Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Weekly macro summary

There have been quite a few interesting events to analyze this week, and below I list the most noteworthy news. Let's get started:

In his latest episode of political interference in key institutions, Trump has decided that the Federal Reserve’s independence is optional. This week he announced the dismissal of Lisa Cook, a member of the Fed’s Board and the first Black woman to hold the position, citing alleged irregularities in her 2021 mortgages. The problem is that those mortgages were public and well known when she was confirmed by the Senate. The move was immediately challenged by Cook’s legal defense, which called it “illegal and without factual or legal basis.” And rightly so.

The Federal Reserve is, by design, an independent institution, with 14-year mandates precisely to prevent political capture. Its founding law only allows removal “for cause,” a legal formula meant for extreme cases, not for presidential vendettas. But Trump, true to his style, is willing to reinterpret the law in whatever way best suits his monetary agenda.

Behind all this is much more than a legal battle: it is Trump’s attempt to completely reshape the Fed’s Board. If Cook is removed, he would have the chance to appoint up to five of the seven members, an absolute majority with direct power over interest rates. In fact, his team already has a name in the wings: Stephen Miran, a White House economist aligned with his low-rate policy.

The market reaction, curiously, has been muted. Stocks flat on the day, the dollar giving up some ground, and slight declines in short-term bond yields. Despite the potentially explosive nature of the case, investors seem to remain under the spell of future liquidity, since if Trump bends the Fed, rate cuts will follow. Institutional integrity matters little. But there are consequences. This deliberate erosion of monetary independence has already sparked suspicion in Europe, and the debate over repatriating gold held in New York has returned with force. Germany and Italy are considering physically bringing back their reserves in the face of the increasingly less theoretical risk that Trump could use the Fed as a tool of foreign policy. If you can’t touch it, it isn’t yours. Vance went even further, with statements lifted straight out of Soviet Russia:

I don't think we allow bureaucrats to make decisions about monetary policy and interest rates without any input from the people that were elected to serve the American people...POTUS is much better able to make these determinations.

— JD Vance

Position accordingly.

The market was on edge awaiting the results of the world’s largest company on Wednesday, and it seems the perfect narrative is starting to crack. Nvidia reported financial results that, in absolute terms, remain monumental… but left investors with a somewhat more bitter taste than usual, accustomed as they are to numbers that border on science fiction.

The key lies in China. Nvidia decided to exclude from next quarter’s guidance any potential sales of its H20 chips to the Asian giant, despite having received some licenses to operate in the country. The reason: regulatory uncertainty in the U.S. and fear of possible retaliation from Beijing. Huang, in a move very much in line with his pragmatic profile, is said to have reached an informal agreement with Trump that would allow sales to restart in exchange for commissions to the Treasury. Kickbacks in the U.S.? Who would have thought that a few months ago…

Curiously, Q3 guidance is still solid: $54B in revenue versus the $53.14B expected. But not spectacular. And that’s the issue. When the growth narrative is based on exponential figures, any curve that begins to normalize gets punished as if it were a profit warning. The data center segment —the absolute engine of this AI era— posted around $41B in revenue, slightly below consensus. While structural demand remains intact (Meta and Microsoft continue burning cash to feed their models), early signs of greater prudence in hyperscaler spending are emerging. If profitability from AI investments continues to lag, we could see a selective adjustment in CapEx.

