Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Starting next week, the companies in our coverage universe (model portfolio + watchlist) will begin their Q2 earnings season, which tends to be very positive for our portfolio, as earnings releases are opportunities to showcase all the value generated and the reasonableness of the associated valuation. As always, we will discuss them in detail from this publication, including comments from the conference calls that we find most interesting.

This week, we will also have a new analysis of a very interesting company that operates in a market with little coverage but great potential for our paying subscribers.

Weekly macro summary

There have also been quite a few interesting events to analyze, and below I list the most noteworthy news. Let's get started:

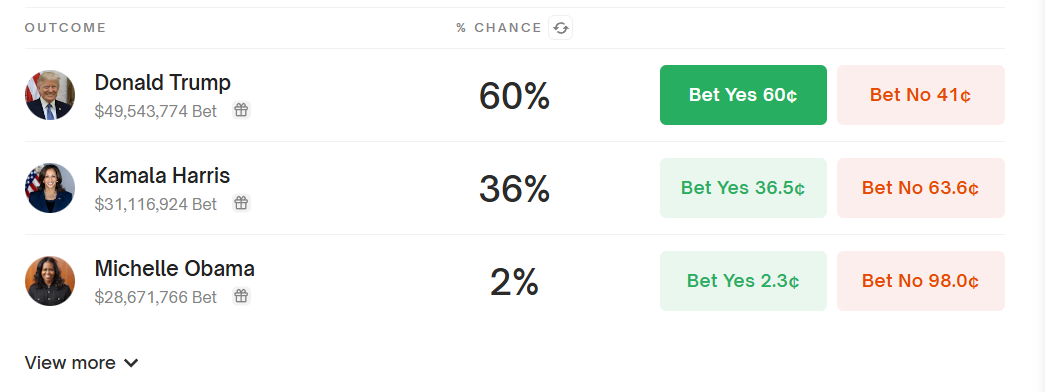

Joe Biden has dropped out of the presidential race, and has shown his support for Kamala Harris, until now vice-president. Many of the main Democratic personalities (Obama, Pelosi... ) have joined this trend, so it seems clear that we are going to have a Trump vs Harris duel in November. Despite the fact that the press highlights that the polls seem to show serious possibilities of becoming the first woman president of the USA, the reality is very different. My approach in these cases is to focus on the big betting markets, which always show an undistorted picture (there are no interests here beyond the crematistic one) of the truth, and these reflect that Trump remains clear favorite to return to the White House, so our positioning in the markets will adapt to this reality until (if it happens) reality changes.

The only truth is reality.

With Israel's recent attacks in Yemen, the conflict in the Middle East appears closer to escalation than resolution. Israel has carried out airstrikes in the Yemeni port city of Hodeidah in response to drone strikes by the Houthi group in Tel Aviv, which killed one person and wounded ten.

Houthi military spokesman General Yahya Saree claimed the group also attacked the Israeli city of Eilat with ballistic missiles, with one being intercepted by Israel's Arrow-3 defense system. They also claimed an attack on a U.S. ship in the Red Sea. Israel claims to have attacked “military targets” in Yemen, while the Houthis promise an effective response. Disruptions in the Red Sea have already become the new normal, creating a period of extraordinary profits for many shipping segments, most notably clean tankers and containers.

China has surprised the markets with cuts to its short and long-term benchmark interest rates, the first such measure since August of last year. This decision comes after disappointing economic data from the second quarter and a leadership meeting of the Communist Party.

The People's Bank of China (PBOC) reduced the seven-day reverse repo rate to 1.7% and also adjusted market operation rates and benchmark bank lending rates. The one-year lending rate was lowered to 3.35% and the five-year rate to 3.85%.

These moves aim to address the economic slowdown, the risk of deflation, and a prolonged real estate crisis. The PBOC's decision comes amid expectations that the U.S. Federal Reserve will also begin to cut its benchmark interest rates, giving China room to ease its monetary policy without its currency suffering too much.

