Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Beyond the model portfolio, we have started to share in this weekly newsletter some classic value stocks that we consider attractive to study and monitor, with the goal of providing educational content and illustrating our investment philosophy and analysis methodology. For this week, we highlight the alcohol sector, which, within the broader consumer category—already heavily punished—stands out negatively. The current narrative, much like it was with tobacco a few years ago, is that this is a sector in terminal decline. And while younger generations are indeed consuming less alcohol per capita, there are categories that continue to grow in volumes (and especially in price), offering interesting opportunities and valuations. Specifically, my preferred options to study are breweries, whose volumes are in cyclical, not secular, decline, and which I expect to recover strongly once economic growth picks up again.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

The level of grift we’re reaching is starting to get worrying. The announcement that Nvidia will invest up to $100 billion in OpenAI is pure nonsense, reminiscent of the dot-com bubble, when infrastructure companies financed their own clients to buy their assets. The deal combines financial investment with a massive supply of chips for data centers: Nvidia puts up capital in exchange for non-voting shares and, with that same money, OpenAI buys the compute infrastructure it needs to maintain its competitive edge. OpenAI secures preferential access to critical technology at a time when competitors like Google or Amazon are exploring their own hardware alternatives, while Nvidia strengthens the network effect of its ecosystem by tying up its biggest customer and, at the same time, taking a stake in it. Still, the circular design —investing money that comes back as chip orders— raises questions about sustainability and, above all, regulatory risk.

The scale is colossal: 10 GW of computing power, equivalent to the energy consumption of more than 8 million U.S. households, with deployments scheduled to start in 2026. In parallel, other players like Oracle, SoftBank and Microsoft are moving forward with equally massive projects (Stargate, a $500 billion plan), confirming that we are facing an unprecedented technological arms race. If this kind of alliance consolidates a de facto duopoly (Nvidia chips + OpenAI software), the room for rivals —whether AMD in hardware or Anthropic in models— narrows, increasing the risk that the industry’s growth becomes overly concentrated. The antitrust debate, so far muted under the Trump administration, could resurface as the scale of these commitments makes clear the systemic dependence on a handful of players.

There’s nothing new under the sun, and the following comic strip perfectly illustrates how wealth is created without adding any value… probably nothing.

The political spotlight has now fully shifted to the pharmaceutical sector, just as Robert Kennedy Jr. promised during his campaign. The controversy around Kenvue erupted after the administration publicly linked Tylenol use during pregnancy with childhood autism, while simultaneously reigniting its criticism of vaccines. The market’s initial reaction was panic, with shares hitting an all-time low on Monday (healthcare has had no shortage of shocks lately…). However, since no new scientific evidence was presented to support those claims, the stock rebounded 6% on Tuesday.

International health agencies (the EU, the UK, and the WHO) were quick to reaffirm the safety of paracetamol during pregnancy, while Kenvue itself reiterated that there is no proven correlation between the drug and neurological disorders such as autism. Regulatory risk seems limited, although the FDA will add extra warnings to labels, while stressing that no causal relationship has been established. From a financial perspective, the key issue is that the White House has elevated unsubstantiated claims to the level of public policy, increasing regulatory uncertainty for the healthcare sector and creating an uncomfortable precedent for other companies with mass-market products. Strategic sector backing, stakes in companies, and selective attacks on industries. Who would’ve thought we’d see this from the United States…

The Trump administration’s announcement of a $100,000 annual fee for H-1B visas represents a radical shift in immigration policy and a direct blow to the tech industry, which relies on this channel to attract specialized talent, mostly from India (70%) and China.

The scale of the increase is hard to overstate: compared to current fees of just a few thousand dollars, the new scheme multiplies costs to levels that could, in practice, force many companies —especially SMEs and start-ups— to rethink their international hiring strategies. Large groups (Amazon, Microsoft, Meta) secure tens of thousands of approvals every year, meaning their potential bill would run into billions. This will likely lead to a drop in hiring quality, greater reliance on local talent, and selective recruitment for only the most critical roles.

Reactions were swift. Amazon, Microsoft and JPMorgan advised their H-1B employees not to travel outside the U.S. until further notice, while Indian firms like Infosys and Wipro saw their shares fall. At the same time, venture capital voices and analysts warn the measure could have structural consequences, shifting high-value jobs overseas and eroding the U.S. position in the AI race against China. The official argument is to “train local workers” and reduce foreign competition. But in practice, this amounts to an enormous tax on global talent, difficult to justify even under a revenue-raising logic.