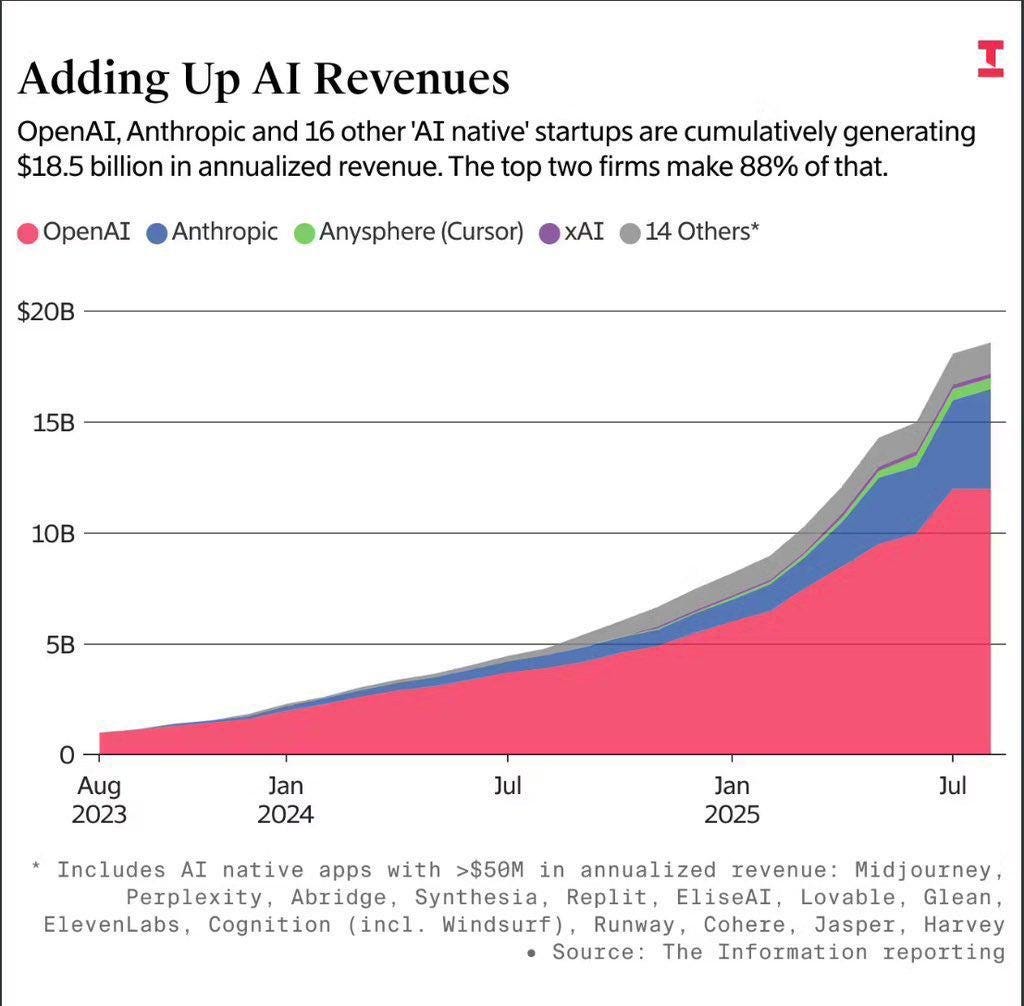

On the conference call, and in an effort to justify the company’s valuation, the CEO predicted that AI CapEx would reach $1T/year, which, as we noted last week, is an absurdity unjustifiable from a return-on-investment standpoint. For now, the revenue run rate (not profits) of the main AI companies is only $18.5B.

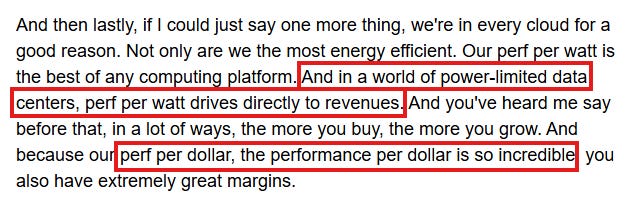

In the same conference, however, the CEO himself gave what is, in my view, one of the keys to capitalizing on this megatrend: the biggest constraint to the proliferation of data centers is energy —both in sheer kW and in terms of grid and infrastructure—which will need to be heavily (read: $$$) upgraded to meet the growing demands of computation.