Netflix continues its dominance in the streaming market, adding eight million subscribers in the last quarter and reaching 277.7 million subscribers worldwide. Despite its success, the company represents only 8% of TV viewing time in the U.S., behind YouTube and other forms of broadcasting such as cable and satellite TV, and plans to continue increasing its budget to strengthen its leadership.

In contrast, Apple, although it spends billions on original content, faces significant challenges with a market share of 0.2% of TV viewing time in the U.S. Despite having award-winning productions that are well-received by critics, few of its shows have achieved social success. The Cupertino-based company is now considering abandoning its original content creation strategy. Apple has invested more than $20B in TV and film productions, but many of these investments have not been profitable.

The streaming market remains competitive and challenging, and Apple has little competitive and brand advantage here: their lack of experience and scale in the industry greatly increases the cost of its productions and skews its results depending on the success or failure of each of its productions.

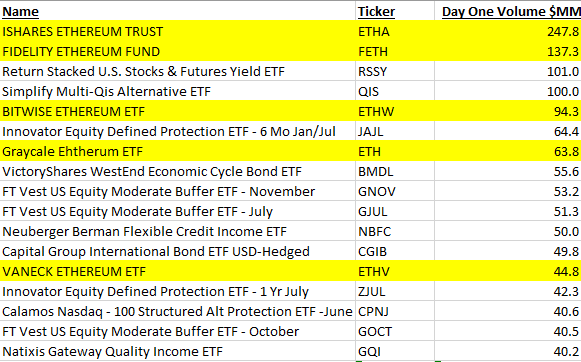

Ethereum ETFs began trading on Tuesday, and their launch has been a major success, slightly overshadowed only by their Bitcoin predecessors. On their first day of trading, they collectively exceeded $1B in trading volume, making them the #1 launch of the past year (excluding BTC) and accounting for approximately 20% of the volume achieved by Bitcoin ETFs, perfectly aligning with prior expectations.

We said this was a major success, but given that the net capital flow has been negative (-$180M), this statement might seem unrealistic. However, if we analyze the composition of these flows in more detail, we can see that $1.15B has exited the Grayscale vehicle while $900M has entered others, which greatly distorts the analysis. The higher costs suggested this path (similar to what happened with their Bitcoin counterparts), but the exit speed (15% of the total vs. 3% for Bitcoin in the first three days) paints a much more bullish scenario, with short-term price pressure but the removal of obstacles in a few weeks. Higher.

More and more institutions and political entities are jumping on the hard money bandwagon, with the latest example being the city of New Jersey, which has announced that the city's pension plan will allocate 2% of its assets to buying Bitcoin. The annual Bitcoin conference also kicked off on Thursday in Nashville, already giving us some major headlines, such as Robert Kennedy Jr.'s support for Bitcoin and his proposal for the USA to back the dollar with gold and this digital asset, which would mean accumulating $615B of the "orange coin," or half of BTC's current market capitalization. However, the highlight will be today, with candidate Donald Trump's speech, where he is expected to confirm this intention to create a strategic Bitcoin reserve for the country. Satoshi is (would be) proud.

