Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

And after the storm—this time a brief one—comes the calm. The announcement of a ceasefire between Iran and Israel triggered a broad rebound in global financial markets, except for oil, which lost its geopolitical premium and dropped sharply.

The truce, which ended twelve days of hostilities, initially brought relief, but mutual accusations of violations from both sides quickly reignited tensions. Donald Trump’s reaction was immediate and explosive, expressing frustration at the lack of genuine commitment to de-escalation and leaving behind some truly historic posts. We are living in strange times, where both the ceasefire and its monitoring are announced through posts on Truth Social, which has effectively become the official news channel, pushing aside an increasingly discredited and irrelevant traditional press.

After Israel clearly weakened Iran’s air defenses, the United States deployed a squadron of B2 bombers, which struck major Persian nuclear facilities. The outcome is unclear (Iran claims no structural damage was done, while the Americans celebrate success), but the Arab country opted for a token retaliation against the U.S. to save face, launching a volley of telegraphed missiles (they gave advance notice) at an empty military base in Qatar. Of course, such a tepid response didn’t come without a price: Trump made it clear there will be no sanctions on Iranian oil, and that China can rest easy with its supplier. In other words—never mind what I said before…

Although there is currently widespread pessimism about the U.S. economic outlook, with macro data offering little hope, my view is that things are about to improve (which is far from the consensus). Pressure on the Fed is rising quickly, and either in July or September we will likely see new rate cuts. Moreover, leading indicators of economic surprises have bounced in recent weeks, which usually precedes an uptick in the broader economic surprise index. In this context—and as long as there are no headline-grabbing announcements about tariffs—the current rally may still have room to run, with the stock market, as always, already pricing in the future.

Real trade agreements are still not materializing (beyond the one with the UK, which was very straightforward), and with just two weeks left before the initial extension expires, I’m not very optimistic about it. "Reliberation Day" is approaching, and it could mark a new episode of extreme volatility, so it seems reasonable to adopt a more defensive positioning—just as we’ve been doing in the model portfolio. A new extension of tariffs might be agreed upon (which would be the most reasonable and positive outcome), but some countries may receive the infamous letters announced by Trump, detailing the tariff levels they will have to pay. This is the deal: if you like it, fine; if not, also fine.

The NATO summit held in The Hague concluded with a symbolic victory for Donald Trump and a real (and total, except for Spain) concession from the allies: a commitment to raise defense spending to 5% of GDP—a figure significantly higher than the already controversial 2% target. Although the statement was brief, the message is clear: Europe accepts that maintaining balance within the Alliance requires more military spending—or at least the promise of it.

Trump hailed the outcome as a major victory and hinted that he expects much of that spending to result in purchases of U.S.-made weaponry. At the same time, he did not hesitate to lash out at Spain, threatening it with trade retaliation for suggesting it could meet its NATO commitments without reaching the new 5% target. The warning was blunt:

That economy could blow up when something bad happens

— Donald TrumpStrategically, NATO reaffirmed its commitment to Article 5, the cornerstone of collective defense. After days of ambiguity, Trump publicly confirmed his support. However, the triumphant tone could not mask the underlying tensions. Macron, who raised his voice during the meeting, warned that one cannot demand increased military spending while simultaneously threatening trade wars within the bloc. The growing contradictions within an Alliance that calls for military unity while splintering economically are undeniable.

The new spending goal—3.5% of GDP for pure defense (troops, weapons) and an additional 1.5% for cybersecurity, infrastructure, and energy protection—poses a colossal fiscal challenge for European countries with tight budgets and negligible productivity. Unlike the previous goal, this new metric broadens the scope of what counts as “defensive” spending, a maneuver likely intended to facilitate nominal compliance.

From a market perspective, the implications are clearer: massive and growing deficits are expected, along with tailwinds for the European industrial and defense base—in other words, inflation in real asset prices. Position accordingly.

The debate over repatriating gold reserves has resurfaced strongly in Germany and Italy, driven by growing concern over global geopolitical instability and Donald Trump’s erratic behavior, particularly his attacks on the Federal Reserve. Both countries—second and third in the world in official gold reserves, behind only the United States—keep over a third of their bullion stored at the New York Fed. Together, this portion stored outside Europe has a market value exceeding $245 billion. Historically, this custody made sense: for decades, New York was a key hub in international metal trade, and storing reserves there offered protection against potential conflicts on European soil. But the context has changed. Trump is threatening to force decisions if the Fed does not cut interest rates, and Europe is beginning to question whether it is still wise to entrust its last-resort asset (especially given that Germany has already sold its BTC) to a power whose leadership is increasingly unpredictable. The campaign recalls the 2013 repatriation initiative, when the Bundesbank transferred 674 tonnes from New York and Paris to Frankfurt.

Italy, for its part, keeps 43% of its reserves in the U.S., and although the Meloni government has remained silent since taking office in 2022, her party had vocally demanded the return of the gold while in opposition.

From a technical standpoint, the central argument of repatriation advocates is not a temporary distrust of Trump, but rather the need to eliminate third-party risk—if you don’t touch it, it’s not yours. The issue of gold touches a deep nerve: monetary sovereignty versus geopolitical dependence. The revival of the debate indicates that, in an increasingly volatile international order, European countries are reconsidering what it actually means to hold strategic reserves—and where it is safe to keep them.