On top of the new CapEx cycle and the shift to a far more capital-intensive business model —which in my view will significantly reduce returns and the multiples at which tech companies trade— there is now an additional obstacle in the race for talent.

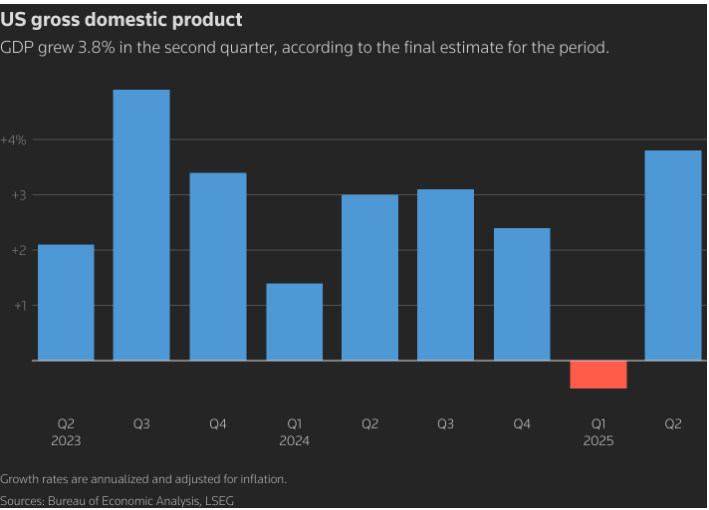

As had already been anticipated and discussed on several occasions, far from the consensus, the U.S. economy is reaccelerating. The revised GDP data shows a much stronger second quarter than initially reported, with the economy growing at an annualized 3.8%, the fastest pace since 2023. The drivers were twofold: stronger private consumption (2.5% versus the previous 1.6%) and a notable rebound in business investment in equipment and intangibles, supported by the artificial intelligence spending boom. Added to this was a less recurrent factor: the contraction of the trade deficit, after a first quarter distorted by a surge in imports aimed at avoiding tariffs.

The picture, however, has important nuances. The external boost is unsustainable, and the inventory adjustment suggests less support in the near future. In fact, “final sales to domestic private purchasers”—a cleaner measure of economic momentum—rose 2.9%, a more moderate pace than the headline figure. At the same time, trade policy tensions and mass deportations are beginning to filter into the labor market, with job creation nearly stalled even though unemployment claims remain low. The result is a paradox: companies are not yet laying off workers, but they are not hiring either, while absorbing part of the tariff costs with pressured margins.

For the Federal Reserve, the message is ambiguous, complicating its path in this final stretch of the year. At first glance, the data does not justify further rate cuts following last week’s 25 bps reduction. But the risk of a slowdown in the second half of the year is evident, with consensus pointing to 2.5% growth in the third quarter before losing traction as the effects of trade and CapEx fade. The government’s goal is increasingly clear: to heat up the economy, even at the cost of higher inflation. In a recent podcast, Atlanta Fed President Raphael Bostic even suggested the Fed should consider replacing its 2% inflation target with a more flexible range.

Just as with SuperMario in Europe, Scott Bessent has confirmed the “whatever it takes” for Argentina. The country has received a small lifeline from multilateral organizations, though far from the substantial aid Washington had hinted at, while still leaving room for stronger support if the situation worsens. Both the World Bank and the IDB have accelerated the disbursement of already committed funds, allowing Milei to access liquidity more immediately. The U.S. bet, as expressed by Scott Bessent, seems more rhetorical than financial—a verbal “backstop” that, in theory, would stabilize expectations without tapping reserves or activating a formal bailout.

The problem is that rhetoric alone may not be enough. Milei heads into the key October 26 legislative elections weakened, having lost support in local contests and with the peso under near-daily pressure. The currency rebounded 4% after the announcements, but this followed a sharp drop that forced the Central Bank to intervene with as much as $700 million in just a few days. The risk is clear: the economic plan relies on a strong peso as an anti-inflation anchor, but each intervention erodes reserves and credibility. Trump, alongside Milei in New York, reiterated political support but dismissed the need for a bailout. On major political betting markets such as Polymarket, Milei’s party’s chances of winning on 10/26 are deteriorating, though there is still a month left and much could change.

Model Portfolio

The model portfolio's return is +23.67% YTD compared to +1.01% for the S&P500 (S&P in €), and +107.3% versus +46.0% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.