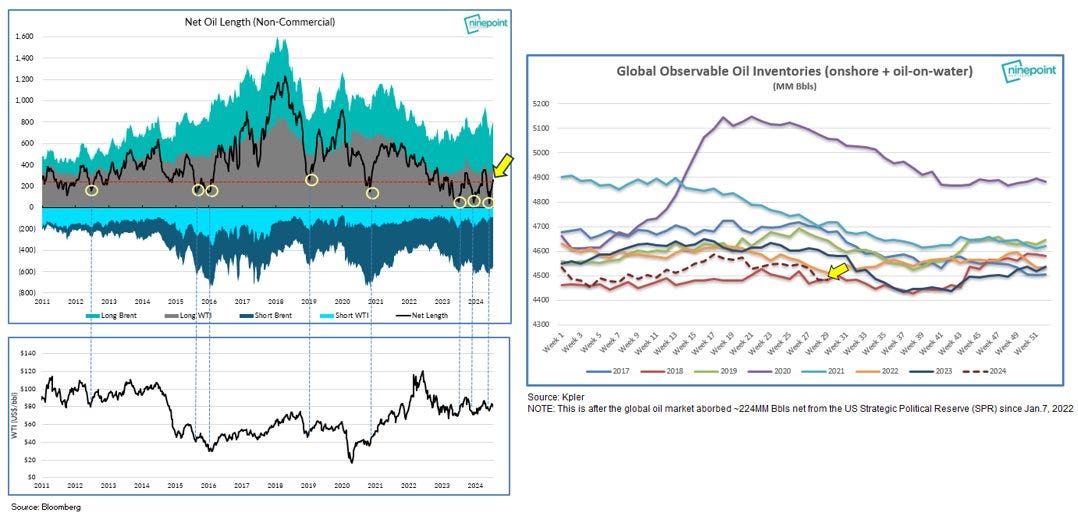

When politics and physics collide, physics always wins. This week's EIA oil inventories report was very bullish, with declines in all categories: -3.74Mb crude, -1.71Mb in Cushing, -5.57Mb gasoline and -2.75Mb distillates. The price does not seem to reflect these positive developments, as financial players have once again taken a bearish position in the futures market, which has weighed on the price discovery process. Global inventories are at 5-year lows, even in an environment of economic weakness.

