Disclaimer

LWS Financial Research is NOT a financial advisory service, nor is its author qualified to offer such services.

All content on this website and publications, as well as all communications from the author, are for educational and entertainment purposes only and under no circumstances, express or implied, should be considered financial, legal, or any other type of advice. Each individual should carry out their own analysis and make their own investment decisions.

This investment idea should have been published at the end of October, but we decided to delay it to include the most recent information from the results on 11/05, which we believe are relevant. Therefore, two investment ideas will be published in November, resuming the usual pace and schedule.

Introduction and business model

Natural Resource Partners is a Master Limited Partnership (MLP) with a portfolio of coal, oil, and gas reserves, as well as a minority stake (49%) in Sisecam Wyoming, a business focused on trona mining and soda ash production. U.S. MLPs are not very attractive from a tax perspective for European investors and have specific tax treatment even for domestic investors: since they are true partnerships, the company itself does not pay taxes directly; instead, investors are required to pay taxes on their share of the earnings. For European investors, distributions (which are usually substantial) are subject to a 37% withholding tax, and there is even a special tax at the time of selling the shares.

The company is organized into two main operating segments:

Mineral Rights: This segment includes approximately 13 million acres of mineral and other subsurface rights in the United States. If combined into a single area, this property would cover around 20,000 square miles. The resources produced on these assets are essential for steel, electricity, and basic building materials production, while also offering opportunities for carbon sequestration and renewable energy.

Soda Ash: This consists of a non-controlling 49% stake in Sisecam Wyoming, a company dedicated to trona mining and soda ash production, located in the Green River Basin in Wyoming. Sisecam Wyoming mines trona and converts it into soda ash, which is marketed both domestically and internationally for the glass and chemical industries.

The company does not operate its assets directly but leases them out, with operators handling their exploitation and taking on operational expenses, capital costs, and other obligations related to production activities. Its portfolio is highly diversified, with more than 150 leases across over 50 lessees, which reduces associated risks and strengthens income stability.

Approximately 50% of the segment’s revenue comes from metallurgical coal royalties, essential for the steel manufacturing process, which we have covered extensively in articles on Alpha Metallurgical Resources, Whitehaven Coal, and Warrior Met Coal, without the risks thermal coal faces from environmental regulations or low-priced natural gas competition. On the other hand, around 20% of the segment’s revenue is generated through thermal coal royalties, driven partly by international demand but in long-term structural decline due to the gradual phase-out of coal-based power generation in the U.S. and the rest of the West.

However, this segment also holds long-term interest, with supply facing a bleak outlook, even worse than demand. Russia’s coal industry, one of the largest producers, is experiencing one of its worst crises in decades, affected by the loss of Western markets, falling demand in allied countries, and a drop in global prices. Production in July fell 6.7% year-over-year to 31.5 million tons, the lowest level since 2020. The sharpest decline was seen in bituminous coal, a key component of total production, which dropped by 8.2%.

Western sanctions, which exclude Russian coal from European markets, have been a critical blow. In Asia, which initially absorbed some of this supply, tariffs and competition from countries like Indonesia and Australia have further reduced Russian exports, particularly to China, India, and Turkey. In the first half of 2024, exports to China fell by 8%, while India and Turkey reduced theirs by 55% and 47%, respectively.

With over half of the companies in the sector (in Russia) posting losses and the global coal price in decline — down 34% in the first half of the year — many miners are currently operating below their production costs. Although the Russian government forecasts increased production in the long term, the lack of demand and the transition of several Asian countries toward cleaner energy sources suggest that mine closures are inevitable, especially those far from export markets.

This geography, while critical, is not the only one facing challenges. Indonesia, as with its tin industry, faces an issue with reserve replacement, and its production is expected to collapse in the coming years if there are no advances in technology or the development of new reserves and deposits.

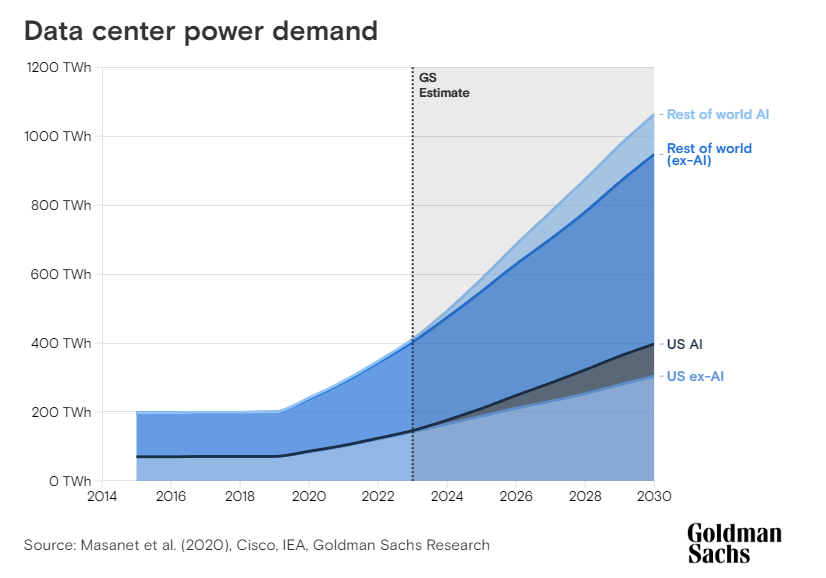

Demand, contrary to the prevailing narrative, still has room for growth: many countries, especially in Asia, continue to add coal-based power generation capacity, and even in the West, driven by the proliferation of data centers requiring large amounts of baseload energy (renewables are not suitable, for example, due to flow intermittency and quality). For this need, only natural gas, nuclear, and coal are viable options. In the long term, nuclear is the best choice, and in the meantime, gas should serve as a bridging energy source, but due to pricing, logistical, and supply issues, coal will likely play a significant role in this regard.

The company, therefore, contrary to what the market discounts, is positioned in two industries (not including soda ash) with very interesting prospects — one benefiting from demand tailwinds and the other from supply challenges.

Investment idea

To answer the question of whether Israel Chemicals can be a good investment opportunity or a value trap, we will analyze the following sections:

Business Segments

Operations and Finances

Balance Sheet

Capital Structure

Let's get started.

Keep reading with a 7-day free trial

Subscribe to LWS Financial Research to keep reading this post and get 7 days of free access to the full post archives.