Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

A U.S. trade court has just delivered a direct blow to the core of Donald Trump’s tariff strategy. In a landmark ruling, the Court of International Trade determined that the president exceeded his authority by imposing sweeping tariffs under the International Emergency Economic Powers Act (IEEPA). The court emphasized that the Constitution grants Congress—not the president—the exclusive power to regulate foreign trade during peacetime, a red line that, according to the ruling, Trump crossed without sufficient legal basis.

As a result, the court immediately annulled all tariff orders issued since January under this legal framework and gave the executive branch ten days to issue new guidelines in compliance with the ruling. The White House quickly filed an appeal, insisting that trade deficits constitute a “national emergency” requiring direct presidential action. However, the panel of judges remained unconvinced: the issue, they said, was not the effectiveness of tariffs, but that the law simply does not allow them in this context. If no further changes or injunctions are granted, the U.S. may have to refund the duties collected under those now-illegal tariffs—although not all tariffs fall into this category.

Markets reacted swiftly: the dollar strengthened and stock markets rebounded, although the market faded afterwards. For investors, the uncertainty tied to Trump’s erratic trade maneuvers had long been a drag on what is, at its core, a strong bull market fueled by large fiscal deficits. This ruling introduces a real possibility that international trade relations may return to a more predictable legal framework.

Since taking office, Trump has made tariffs the cornerstone of his trade policy, using them as a pressure tool against China, the EU, and other partners. However, the volatility and sudden changes have severely disrupted supply chains, driven up operating costs for thousands of small and medium-sized businesses, and created legal uncertainty. Until now, the strategy had been supported by broad interpretations of executive power—now judicially delegitimized.

In the short term, this decision severely limits the administration’s ability to use tariffs as a bargaining chip, just as negotiations with China, the EU, and other key players enter critical phases. Without “instant levers” like 10% to 50% tariffs, the U.S. will be forced to renegotiate trade relations using more sophisticated—or slower—strategies. Moreover, it casts doubt on the viability of tax cuts that were supposedly to be offset through increased revenue, including via tariffs.

With the arrival of June, Elon Musk officially ends his unusual stint as a special government employee under the Trump administration, thanking the president for the “opportunity to reduce unnecessary public spending.” During the first five months of the term, Musk led the so-called Department of Government Efficiency (DOGE), an ad hoc office created to spearhead cuts to the federal structure. The name and acronym of the department seem deliberately provocative: they suggest both a technical mission and a nod to the crypto world, where Musk has been a prominent figure.

As a special government employee, Musk was permitted to work up to 130 days per year in this role—a number reached by the end of May, when his formal departure process began, according to White House sources. Musk has confirmed that he will remain partially involved and keep an office at the presidential residence. However, his exit comes amid friction with the administration. In an upcoming CBS interview, Musk openly criticizes Trump’s new budget proposal, claiming it undermines the work his team has done. The public criticism from the top beneficiary of government contracts in the space and tech sectors hasn’t gone unnoticed: it reveals a clash of priorities between a business-driven efficiency mindset and the political reality of federal spending.

As early as April, Musk had warned during a Tesla earnings call that his government involvement would drop significantly starting in June. Still, he plans to devote some time to related tasks through the end of the term. However, his political involvement is starting to create tensions on other fronts. On Wednesday, several pension funds urged Tesla’s board to require at least 40 hours of actual weekly work from Musk if he wants to receive a new compensation package as CEO.

What stands out most—and what Musk has learned the hard way—is that nothing can stop this train: reducing the deficit and steering U.S. public finances is now impossible. Not even one of the greatest entrepreneurs in history, backed by a government with absolute power, has managed to cut even a single dollar from the deficit.

Europe appears ready to play a high-stakes geopolitical card: turning the euro into a real alternative to the dollar as the world’s reserve currency. In exchange, it might lose some currency competitiveness—but it would do so betting on the attraction of massive capital inflows it urgently needs to finance its new strategic ambitions. Christine Lagarde, though not the sharpest in the room, smells blood and sees an opportunity laid out before her—one Europe does not intend to miss.