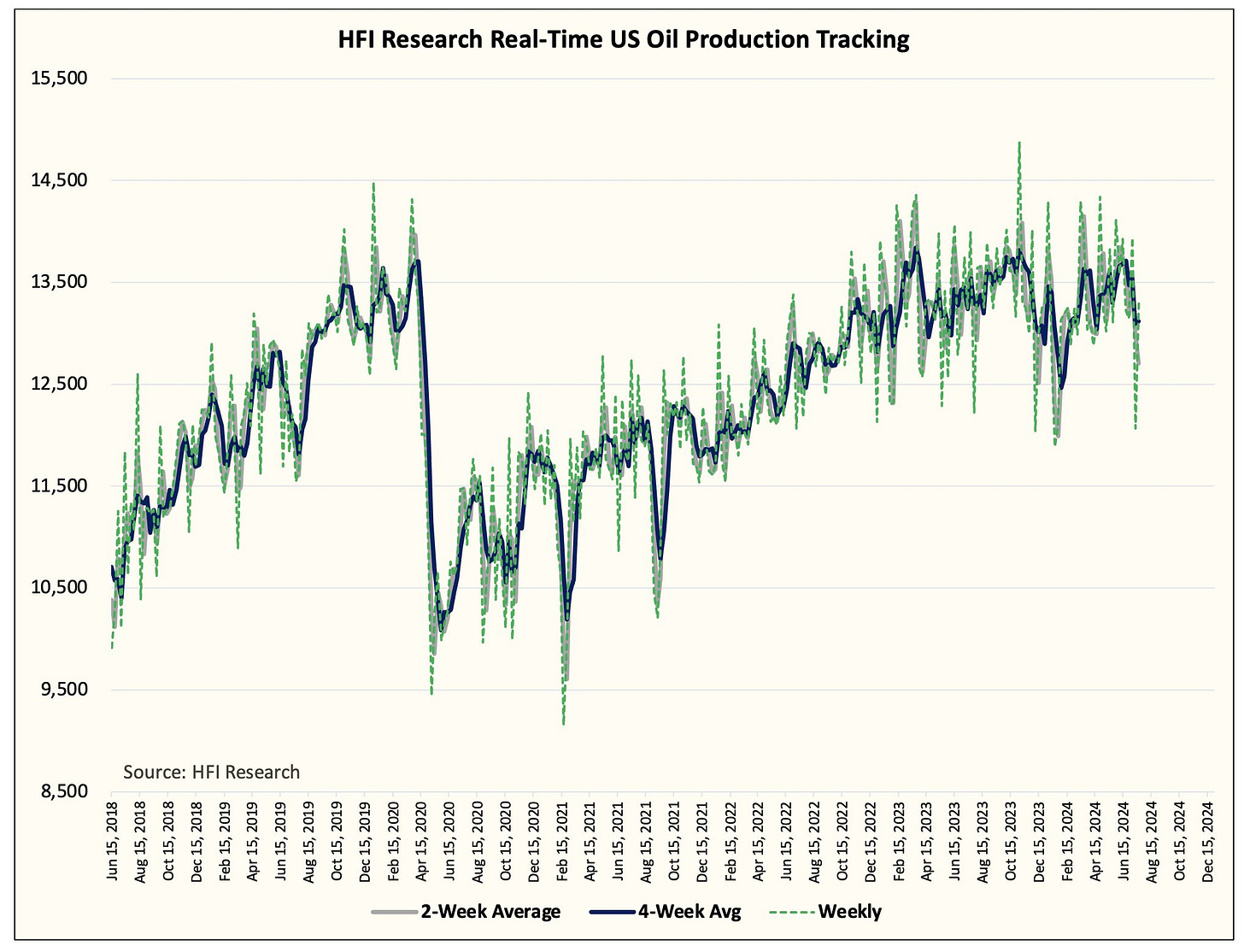

Most relevant, however, are the US production data. EIA forecasts, from which a market in equilibrium is derived, assume a growth for next year of ~500k b/d in the country's production, but the observed reality points to a stagnation of such growth, very much in line with G&R's thesis on the depletion of major shale fields and peak oil. Should this thesis be confirmed, the implications would be gigantic, and would add significant upward pressure to the crude oil price.

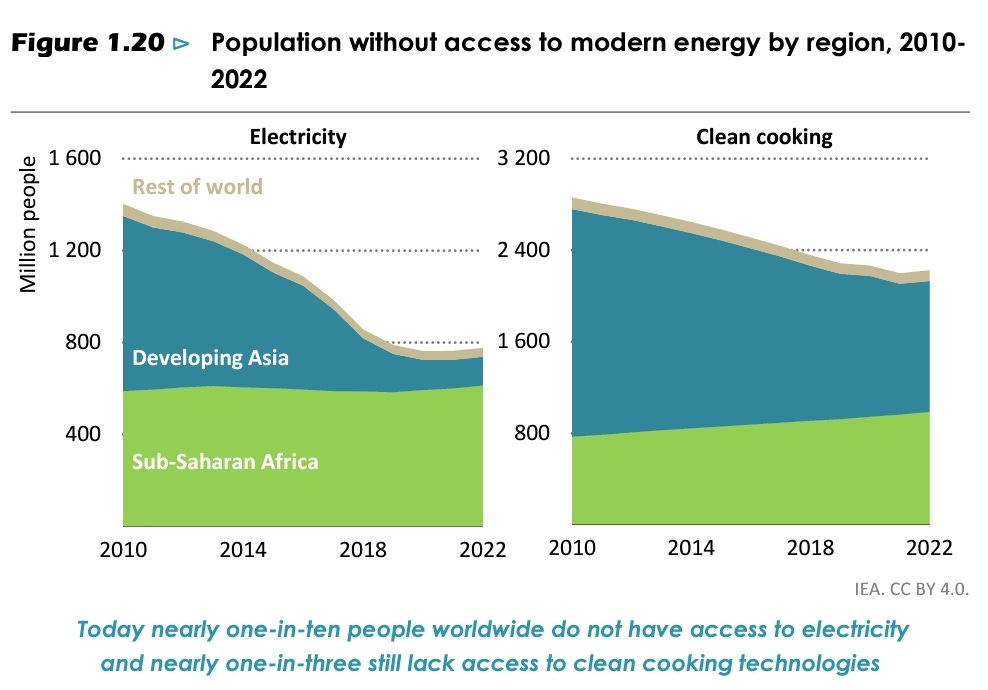

As it’s becoming usual every week, I bring you new news about a carmaker delaying its electrification plans: Porsche has modified its targets for the transition to electric vehicles (EVs), stating that it will take longer than anticipated five years ago. The company had projected that 80% of its sales would be EVs by 2030. However, they have now linked this target to customer demand and the development of the electromobility sector. This revision is not exclusive to Porsche. Other manufacturers, such as Mercedes-Benz and Renault, have also acknowledged that their all-electric sales targets for the next decade were too optimistic, due to customer reluctance to move away from gasoline vehicles. Porsche's adjustment of expectations reflects a broader trend in the automotive industry, where EV sales targets are being reconsidered in light of actual market demand. In many other economic areas we see the world moving at uneven paces, and the low penetration of clean energy technologies in other areas underscores that the global energy transition is complex and multifaceted, and that solutions such as solar panels and wind turbines, while crucial, are not a panacea for all global energy problems.

