Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

Yet another deal signed before the deadline. In a fresh display of negotiating strength, Trump has managed to seal with Japan what he himself described as the greatest trade agreement in history. Beyond the hyperbolic headline, the significance lies not in the size of the deal, but in what it represents: Japan has effectively bought tariff immunity with a chequebook... and Boeing.

The core of the agreement is simple: a reduction in tariffs on Japanese automotive exports (from 27.5% to 15%) and the cancellation of planned increases scheduled for 1 August, in exchange for three things: increased defence spending on US-made equipment ($17 billion annually, a 21% rise), a large-scale purchase of US agricultural products ($8 billion, rice included), and above all, an investment package of up to $550 billion on American soil. That is not a typo: five hundred and fifty billion dollars.

The structure is creative—borderline geopolitical financial engineering. Japanese public funds will be used to build factories in the US, which will then be leased to private operators, with profits shared (90% to the US, 10% to Japan). A win-win... if viewed from Washington. It’s no surprise the Nikkei surged, or that Toyota and Honda posted double-digit gains. What is surprising, however, is the awkward silence from American car manufacturers, who now see a Japanese vehicle assembled outside the US enter at 15%, while one produced in Mexico with 80% local content pays 25%. That doesn’t sound very “America First”.

In Tokyo, the agreement is being praised—at least publicly. Ishiba, still reeling from the election outcome, called it the most favourable deal ever signed by a surplus country with the US. But reading between the lines, the message is different: Japan has yielded to avoid an all-out trade war. And in doing so, it has made one of the biggest bets yet on American industrial reshoring.

Trump, for his part, has scored just in time. A real buzzer beater.

He doesn’t just win the narrative (I only lower tariffs if you open your market), but also puts pressure on the EU, South Korea, and others to pay up before 1 August. The incentive? A 15% tariff on your cars… or 25% (or more) if you prefer to negotiate from the back foot. Steel and aluminium (currently facing 50% tariffs) are not included, nor are semiconductors and pharmaceuticals, which will be negotiated separately. In other words, there’s more headline material in the pipeline. “#MissionComplete,” said the Japanese negotiator. But for Trump, this was merely a warm-up. The real match is with Europe.

Trump is also once again targeting the Federal Reserve and its chairman, Jerome Powell, in yet another chapter of his ongoing crusade against US monetary policy. In a recent interview, the president did not hide his wish to see Powell out of office, even hinting at a premature dismissal before Powell’s term ends in May—though he acknowledged such a move could destabilise markets. His line of attack is twofold: he accuses the Fed of being too slow to cut rates and shines a spotlight on the renovation costs of its Washington headquarters, a project that has ballooned to $2.5 billion. While no irregularities have been found, the White House is exploring ways to pressure Powell into resigning before his term ends in 2026.

This goal, in fact, is not new. Even in his early years, Trump tried to shape monetary policy to his liking (despite having nominated Powell himself), and this latest round of pressure—far more explicit and media-driven—reflects a strategy in line with his interventionist view of institutions. It is no coincidence that allies like Scott Bessent are questioning the Fed’s intellectual legitimacy and calling for structural reform of its operations. The underlying message is clear: control of the economic cycle is now also a political battlefield.

All those PHD’s there—I honestly don’t know what they do.

— Scott BessentPowell, nominated by Trump in 2017 and reappointed by Biden, has reiterated that he has no intention of resigning. But with a market hungry for rate cuts and a president determined to use every lever of power to make it happen, institutional tension is boiling. Meanwhile, investors are juggling: pricing in rate cuts, celebrating every sign of easing inflation, and clinging to the hope that the Fed will cave before the pressure becomes unbearable.

What’s at stake here isn’t just a matter of interest rates—it’s the very independence of the central bank. And if that final bastion falls, the impact on institutional trust could be far deeper than any basis point.

In fact, Trump made a surprising visit to Powell and the new FED facilities during the week, once again calling for rate cuts and starring in some tense (and comically absurd) scenes with the head of the FED, with whom he had a public disagreement over the true costs of the Central Bank’s infrastructure renovation.