The ECB president’s speech was neither accidental nor routine. Amid growing doubts about the institutional stability of the U.S., its global alliances, and its erratic monetary policy, Lagarde argued that the euro must take advantage of Europe’s comparative advantage as a more predictable bloc, committed to the rule of law. And she did so at a time when correlations between U.S. assets are dangerously breaking down: since April, the dollar and Treasury bonds have both been falling—even as equities drop. In other words, the traditional U.S. safe haven is no longer playing its role.

The message between the lines was clear: U.S. institutional erosion is a strategic window for the eurozone. But for the euro to realistically compete for safe haven status, deep internal reforms are required. Lagarde emphasized two key pillars: completing the European capital markets union and advancing joint debt issuance—still a politically toxic subject in Berlin. “Public goods must be jointly financed,” she stressed, in a politically charged remark.

She also highlighted that Europe’s military rearmament is not only a strategic matter but could also become a compelling argument for official investors seeking strong alliances with real defense capabilities. Europe wants to move past its dependence on U.S. security… and financing that ambition will be costly.

And it’s no small sum. According to ECB estimates, the investment effort needed for defense, green energy, and technology will require additional funding of €1.5 trillion annually until 2028. That’s more than twice the amount Europe mobilized over the entire last decade. To put it into perspective: it’s roughly equivalent to the total European capital that has flowed into U.S. equities since 2012.

It matters little that the euro has appreciated nearly 20% in real terms over the past decade. The ECB appears comfortable with a strong currency if it helps attract global capital and finance strategic projects. In contrast to Trump’s monetary protectionism, Europe is betting on institutional stability, fiscal cooperation, and joint debt. A slower approach—but one intended to offset the continent’s low competitiveness.

The eurozone has accepted that a massive bill lies ahead. And if it wants to pay it without losing sovereignty or relying on foreign capital under unfavorable conditions, it must turn the euro into more than just a regional currency. What Europe now seeks is something that, for decades, was an exclusive privilege of the United States: to become the world’s preferred safe haven.

Many investment opportunities and ideas present themselves as clear and obvious—and perhaps for that very reason, they go unnoticed by the general public. The launch of Bitcoin ETFs at the beginning of last year is a clear example: much like what happened with the Sprott Physical Uranium Trust in 2021, when a virtually endless source of demand meets a limited supply, the outcome can only be one: the price will rise. In Bitcoin’s case, the effect is even more pronounced, as its supply is not only truly limited but also decreasing over time.