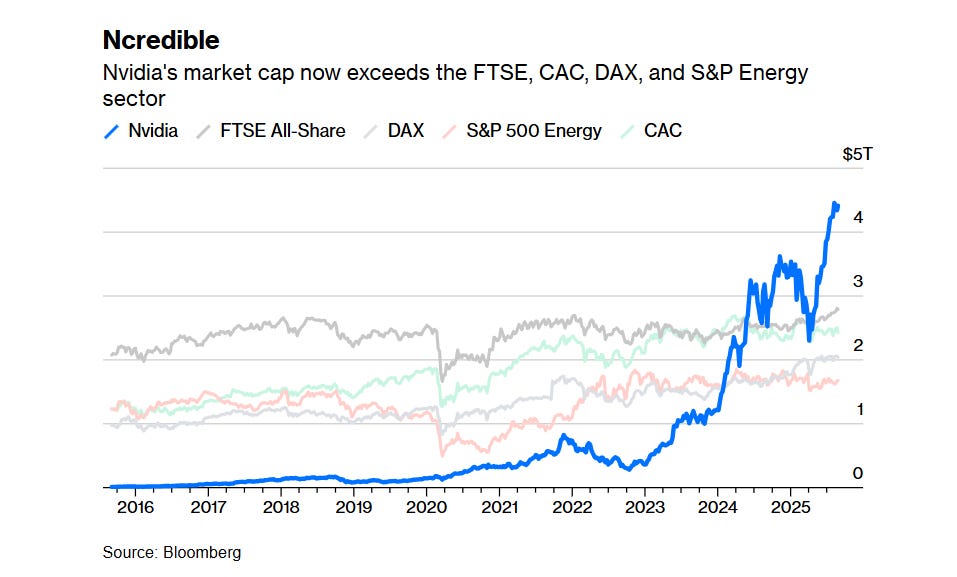

Meanwhile, despite Thursday’s and Friday’s declines, everything remains fine for Nvidia, whose market cap surpasses the entire FTSE, CAC, DAX, or the energy sector.

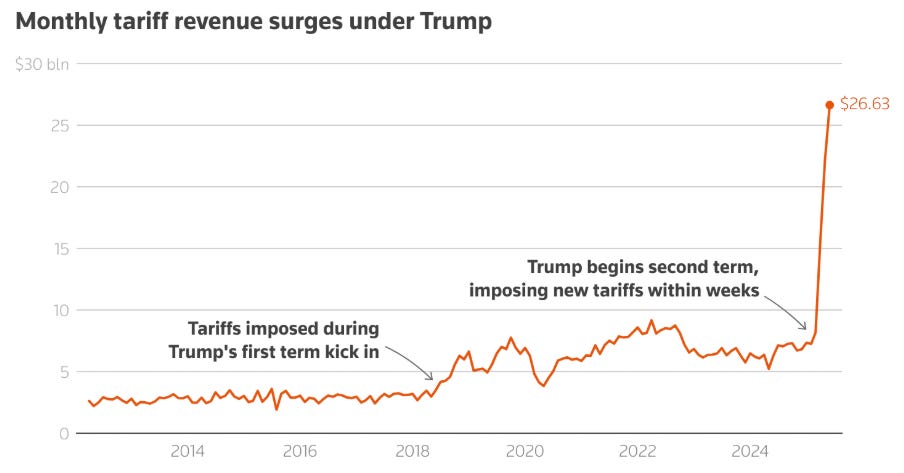

The end of the tariff exemption for packages under $800 marks a radical shift in U.S. trade policy and could have profound implications both economically and geopolitically. What until now was a channel that favored cross-border e-commerce —particularly for giants like Shein or Temu— is turning into yet another front in Trump’s tariff war.

The official justification is to curb the entry of synthetic drugs while also boosting revenues (the White House claims up to $10 billion a year). In practice, the impact is immediate. Consumers will face higher prices on platforms like Etsy or eBay, small businesses that relied on the channel will suffer from increased costs and bureaucracy, and international logistics companies —FedEx, UPS, DHL— will have to absorb the transition with new billing systems and customs management. Europe is already reacting, with several postal operators suspending shipments until it becomes clear how to apply the flat-rate duties ($80–200 depending on the country) that will govern temporarily before the full switch to ad valorem tariffs in 2026.

From a markets perspective, this measure levels the playing field: Asian fast fashion and cross-border marketplaces lose part of their advantage over traditional retailers like Walmart, which already pay tariffs when importing in containers. At the same time, the U.S. textile industry celebrates a historic victory against foreign competition. The risk is that this move is not an isolated event, but rather a prelude to broader rounds of tariffs —in line with recent measures on copper and Brazil. If there’s one thing evident in this cycle, it is that Trump has turned tariffs into a tool of foreign policy, even as some countries like India say they will not comply and will continue importing Russian crude and acting the same despite threats, tax collection efforts, and industrial repositioning all happening simultaneously. Inevitably, that means greater volatility for global trade and supply chains.

