels summit, 19 leaders —including Macron, Meloni, Tusk, and Merz— have called for a systematic review of EU regulations to eliminate “unnecessary or disproportionate” rules and to curb the legislative avalanche of recent years. The official goal is to simplify the regulatory framework in order to strengthen the competitiveness of European industry (something we are already late on…).

Since the trade deal signed by Ursula von der Leyen with Trump at his Scottish resort, the Commission has committed to ensuring that European green and sustainability rules “do not impose excessive restrictions on transatlantic trade.” In practice, this has led to the revision or dismantling of much of the regulatory architecture of her first mandate —from the supply chain due diligence directive to the carbon tax or restrictions on products linked to deforestation—, now squarely targeted by the simplification program.

On the one hand, the aim is to appease Washington, which has spent months denouncing Europe’s “overregulation”; on the other, to give oxygen to an industry that has suffered years of declining competitiveness against the U.S. and China (just ask Volkswagen, which is up against the ropes). What was once presented as an agenda of strategic autonomy is now being reframed as a diplomatic and economic gesture toward Trump.

Still, internal divisions are clear. While leaders such as Macron and Merz push to scrap rules that big corporations see as a burden, voices like Teresa Ribera’s warn of the risk of sacrificing the green agenda in the name of competitiveness. Brussels insists that simplification will not mean lowering standards, but the debate over where to draw the line —between regulatory sovereignty and commercial pragmatism— once again highlights Europe’s fragile balance between principles and power.

The 10% rebound in oil prices during the week, following U.S. sanctions on Rosneft and Lukoil, confirms just how trapped the energy market remains between geopolitics and the physical limits of supply. The measures directly affect around 7% of global crude supply and have forced major Asian buyers —particularly China and India— to reconsider their exposure to Russian crude, triggering a spike in refining differentials and reigniting volatility in diesel margins.

Although the initial reaction is purely technical —reallocation of flows and inventory hedging— the underlying issue is more structural. In recent years, Russia has been the key stabilizer of marginal supply, and its partial exclusion from the Western payments system forces reliance on increasingly costly and opaque channels. If the disruption persists, the market could enter into deficit from 2026 onward, against a backdrop of underinvestment and the natural decline of mature fields. All the IEA’s plans could be blown apart with the stroke of a pen. OPEC, for its part, hints that it could offset any shortage by easing its cuts, but the reality is that its effective spare capacity is smaller than officially declared, and practically nonexistent after this year’s announcements, which have already returned much of those volumes to the market.

Overall, the episode fits with the thesis we have been developing in recent reports: oil remains the “overlooked asset” of the current cycle. Sanctions not only reorder the trade map, but also once again highlight that the energy transition does not eliminate dependence on crude, it merely shifts it geographically. And every time geopolitics interrupts that flow, the market is reminded —abruptly— of the strategic value of a barrel of oil. On the other hand, to put these moves into context, geopolitical disruptions do not change fundamentals; they are temporary patches on price. If we truly want a sustained bull market in crude, it must come from a supply-demand imbalance, not from Western sanctions.

Model Portfolio

The model portfolio's return is +31.14% YTD compared to +3.92% for the S&P500 (S&P in €), and +119.8% versus +50.3% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.