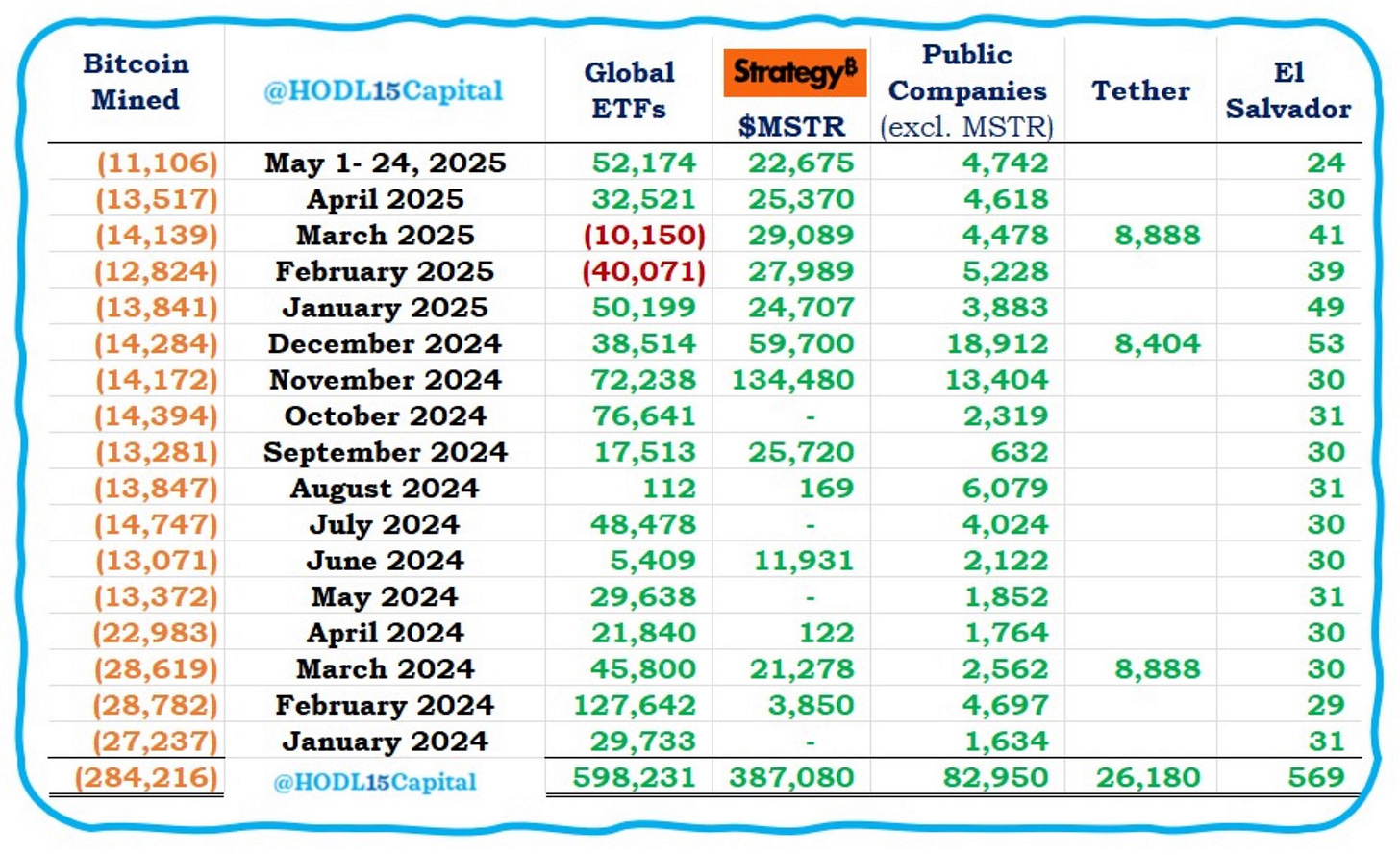

The following table compares the number of BTC mined each month (since the ETF launch) versus the purchases made by major institutional players, revealing a shortfall of nearly 810,000 BTC in just a year and a half.

To put that number into context, with a total cap of 21 million units—of which 2.5 million (lost coins and Satoshi’s holdings) are effectively out of circulation—those 800,000 BTC represent 4.5% of the total supply of the asset. That is an extraordinary figure in just 18 months. And the best is yet to come.

It’s becoming increasingly clear that fears over OPEC+ returning large volumes of crude to the market were exaggerated. While it’s true that, on paper, the quota increases for these months were quite significant, it’s important to note that many member countries had been cheating (in the chart below, left column, you can see actual production vs. assigned quotas).

As a result, with this "paper" increase, exports are likely to remain flat—or rise only marginally—while these countries simply begin operating within their official quotas. This means, as always, that Saudi Arabia remains the swing producer and regains control of the market, which is always good news for investors in the sector.

The drill baby drill plan isn’t going as expected, judging by Chevron’s latest decision to lay off 800 workers—who are far from surplus in the industry—currently employed in the Permian Basin. Given this year’s prices, we’re almost guaranteed a high-deficit environment by 2026, due to supply reductions in some basins and disappointing growth in others. This sets the stage for very compelling investment ideas that offer not only sector-wide catalysts but also company-specific (micro) triggers heading into 2026.

Model Portfolio

The model portfolio's return is -2.65% YTD compared to +1.06% for the S&P500 (our portfolio mesured in € terms, which is weighting -10% in our portfolio this year vs the S&P in $), and +63.1% versus +46.1% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.