Model Portfolio

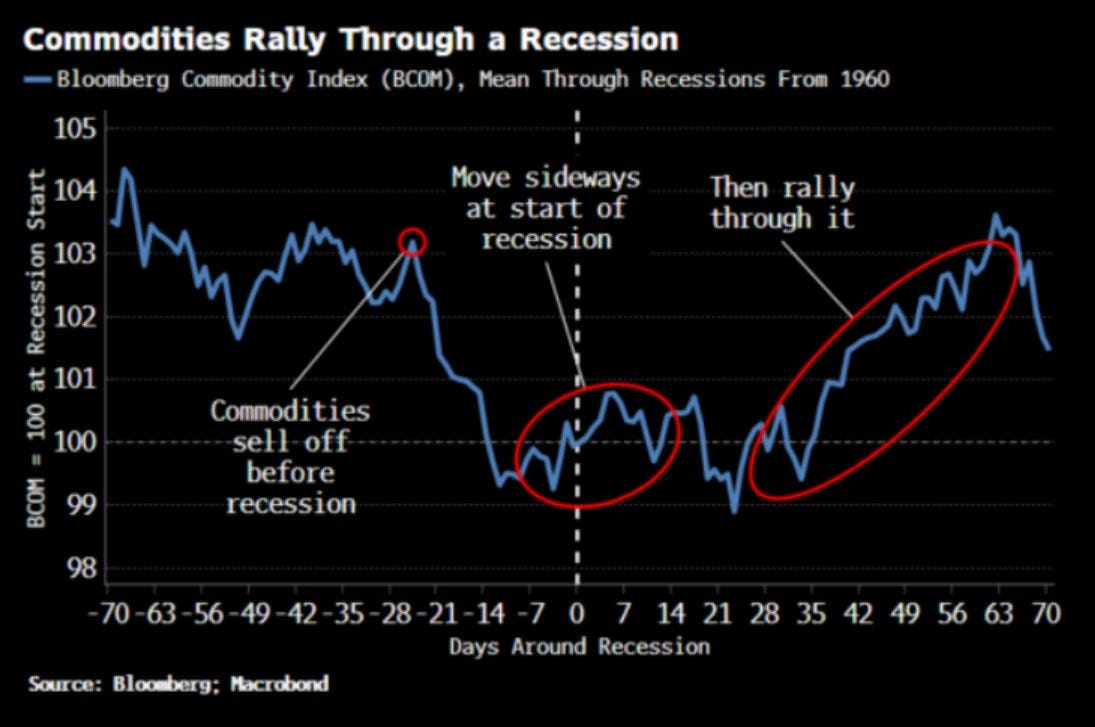

Sometimes, data and observed reality often differ from our expectations. One of the most intellectually attractive points of stock market investing is that markets are prospective, and it is not so much the current reality that is relevant (and certainly not the past reality that matters any more) but the future and understanding where we are headed. In the last two years we have heard all the time that commodities were falling and showing weakness due to the imminent arrival of a global recession, and that this was just the prelude to everything that would happen when it finally materialized.

History, however, shows us another reality: while it is true that commodities tend to fall in anticipation of an economic slowdown, the market does not punish twice, and quickly begins to discount and value the eventual recovery that always comes. If the U.S. eventually goes into recession, and it spreads to other regions, which is not my base scenario, it should not be as negative a situation as is being discounted right now, especially in the era of loose monetary policy that we live in. This too shall pass.

The model portfolio's return is +21.03% YTD compared to +13.90% for the S&P500, and +57.99% versus +35.29% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.