To add more fuel to the fire, U.S. courts ruled on Friday that most of the tariffs imposed by the administration are illegal, opening the door to their removal (and retroactive repayment). Of course, they will appeal, and perhaps the tariffs will ultimately remain in place, but this adds further pressure to reach effective trade agreements that create a more favorable environment for businesses.

And after Kazatomprom, as always, Cameco. The uranium producer, in its earnings release, cut its production guidance for the year by 20%, adding more fuel to the fire in an already tight and deficit market. Reactions were swift, and on Friday there were fireworks in the share prices of most companies in the sector (and in the spot price of the metal), as this represents the (temporary, for this year) disappearance of nearly 5% of global supply. This episode, which is not an isolated one, once again shows how complex mining is and how, even in the best operations, operational issues are normal. Although investor focus shifted away from the sector some time ago, the fundamentals continue to improve and value is accumulating, and it does not take much more to trigger a new bullish phase in the cycle.

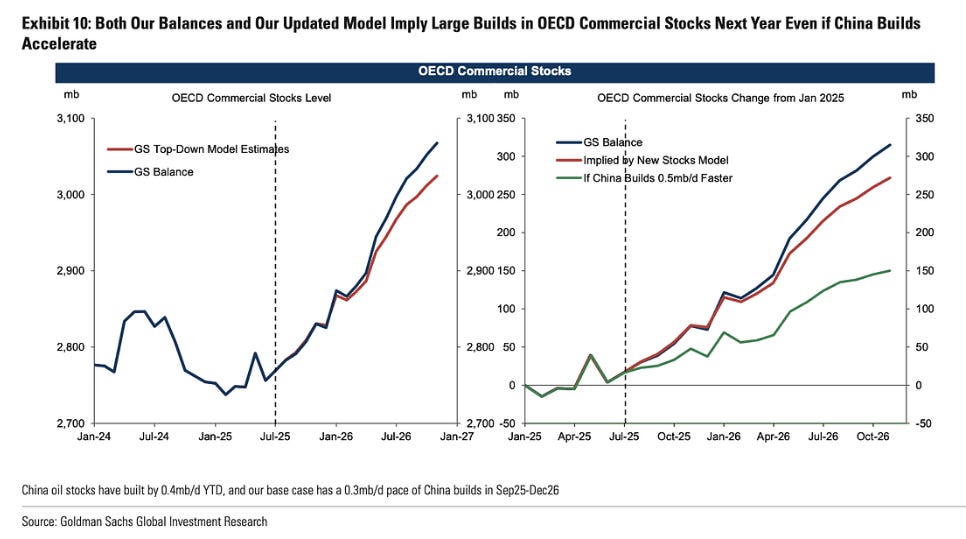

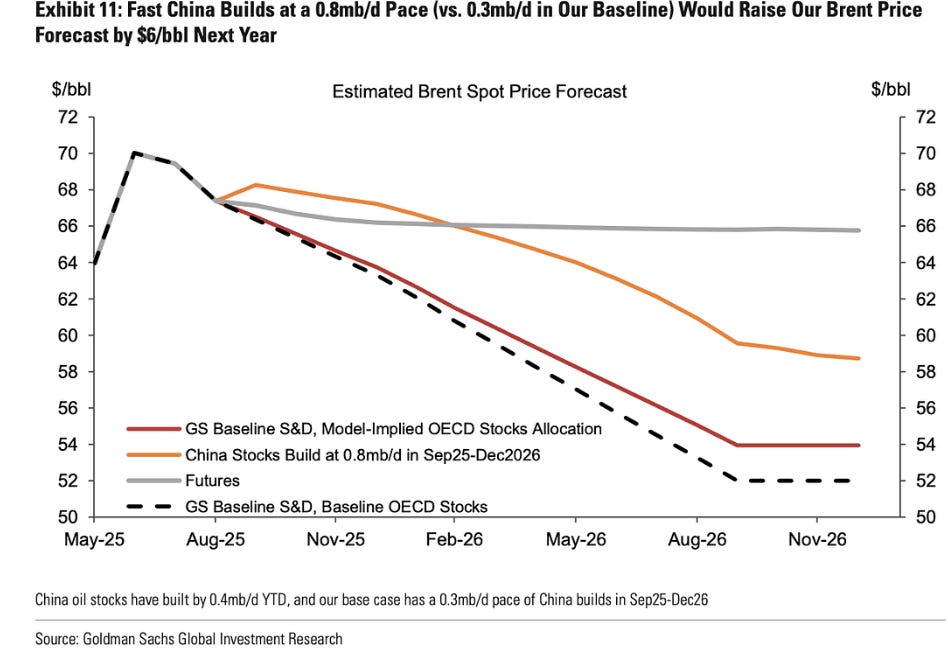

Goldman has once again switched sides, now predicting a collapse in both price and fundamentals of the oil market for the second half of this year and into the next. Riding on what they see as a clearly oversupplied market —which they expect