Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

Note: This article has been updated as of April 19, 2025. The original version was published on November 19, 2023, when the stock was trading at $53.8 per share.

Introduction and business model

Warrior Met Coal is a metallurgical coal mining company based in Brookwood, Alabama. It operates two producing assets, Mines 4 and 7, with a combined capacity of 8Mt per year, 89Mt in reserves, and a projected 25-year mine life under the current production plan. As discussed in the article on Alpha Metallurgical Resources, one of its competitors, Warrior’s product is a critical component in steel manufacturing—one that currently has no economically viable technological substitute.

In fact, the latest EIA report, which already includes a significant political bias in both methodology and conclusions, projects under its base scenario (STEPS) that demand for metallurgical coal will remain stable through 2050. This suggests there is no terminal value risk in the short or medium term.

As a second-order effect, steel will continue to play a key role in economic development and stands to benefit from many emerging megatrends: population growth and economic development in Asia and Africa, housing and infrastructure construction and maintenance, the energy transition, and electric vehicles. This is a widely acknowledged fact among policymakers, and the pressure to phase out metallurgical coal is low—unlike thermal coal—until a truly viable alternative emerges. The following table summarizes the everyday uses of steel that we often take for granted.

As introduced earlier, Warrior has two producing assets and is developing a third, which—once operational—will become the crown jewel (in this sense, if you follow the oil & gas space, the setup is similar to that of $IPCO, which we have also analyzed). Specifically, the company produces high-quality metallurgical coal (HCC) from the following mines:

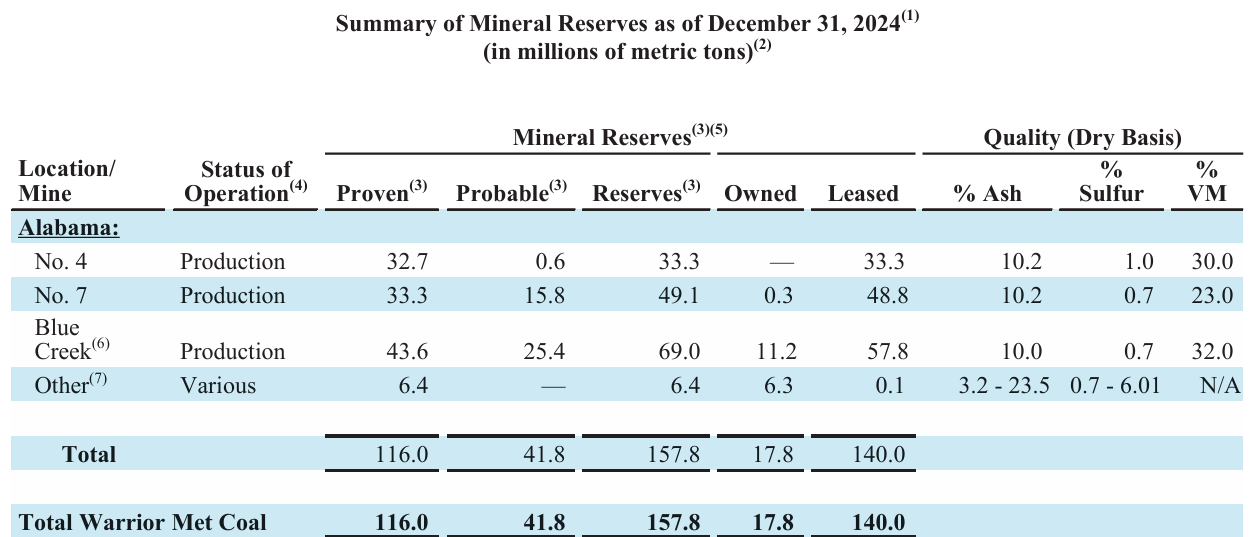

Mine 4: Operations began in 1974 under Jim Walter Resources, and Warrior acquired it in 2016 after Walter Energy’s bankruptcy in 2015. It has a maximum annual production capacity of 2.4Mt and 33.3Mt in reserves.

Mine 7: With a maximum capacity of 5.6Mt annually and 48.8Mt in reserves, this mine produces coal that sells at a premium compared to other U.S. coal specifications.

Blue Creek: One of the few remaining undeveloped high-quality (high-vol A) metallurgical coal deposits. It’s expected to produce 4.8Mt per year and holds 69Mt in reserves. In addition to defined reserves, there are 38.2Mt in resources, bringing the total to 107.4Mt. With the development underway, this would allow for 30 years of mine life, potentially extending to 40 years with further exploration.

The coal produced is processed in company-owned facilities. All three mines, including Blue Creek, are located about 300 miles from Warrior's export terminal in Mobile, Alabama—this proximity and logistical flexibility offer a cost advantage over many U.S. competitors. Warrior is a pure-play metallurgical coal producer, with negligible contribution from thermal coal. Its coal quality and location make it an ideal exporter with access to major demand hubs (Europe, South America, the U.S., and Asia) and the ability to rebalance shipments quickly. Last year, 38% of exports went to Europe (down from 63% the previous year), reflecting the flexibility to shift exports to Asia, where demand has proven more resilient amidst Europe’s economic weakness in 2023 and 2024.

Despite the high quality of its coal—often sold at a premium to benchmark indices—Warrior typically engages in medium-term contracts (1–3 years) negotiated well in advance. While this protects against downside risks during price slumps, it can also limit upside capture during sudden price spikes in bullish cycles.

Currently, the metallurgical coal sector is navigating a pronounced cyclical downturn, driven—unlike previous cycles—by both sides of the market balance:

Supply: New metallurgical coal projects are increasingly difficult to launch due to political and financial hurdles, which artificially restricts capital cycles in the industry. However, the ramp-up of several pre-planned projects (among the last remaining global sources of sufficiently high-grade material) has created a temporary surplus. As reserves are gradually depleted, the market is expected to revert to a much deeper deficit, especially in high-quality coking coal.

Demand: Demand for metallurgical coal is closely tied to steel demand (with near-perfect correlation), since most existing and newly built plants are blast furnaces. Steel demand is highly stable and strongly linked to economic growth. Most sources (World Steel Association, Fitch, Eurofer, etc.) forecast a ~1% CAGR in global steel demand—though not in a linear fashion. In 2024, demand actually declined (~1%) due to weakness in China's industrial and construction sectors. Uncertainty surrounding 2025 (trade tensions) doesn’t help either. For now, the outlook remains gloomy, and no major recovery is expected until late 2025 or even 2026—unless China implements a strong stimulus response.

These two factors have driven a steep drop in coking coal prices—from around $300/Mt to the current ~$190/Mt (even dipping to $170/Mt in March)—now below breakeven levels for a significant portion of global producers.

Is this a buying opportunity? Will we see another bull cycle in coal? Let’s take a closer look.

Investment thesis

As I’ve publicly stated on several occasions, I’m very bullish on the metallurgical coal industry—it was my top position during 2022 and 2023. Specifically, my main bet (and portfolio holding) was [company], which I considered the best vehicle to play this idea due to its unmatched shareholder return program and balance sheet. However, after a 70%+ rally, the risk/reward profile was no longer as attractive, so we decided to rotate capital into other ideas within the same sector. Let’s now go over the key points of the investment thesis in [company] to assess whether it may be a compelling opportunity.

Earnings and balance sheet

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.