China has given the green light to what is, in theory, set to become the largest hydroelectric project on the planet: a $170 billion megastructure along the Yarlung Zangbo River, which becomes the Brahmaputra once it crosses into India. The goal is to generate more electricity than the entire United Kingdom and accelerate the energy transition. But, as is always the case with such projects, the story goes far beyond kilowatts. The development, which will comprise five dams over a 50 km stretch with a vertical drop of 2,000 metres, is intended to begin generating power sometime in the next decade. However, there is almost no official information on how or when it will be built. And that — more than the dams themselves — is what fuels fears in New Delhi and Dhaka.

From the Indian side, the project revives long-standing concerns: China’s lack of transparency, a history of conflict in the region (including a border war in the 1960s), and the fear that Beijing might use water as a geopolitical weapon. Allegations range from the potential desertification of parts of northeastern India to a reduced flow of sediment crucial for Bangladesh’s riverine agriculture. The real risk? It is less geopolitical than geological. The project is located in a highly seismic zone, with frequent landslides, unstable glaciers, and extreme weather. Building there, at 3,000 metres above sea level, will be neither cheap nor easy. If the track record of smaller dams is any indication, both timelines and costs could soar.

China has been diversifying its energy sources for years (take note, Europe), seeking to combine growth in renewables with an expansion in fossil fuels and a nuclear programme more ambitious than any other. This is Asia’s century, after all.

In this regard, China is also beginning to rationalise the overcapacity that has led it to engage in dumping in order to gain market share across many industries, such as steel and petrochemicals. We’re already starting to see signs of this, like the news published this week about inspections at mines to verify whether approved production levels have been exceeded—causing a sharp rally in coal stocks. As always with the Asian giant, we’ll have to see how and to what extent this rationalisation of capacity materialises, but it’s a first step towards a recovery in the cycle. It’s likely that in the coming quarters and years we’ll start to see a turning point in everything related to raw materials and energy, driven by the exponential growth of the AI industry (which already accounts for one-third of US GDP growth this quarter) and its heavy reliance on energy and key minerals.