will translate into an inventory build of 1.8Mb/d (an enormous figure), one-third of it in the OECD— they forecast that the price of oil will fall to $50/b in 2026, putting most global producers (shale, Canada…) under serious pressure and also curbing growth CapEx for the major companies.

They add some upside surprise potential (relative to their already very low base case) if China continues adding barrels to its reserves, which would lift the expected Brent price to $58/b.

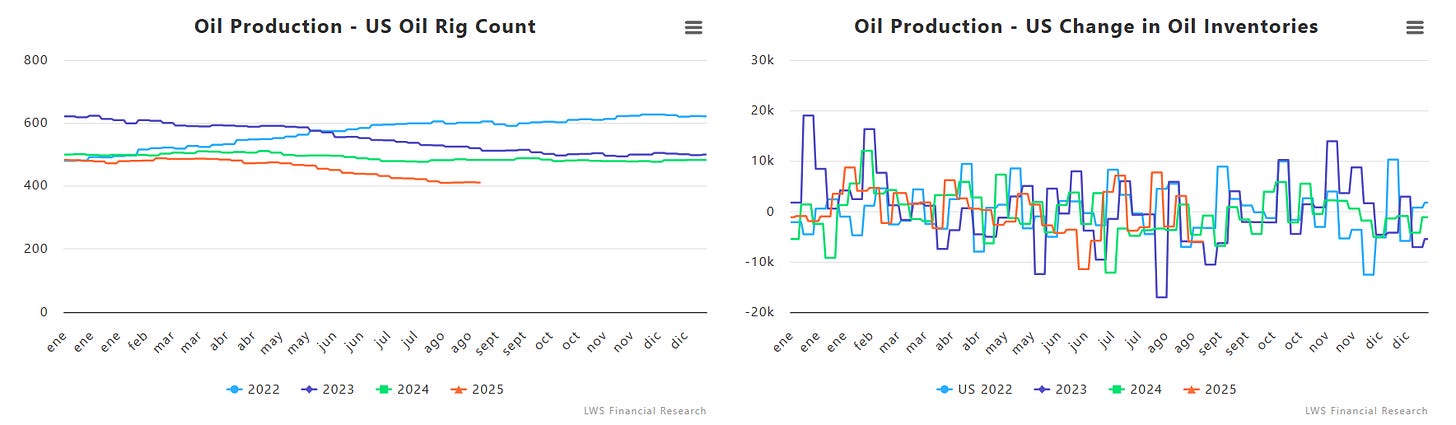

The reasons cited for their pessimism are relevant and could materialize (partially or all at once), so monitoring this is important. In our model portfolio we currently have little direct exposure to oil (PBR and IPCO), which carries limited downside to such declines; moreover, the effect of such low prices, if realized, on supply itself is underestimated —closing the loop and making them unsustainable over time. Despite this year’s hedges, we see rigs and shale activity continuing to fall, and inventories too (with U.S. demand at record highs), which will eventually and inevitably translate into production problems.

Model Portfolio

The model portfolio's return is +15.23% YTD compared to +10.33% for the S&P500 (our portfolio mesured in € terms, which is weighting -14% in our portfolio this year vs the S&P in $), and +93.1% versus +59.6% for the S&P500 since inception (September 2022). The model portfolio, as of Friday's close, is as follows:

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.