The weekly inventory data published by the EIA for the week ending June 20 show a sharp decline across all reported products and categories: -5.84Mb of crude, -0.46Mb in Cushing, -2.1Mb of gasoline, and -4.1Mb of distillates. This massive adjustment in inventories, especially in refined products, coincides with a particularly strong start to the U.S. driving season—the best since 2018 in terms of cumulative demand during the first three weeks. Although crude demand in China had been very weak in recent months, the latest data show a hopeful recovery: state-owned refineries have ramped up activity, with utilization levels now exceeding the highs reached during the 2023 boom.

Hopes—which increasingly resemble wishful thinking more than reality—are that the supply increase from regions like Guyana and Brazil will take over from the United States in terms of non-OPEC supply. However, hope is one thing, and data is another: over the next year and a half, Guyana is expected to add only 250k b/d (not bad, but not a game-changer), and the following chart shows the grim reality of Brazil…

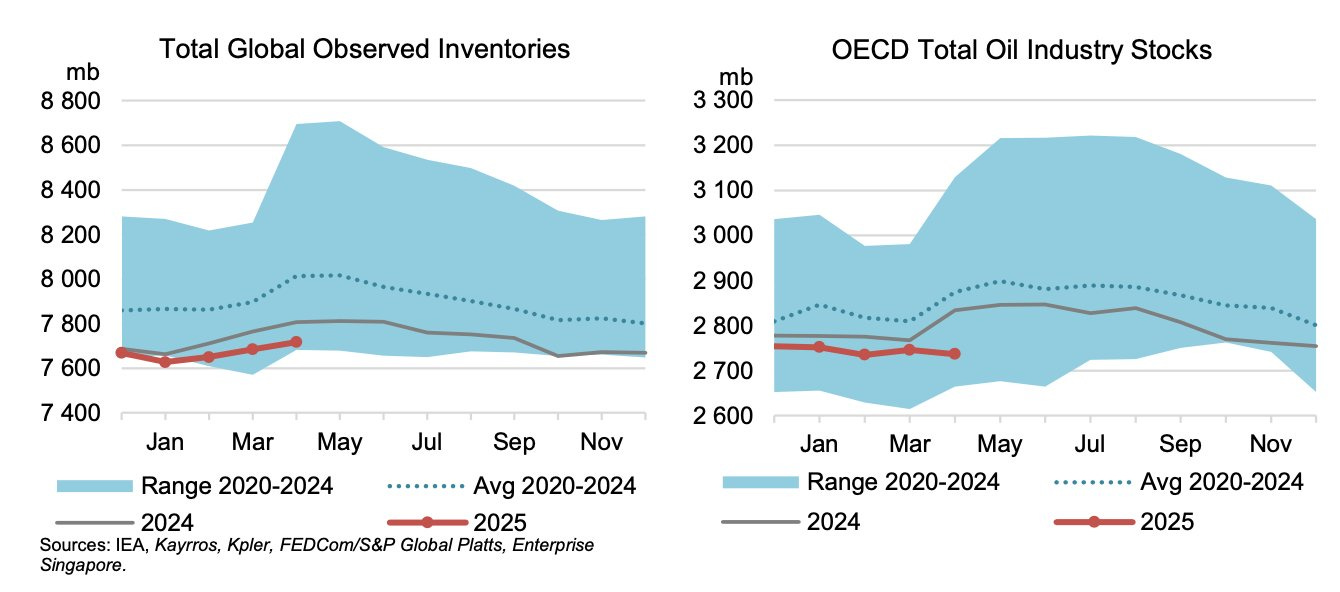

It’s not just declines in the United States or weakness elsewhere—globally, we are not seeing any counter-seasonal inventory builds (especially in the OECD), just as we enter the strongest demand season. Moreover, when we compare absolute levels with previous years, we see that we are positioned at the lower end of the five-year range.

Despite recent U.S. airstrikes on Iranian nuclear facilities—which briefly pushed up oil prices—shale oil producers in the U.S. are not responding with an immediate increase in output. Although Trump has once again revived his classic “Drill, Baby, Drill” mantra, the reality on the ground is quite different: instead of ramping up aggressively, producers are opting for hedging strategies to lock in current prices, wary of a repeat of April’s price collapse. Rather than increasing the number of rigs and wells, they prefer to secure their cash flow in case this price rally proves unsustainable (as now seems likely). This caution reflects lessons learned from the past and a persistent pressure to maintain financial discipline: the goal is no longer growth at all costs, but rather returning value to shareholders and safeguarding the best assets.

Moreover, brief spikes in prices are not enough. Sustained prices above $70–75 per barrel for at least six months would be needed to justify new rounds of exploration investment. Price jumps triggered by geopolitical events don’t offer long-term certainty, and the sector knows it: the days of debt-fueled boom times are over.

True to his style—and ignoring both the fundamentals and the physical reality of “drill, baby, drill”—Trump continues to try to influence the market and oil prices via tweets, sometimes veering into the absurd. But as the famous movie says: whatever works...

Model Portfolio

The model portfolio's return is +7.3% YTD compared to +5.18% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +79.8% versus +52.1% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.