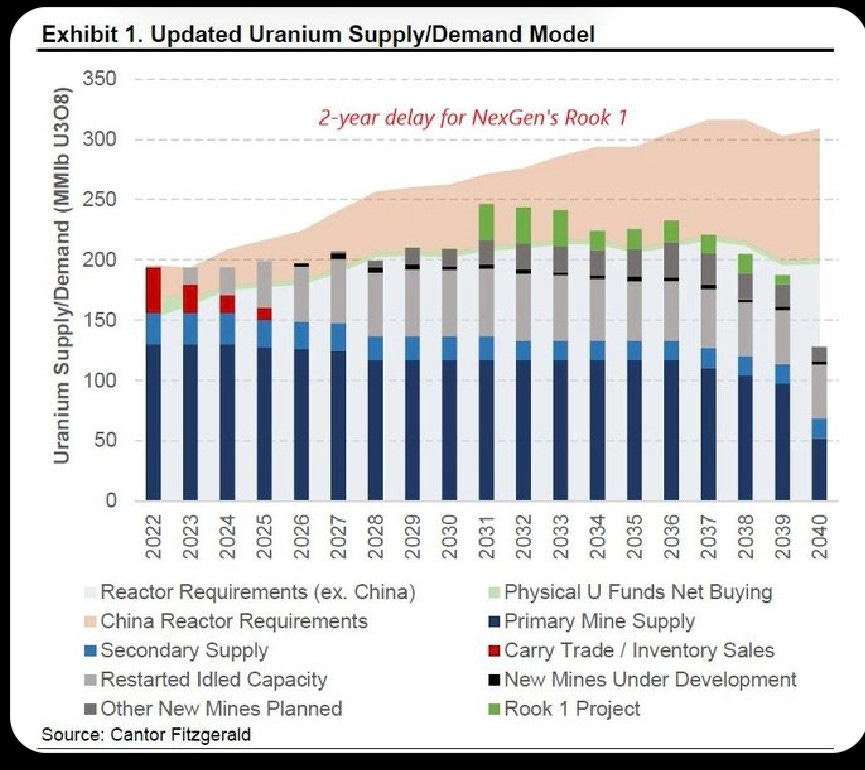

As we always highlight, the biggest beneficiary of this trend is nuclear energy, which continues to enjoy positive developments (new demand and virtually no new supply). For example, the UK has just announced final approval for the construction of a new reactor, Sizewell C, giving some renewed momentum to Europe. The outlook for the coming years is excellent, with guaranteed demand that is not being met by current (or even projected) supply—leading to massive and growing deficits that are simply unsustainable over time.

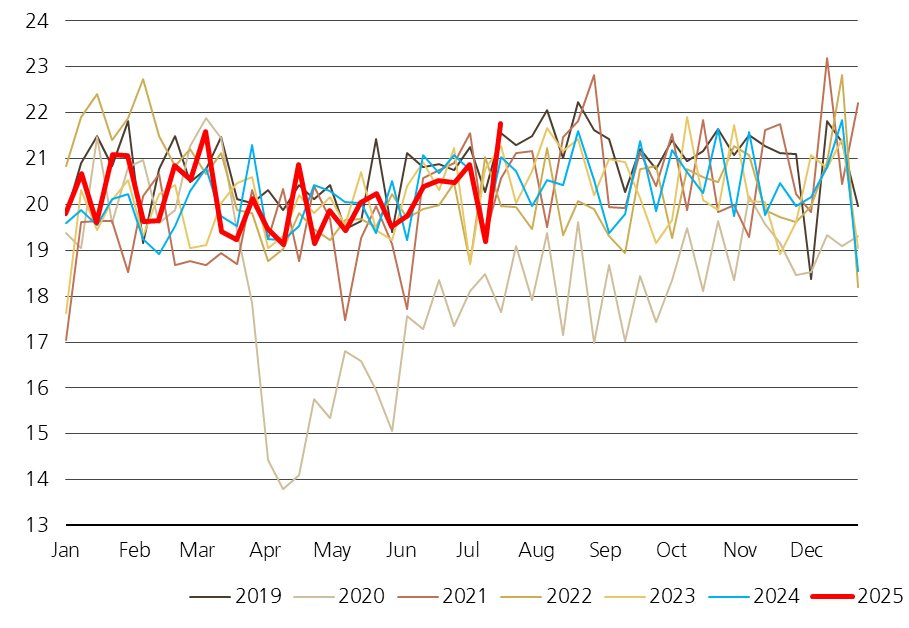

After last week’s odd figures (with more and more analysts pointing out the unreliability of the reports), U.S. oil inventories are once again showing declines: crude stocks dropped by -3.17Mb, gasoline by -1.74Mb, while distillates rose by 2.93Mb, all alongside the highest apparent demand figure in history. Adding to the strength of these numbers, Chevron announced this week that it will focus on cash flow and shareholder returns, having reached an earlier-than-expected production peak and plateau in its shale operations—200kb/d below its initial targets.

The downside to these positive developments lies in the sharp increase in China’s inventories. It appears the country is taking advantage of current low prices to refill its Strategic Petroleum Reserve (SPR), which is introducing an unsustainable, one-off source of demand into the market and keeping conditions particularly tight. At the current rate of replenishment, this could continue for another 15 weeks, but after that, unless other sources of demand step in, the market could face a significant imbalance—potentially driving crude prices back down to $60/bbl.

This stockpiling lines up perfectly with the rise in OPEC+ exports, raising doubts about the market balance in Q4 if demand fails to rebound. This concern is, in fact, the main reason behind the current price weakness and the bearish investor positioning.

Model Portfolio

The model portfolio's return is +17.02% YTD compared to +8.97% for the S&P500 (our portfolio mesured in € terms, which is weighting -13% in our portfolio this year vs the S&P in $), and +96.1% versus +57.6% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.